Transcription of COVID-19-Related Quarterly Filing – Form 941 and Form 7200

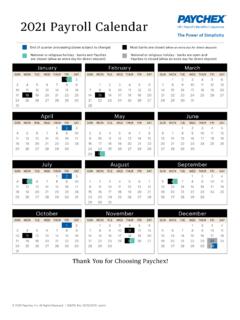

1 COVID-19-Related Quarterly Filing form 941 and form 7200 During the COVID-19 pandemic, The Families First Coronavirus Response Act (FFCRA) and the Coronavirus Aid, Relief, and Economic Security (CARES) Act both provide refundable tax credits for qualifying wages for: Employee Retention Tax Credit (CARES Act) Refund of wages paid for qualified sick leave (FFCRA) Refund of wages paid for qualified expanded family leave (FFCRA)As a result, the second quarter 2020 form 941 has been extensively revised. Two other factors that may affect this return are: Filing form (s) 7200 Employer Deferral of Social Security TaxFor more detail on these topics, go to the Customer Support during COVID-19 FAQs on second quarter 2020 form 941 is due on July 31, 2020, and Paychex is prepared to file the new s New with form 941?

2 There is now a Worksheet included with the return titled Credit for Sick and Family Leave Wages and the Employee Retention Credit. Based on the information you reported to Paychex, we ll complete the worksheet and use this information to complete the revised 941. The IRS is not requiring the worksheet to be filed with the return, we ll retain it in our records for your account in the event we need to refer to this information in the ReturnWe ll complete the updated form 941 based on the information you ve reported to Paychex, including: Qualified wages for qualified sick leave and family leave wages Qualified health plan expenses on qualified sick and family leave wages Qualified wages for the employee retention credit Qualified health plan expenses on wages reported for the employee retention credit Employer social security tax you ve deferred Advances received from Filing Forms(s) 7200 Important We ll report this information based on what you ve reported to Paychex, including any advances you ve received from Filing form (s) 7200.

3 Refer to the form 7200 section for additional information about what we need from 941 has been expanded to three pages to accommodate additional reporting for COVID-19 related wages and employer tax creditsSchedule BSchedule B for semiweekly schedule depositors has also been revised. Schedule B amounts will be reduced by the employer social security tax credits based on the information you reported to 941 for 2020:(Rev. April 2020)Employer s Quarterly Federal Tax ReturnDepartment of the Treasury Internal Revenue Service950120 OMB No. 1545-0029 Employer identification number (EIN) Name (not your trade name)Trade name (if any)AddressNumber Street Suite or room numberCityStateZIP codeForeign country nameForeign province/countyForeign postal codeReport for this Quarter of 2020 (Check one.)

4 1: January, February, March2: April, May, June3: July, August, September4: October, November, DecemberGo to for instructions and the latest the separate instructions before you complete form 941. Type or print within the 1:Answer these questions for this Number of employees who received wages, tips, or other compensation for the pay period including: June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) ..12 Wages, tips, and other compensation .. income tax withheld from wages, tips, and other compensation .. no wages, tips, and other compensation are subject to social security or Medicare taxCheck and go to line 1 Column 25aTaxable social security =.

5 5a(i)Qualified sick leave wages .. =.5a(ii)Qualified family leave wages .. =.5bTaxable social security =.5cTaxable Medicare wages & =.5dTaxable wages & tips subject to Additional Medicare Tax withholding . =.5eTotal social security and Medicare taxes. Add Column 2 from lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d 3121(q) Notice and Demand Tax due on unreported tips (see instructions) .. taxes before adjustments. Add lines 3, 5e, and 5f .. quarter s adjustment for fractions of cents .. quarter s adjustment for sick pay .. quarter s adjustments for tips and group-term life insurance .. taxes after adjustments.

6 Combine lines 6 through 9 .. small business payroll tax credit for increasing research activities. Attach form 8974 portion of credit for qualified sick and family leave wages from Worksheet 1 portion of employee retention credit from Worksheet 1 ..11c. You MUST complete all three pages of form 941 and SIGN For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment No. 17001 ZForm 941 (Rev. 4-2020)Line 5 has been expanded to include reporting qualified sick leave and family leave wages your business paid for COVID-19 from April 1 to June 30, 2020, for social security tax. These wages aren t subject to the employer share of social security : These wages are still subject to the employer share of Medicare 11 has been expanded to include the nonrefundable portion of employer social security tax for qualified sick and family leave wages and the employee retention credit for (not your trade name)Employer identification number (EIN)Part 1:Answer these questions for this quarter.

7 (continued)11dTotal nonrefundable credits. Add lines 11a, 11b, and 11c .. taxes after adjustments and nonrefundable credits. Subtract line 11d from line 10 . deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter amount of the employer share of social security tax .. portion of credit for qualified sick and family leave wages from Worksheet 1 portion of employee retention credit from Worksheet deposits, deferrals, and refundable credits. Add lines 13a, 13b, 13c, and advances received from Filing form (s) 7200 for the deposits, deferrals, and refundable credits less advances.

8 Subtract line 13f from line due. If line 12 is more than line 13g, enter the difference and see If line 13g is more than line 12, enter the one:Apply to next a us about your deposit schedule and tax liability for this 2:If you re unsure about whether you re a monthly schedule depositor or a semiweekly schedule depositor, see section 11 of Pub. one:Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500, and you didn t incur a $100,000 next-day deposit obligation during the current quarter. If line 12 for the prior quarter was less than $2,500 but line 12 on this return is $100,000 or more, you must provide a record of your federal tax liability.

9 If you re a monthly schedule depositor, complete the deposit schedule below; if you re a semiweekly schedule depositor, attach Schedule B ( form 941). Go to Part were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the quarter, then go to Part liability:Month liability for must equal line were a semiweekly schedule depositor for any part of this quarter. Complete Schedule B ( form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to form 941. Go to Part 3. You MUST complete all three pages of form 941 and SIGN Page 2 form 941 (Rev.)

10 4-2020)Line 13 has been expanded to include the following for COVID-19 related employer social security (SS) tax:. Any employer SS tax that you ve deferred The refundable portion of employer SS tax for qualified sick and family leave wages The refundable portion of the employee retention credit Advances received from Filing Forms (s) 7200950920 Name (not your trade name)Employer identification number (EIN)Part 3: Tell us about your business. If a question does NOT apply to your business, leave it your business has closed or you stopped paying wages ..Check here, andenter the final date you paid wages/ / ; also attach a statement to your return.