Transcription of FOR FILING PURPOSES ONLY. DO NOT DUPLICATE. 9960 …

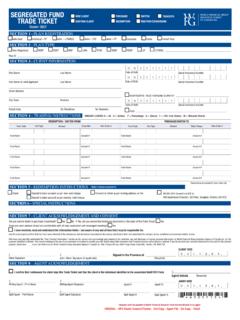

1 FOR FILING PURPOSES ONLY. DO NOT DUPLICATE. 9960 TRADE TICKET New Client Existing Client Purchase Redemption Transfer RED/PUR Conversion Switch SECTION 1 | PLAN REGISTRATION Plan ID #. Individual Joint - WTROS Joint - ITF Formal Trust * Attach Corporate Resolution and Articles of Incorporation for Corporation. Additionally, please provide the FATCA Corporate Disclosure form, Declaration of Tax Residence for Entities which is available at: Individual - ITF Joint - JTIC Estate Corporation* SECTION 2 | PLAN TYPE. TFSA SP RRSP LIRA RDSP Self Directed Name Self-Directed ACC#. Open RRSP RRIF LIF RESP I RESP F LRSP In Trust For Other SECTION 3 | CLIENT INFORMATION. First Name Last Name Date of Birth (mm/dd/yyyy) SIN Number Joint Applicant First Name Joint Applicant Last Name Date of Birth (mm/dd/yyyy) SIN Number RESP/RDSP/In Trust for/Beneficiary Telephone Number Email Address Beneficiary/ITF Name SECTION 4 | TRADING INSTRUCTIONS Amount Type (AMT) Legend A=All D=Dollars P=Percentage S= Shares T=10% Free M=Matured Shares Redemption/Switch From Purchase/Switch To Gross/ Gross/ Sales Fund Code AMT Amount Account # Wire Order Fund Code AMT Amount Account # Wire Order Net Net Charge Unsolicited Trade(s) ( not recommended by the Representative): Provide details in the Special Instructions section or attach as a separate page.

2 PAC & SWP UPDATES Action Legend N=New C=Change Existing S=Stop Frequency: Monthly Quarterly Other PAC/SWP Action Fund Code Amount Existing Account Number Start/Stop Date PAC SWP. PAC SWP. SECTION 5 | BORROWING FUNDS. Did you borrow funds to purchase the investment (This includes HELOC, LOC, etc.)? Yes No If yes, did you review the Risk of Borrowing to Invest disclosure provided on the back of the Trade Ticket and WFGS NAAF/KFC, and are you comfortable with all risks associated with leveraged investing? Yes No Source of Funds SECTION 6 | REDEMPTION INSTRUCTIONS. Forward Via: New EFT (Void cheque attached) Existing EFT Cheque (If cheque, complete the information below). Payable To: Client In Trust WFGS. Forward To: Client Address Dealer (6700 Pierre-Bertrand Blvd., Suite 300, Qu bec (Qu bec) G2J 0B4). Reason for Redemption SECTION 7 | SPECIAL INSTRUCTIONS.

3 SECTION 8 | FEE DISCLOSURE For purchase, provide DSC/LL Schedule percentage %. For Redemptions, provide amount: $ Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7. SECTION 9 | CLIENT ACKNOWLEDGMENT AND CONSENT. I acknowledge that I have received and reviewed the current Fund Facts document(s) in advance of signing this form, and I understand the applicable charges, fees and trailing commissions associated with the transaction(s). I confirm that I have witnessed the client sign this Trade Ticket and that Rep Initials: the client is the individual identified in the associated NAAF/KYC form. Note to Client: Only sign this form when all sections are complete. Client Name Client Signature Signing Province Date (mm/dd/yyyy). Joint Client Name Joint Client Signature Signing Province Date (mm/dd/yyyy). Representative Name Representative Signature Representative Code # % Date (mm/dd/yyyy).

4 Split Representative Name Split Representative Signature Split Representative Code # % Date (mm/dd/yyyy). Cheques must be payable to WFG SECURITIES INC. IN TRUST and not directly to the representative. Original - WFG Dealer Connect 2nd Copy - Representative File 3rd Copy - Client Signature Guarantee 2018-2021 transamerica Corporation WFGCA10079 Stamp DISCLOSURES AND STATEMENTS. CLIENT ACKNOWLEDGMENT DUAL LICENSE DISCLOSURE STATEMENT. I/we acknowledge and agree that I/we: I/we acknowledge that WFGS Mutual Fund Representatives may also be Understand that a WFG Securities Inc. (WFGS) Mutual Fund licensed as Insurance Agents that conduct insurance business through Representative may not offer tax advice and that I/we am/are responsible World Financial Group Insurance Agency of Canada Inc. (WFGIA). In for the tax consequences of this transaction. A WFGS Mutual Fund addition, your representative may conduct other business activities that Representative may have an outside business activity related to providing are classified as being an outside business activity (OBA).

5 Tax advice, but any such services are not provided nor endorsed by WFGS. Instruct WFGS to make the transaction as indicated on the reverse. Your representative will provide a separate disclosure to you in regards to Know that for my/our protection, redemptions of mutual fund units these activities that are outside of WFGS and/or WFGIA. require written instructions with my/our signature(s). Your Personal Information Personal information provided herein will be collected, used and disclosed FUND COMPANY PROSPECTUS as described in your New Account Application Form (NAAF/KYC) and as otherwise outlined in this form or at the time of collection. The personal I/we acknowledge receipt of the current Fund Facts, and I/we declare information provided herein will be disclosed to the Fund Company or that I/we understand the charges, terms, conditions, statutory rights Trust Company whose product(s) you have invested in, or are purchasing and provisions stated therein, which apply to the purchase for which or redeeming, to enable these companies to process your investment the application is made.

6 I/we will receive a confirmation of the above instructions and record any changes in information related to your transaction(s). I/we will contact the Distribution and Compliance Team, investment account(s). indicated below, if it is not received. WFGS has contracted with WFG Dealer Connect to provide for the back office processing of client transactions. RISK OF BORROWING TO INVEST. Your Social Insurance Number will be used for income reporting PURPOSES . Here are some risks and factors that you should consider before borrowing From time to time, WFGS may use your personal information to determine to invest. if other financial or insurance products and services meet your needs, and they may offer them to you. Is it right for you? Borrowing money to invest is risky. You should only consider borrowing Subject to exceptions set out in applicable legislation, you may access to invest if: your file and request corrections to your personal information by sending o You are comfortable with taking risk a written request to: WFGS, Attn: Privacy Office, 5000 Yonge Street, Suite o You are comfortable taking on debt to buy investments that may go 800, Toronto, ON M2N 7E9.

7 Up or down in value o You are investing for the long-term By completing and signing this application, you acknowledge and agree o You have a stable income that you have provided personal and financial information that is true You should not borrow to invest if: and accurate, and you consent to the collection, use and disclosure o You have a low tolerance for risk of your personal information, as described herein, or at the time of o You are investing for a short period of time collection, and as required or permitted by law. o You intend to rely on income from the investments to pay living expenses o You intend to rely on income from the investments to repay the loan o You may not be able to pay back the loan, should income from the IMPORTANT NOTES FOR CLIENTS. investment stop or decrease Investment benchmarks are usually a group of securities known as a You can end up losing money.

8 Market index.. If the investments go down in value and you have borrowed money, your losses would be larger than had you invested using your own money. One common example is the S&P/TSX Composite Index. Whether your investments make money or not, you will still have to pay A market index provides good historic information, but isn't a perfect back the loan, plus interest. You may have to sell other assets, or use comparison to your investment for three reasons: money you had set aside for other PURPOSES , to pay back the loan. 1. A market index does not reflect the costs of managing and If you used your home as security for the loan, you may lose your home. operating a mutual fund. To compare your mutual fund to a If the investments go up in value, you may still not make enough money benchmark, subtract the fund costs from the benchmark. to cover the costs of borrowing.

9 2. A market index measures performance over a specific time period. If you held the mutual fund over a different time period, it Tax Considerations will not be a perfect match. You should not borrow to invest just to receive a tax deduction. 3. Benchmarks use a time-weighted formula to calculate Interest costs are not always tax deductible. You may not be entitled to performance. The statement you will receive will use a a tax deduction, and you may be reassessed for past deductions. Before money-weighted formula to calculate your return. borrowing to invest, please consult a tax professional to determine whether your interest costs can be used as a tax deduction. For these reasons, your return might not mirror the benchmark for the fund. Your representative should discuss with you the risks of borrowing to invest. If you have any questions concerning the processing of your transaction, please direct any inquiries to: WFG Securities Inc.

10 Attn: Disribution and Compliance 5000 Yonge Street, Suite 800, Toronto, ON, M2N 7E9. Tel: 416-225-2121. 2018-2021 transamerica Corporation For internal use only. WFGCA10079