Transcription of C ERROR DENIAL REASON CODES - Cook County

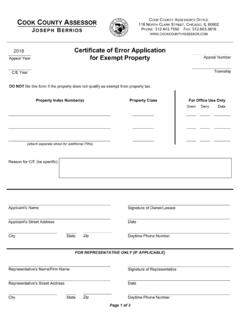

1 12/06/20181 of 1 cook County ASSESSOR cook County ASSESSOR S OFFICE 118 NORTH CLARK STREET, CHICAGO, IL 60602 PHONE: FAX: CERTIFICATE OF ERROR DENIAL REASON CODES GENERAL documentation has been submitted to establish tha t a reduction is data has been submitt ed to establish that a reduction is certificate of ERROR for this tax year can no longer be Board of Review complaint was filed for this tax year, and insufficient new evidence orargument has been submitted to support a evidence and/or arguments submitted do not establish that a reduction is property does not qualify for the relie f re certificate of ERROR has been denied, but a reduction has been granted as the result ofanother application or in another certificate of ERROR is not necessary because the Illinois Department of Revenue has alreadygr anted the exemption for this tax s Office records already reflect the exemption for this tax property did not qualify for an exemption for this tax documentation has been submitt ed to establish that the property qualified for anexemption for this tax certificate of ERROR is not necessary because County records reflect that the taxes for this taxyear have already been OCCUPANCY property is receiving a senior citizen assessment freeze exemption, which provides alower assessed value than the requested certificate of ERROR is not necessary.

2 Application for any refund resulting from the decisionof the Property Tax Appeal Board must be made at the Treasurer s tax year is not in the triennial assessment period for which a reduction was granted bythe Property Tax Appeal Assessor s Office has already acted to maintain the assessed value approved by thePr operty Tax Appeal Board for this tax DATA is due to the absence of a full is due to the absence of an owner and/or witness affi is due to the absence of sale s KAEGI