Transcription of BEGINNING OCTOBER 1, 2012, A NEW LOAN WAIT PERIOD …

1 Prudential Retirement is implementing a loan wait PERIOD of seven (7) calendar days when loans are requested from a Defined Contribution plan account. This new policy is to help protect you and your participants. Reason for this change: On occasion, after a loan payoff is applied to a participant s account, Prudential receives notification that the participant s loan payoff check has bounced or the ACH debit has been rejected. An internal review revealed that 99% of bounced checks and ACH rejects were identified on or before day seven (7).

2 To ensure your plan remains in compliance when a participant takes a new loan prior to the existing loan being paid off, Prudential has decided to implement a new administrative policy of a seven (7) calendar day loan wait PERIOD for ALL plans, including payroll deduction plans. This new policy helps protect your plans in two ways:1. If a payoff bounces and the participant exceeds the number of loans allowed, this is considered a failure to follow the terms of the plan, which could jeopardize the plan s qualified status if not corrected.

3 2. Loan errors generally require a correction, the costs of which are incurred by the plan. This new policy helps protect your plan participants in two ways:1. If the payoff bounces, the amount of the new loan may exceed the IRS amount limitation for plan loans, which could be a taxable event for the participant if not If the participant does not submit a good payoff on his or her existing loan, and stops paying, there is the chance that loan payments may fall behind and risk participant website will have updated Plan Loan Rules and the loan landing page will include the following message: Participants must wait seven days after paying off a loan before requesting a new loan.

4 RSDM481 Published 08/2012 For informational purposes only; no action is required. 2012 Prudential Financial, Inc. and its related entities. Prudential, the Prudential logo, the Rock symbol and Bring Your Challenges are service marks of Prudential Financial, Inc., and its related entities, registered in many jurisdictions OCTOBER 1, 2012, A NEW LOAN WAIT PERIOD policy WILL GO INTO EFFECTQ uestions?If you have any specific questions regarding the policy or specific clients, contact your Prudential Retirement Relationship Published 08/2012 For informational purposes only; no action is required.

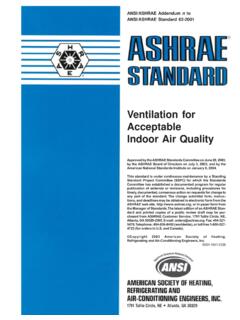

5 2012 Prudential Financial, Inc. and its related entities. Prudential, the Prudential logo, the Rock symbol and Bring Your Challenges are service marks of Prudential Financial, Inc., and its related entities, registered in many jurisdictions THE SEVEN (7) DAY WAIT PERIOD IMPACTS YOUR PLAN PARTICIPANTD uring the seven (7) day wait PERIOD , a participant will not be able to see loan amounts available on the participant website, or hear them on the toll-free phone number. When the seven (7) day wait PERIOD is over, the participant will be able to view and hear available loan amounts and request a new s an example for a plan with one (1) loan outstanding at a time and a seven (7) day wait PERIOD : OctoberSUNMONTUEWEDTHURFRISAT12345678910 1112131415161718192021222324252627282930 31 The loan payoff is posted to the (7) day loan wait (7) day loan wait can see, or hear, their loan amounts available online and by phone and/or request a new loan.