Transcription of ESS2 Payroll and Compensation TRAIN - Tennessee

1 ess2 Payroll and Compensation Training Guide ess2 Payroll and Compensation Page ii Table of Contents ess2 Payroll and Compensation .. 1 Payroll and Compensation .. 1 View paycheck .. 1 View and Print Paychecks .. 1 Direct Deposit .. 8 Creating the Balance Account .. 8 Adding Deposit Accounts .. 17 W-4 Tax Information .. 24 W-4 Tax Information - View and Update .. 24 W-2 Reissue Request .. 31 W-2 Reissue Request .. 31 TN Longevity Payment Election .. 33 Reviewing and Changing Longevity Payment Election .. 33 Compensation History .. 37 Viewing Compensation 37 Training GuideESS2 Payroll and Compensation Page 1 ess2 Payroll and Compensation Payroll and Compensation What is the Payroll and Compensation Section of Employee Self-Service?

2 _____ Employee Self-Service (ESS) gives employees access to their personal accounts and information in Edison. ESS is made up of different sections. Below is a list of sections in ESS, with items the employee may see or do in each section. Employee Self-Service Sections (Individual tutorials are available for each ESS section.) * Payroll and Compensation Time Reporting - View and print paycheck - Access and submit time sheet - Verify and change direct deposit information (if reporting time in Edison) - Change W- 4 information - Submit and review leave requests - Request a reissue of a W- 2 - Submit and review overtime requests - Verify or change longevity payment election - View leave balances and service credits Personal Information Learning - Review personal status information - View and enroll in available learning - Review and change home address classes - Review and change phone numbers - Review and change Emergency Contacts Benefits

3 Performance Management - View information for elected benefits - Review and acknowledge personal performance documents _____ This tutorial, ESS 2 - Payroll and Compensation , explains how to access information and perform activities in the Payroll and Compensation section of ESS. The lessons in this tutorial correspond to the six categories found in Payroll and Compensation : View paycheck , Direct Deposit, Compensation History, W-4 tax information, W-2 R reissue Request, TN Longevity Payment Elections. Brooke Roberts and her information will be used for all lesson examples.

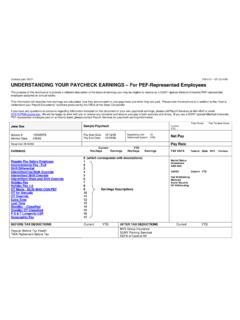

4 View paycheck View and Print Paychecks Procedure This lesson demonstrates how to access, view, and print current and previous paychecks. Training Guide ess2 Payroll and Compensation Page 2 Step Action 1. Navigate to the View paycheck by clicking on the link provided. Step Action 2. The View paycheck page automatically displays the most recent paycheck . Information is divided into sections. 3. The first section displays the Net Pay amount for this paycheck , Pay Period Begin and End Dates for which the employee is being paid, and the Check Date. 4. The General section displays the details of the Employee's Name, Employee ID, and Address taken from the personal data information in the Edison system.

5 Also displayed are the Business Unit, Pay Group, Department, Location, Job Title, and Pay Rate information from the Job Data information in the Edison System. Training GuideESS2 Payroll and Compensation Page 3 Step Action 5. The Tax Data section displays the employee's marital status for both federal and state income tax purposes. It also displays the number of Federal Allowances (exemptions) and State Allowances (exemptions) to be used to calculate the paycheck . If additional amounts are being withheld for federal and/or state taxes, they are also displayed in this section. Step Action 6. The paycheck Summary section provides details of the Current paycheck and Year-To-Date (YTD) amounts.

6 The Current and YTD rows display details of Gross Earnings, Federal Taxable Gross, Total Taxes, Total Deductions and Net Pay. Note: Year-to-Date (YTD) balances are only available on the most current paycheck . The YTD balances will not populate on past paychecks brought up to view. 7. The Earnings section displays a Description of the different types of earnings (Regular, Overtime, Longevity), number of Hours (optional), Rate (optional) and the corresponding dollar Amount for the current pay period and the Year-to-Date (YTD) Amount. Training Guide ess2 Payroll and Compensation Page 4 Step Action 8. The Taxes section displays a Description of the types of taxes withheld and the corresponding current dollar Amount and Year-to-Date (YTD) Amount.

7 Step Action 9. The Before-Tax Deductions section lists any deductions taken before the income tax is calculated. This section displays the Description of the Before-Tax Deductions and the corresponding Amount and Year-to-Date Amount (YTD.) Examples of Before-Tax Deductions include employee paid Health Plan deductions, 401K contributions, and Flexible Account Spending (FSA) deductions. 10. The After Tax Deductions section lists all after tax deductions for the employee for this pay period. This section displays the Description of the After Tax Deductions and the corresponding dollar Amount and Year-to-Date Amount (YTD). Examples of After Tax Deductions include Term Life deductions, Long Term Care deductions, garnishments, 401K contributions, and charitable deductions.

8 11. The Employer Paid Benefits section lists all the benefits paid by the employer for the employee. This section displays the Description of the Employer Paid Benefits and the corresponding Amount and Year-to-Date Amount (YTD.) Examples of Employer Paid Benefits may include the employer portion of medical insurance plan, retirement, life insurance, and 401K contributions. Training GuideESS2 Payroll and Compensation Page 5 Step Action 12. The Net Pay Distribution section provides information about the distribution of the paycheck . Items displayed include: Payment Type - Direct Deposit/ Advice paycheck Number - System generated number assigned to this paycheck Account Type - Savings or Checking Account Number - Employee's bank account number that received the deposit Amount - Dollar value that was deposited for this check Note: If an employee has multiple direct deposits, the information for each account will be shown here.

9 Step Action 13. Brooke has reviewed her current paycheck and would now like to look at a different paycheck that was received a few weeks earlier. To view previous paychecks, click on the View a Different paycheck link. Training Guide ess2 Payroll and Compensation Page 6 Step Action 14. A page appears containing a list of previous paychecks available for viewing. Brooke would like to view the paycheck from the pay period that ended on January 15th of 2011. Click on the 2011-01-15 link. 15. The paycheck from the pay period ending on January 15, 2011 populates. Note: Year-to-Date (YTD) balances are only available on the most current paycheck . The YTD balances do not populate on this past paycheck or other past paychecks brought up to view.

10 16. Brooke decided to navigate back to her current paycheck issued on 2/15/2011. She would like to print this paycheck . Click on the View Printer Friendly paycheck link. Training GuideESS2 Payroll and Compensation Page 7 Step Action 17. A printable version of the check will appear in a new window. If it is difficult to see, change the view to 100%. Click on the menu for viewing size and select "100%". Training Guide ess2 Payroll and Compensation Page 8 Step Action 18. To print the paycheck , click the File menu, select Print. It will take the user to the printing functions and options established for the computer on which the user is working. From there the user may print the paycheck .