Transcription of FSA ENROLLMENT KIT - Mydenny's

1 FSAENROLLMENTGUIDEE veryone spends money on doctorvisits, prescriptions, dental exams, glasses andcontacts,andover-the-counter medicines, not to mention daycare. Why not savetax dollars onyour eligible expenses? By enrolling ina Flexible Spending Accountyou can make these every day expenses more s 1, 2016 December31, 2016 Plan SpecificationsMedical FSA Maximum Annual Contribution$2, care FSA Maximum Annual Contribution$5, (or $2,500 if married but filing separately)Minimum Contribution Required to Participate$ ScheduleWeekly WednesdayReimbursement MethodCheck/ Debit CardMinimum Reimbursement AmountNoneRun OutPeriod tofileclaims90 daysafter the end of the plan year (3/31/2017)Grace Period to incur claims2 months through 3/15/2017 REMINDERS: Expenses for entire family may be reimbursed regardless of whether or not they are covered by the health/dentalinsurance.

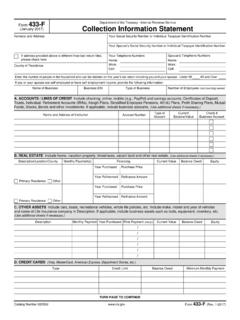

2 Expenses must be incurredduring the plan year andwhile you are actively employed. Election is irrevocable unless there is an IRSapprovedQualifying Event. Use-It or Lose-It: If contributions made into the FSA are not used by the end of the plan yearand correspondinggrace / run out period, you will lose the remaining funds. You have 90-daysfrom the end of your plan year to fileclaims for reimbursement. YourFSA Medicalannual election (total amount to be contributed for the year) is available at any time. Only the amount contributed to date is available for your dependent care FSA, and the date of service must haveoccurred before the reimbursement can be made. Claims are processed within 24-36 hours of Asked QuestionsWhat is a Flexible Spending Account (FSA)?3 How does a FSA work?3 Eligible Expenses3 How much should I contribute?

3 4mySourceCard5 Claim Filing Instructions6 How doIaccess funds?6 MobilemyRSC App7 Page3 WHAT IS AFSA?Flexible Spending Accounts(FSAs)use pre-tax dollars for reimbursement of what would otherwise be after-tax used for unreimbursed medical, dental and vision care FSAsare used to reimburse daycare expensesfor children up to and including age 12or care for a mentally or physically disabled spouse or other adult claimed as a dependent onyour tax enrolling in a FSAyou are lowering your taxable income, paying less in taxes and increasing yourspendable income!Take a look at the following real savings example:*Qualified expenses include insurance premiums, unreimbursed medical expenses and daycare costsHOW DOES A FSA WORK?As an employee you elect to have a certain dollar amount deducted from your earnings before taxes and deposited into aMedical FSAand/orDependent care you incur an expense you submit the receipt along with a claim form for EXPENSESM edical FSAE ligible ExpensesThe purpose of a FSAis to enable you to save tax dollars on the expenses that are not covered by yourmedical or other insurance plan.

4 The IRS Publication 502 lists thepotentiallyeligible expenses; however,notall expenses in Publication 502 are eligible expense includes any item for which you could haveclaimedasa medical expense on an itemizedfederal income tax returnwith the exception ofinsurancepremiums, long-term care and other similar expenses may include: Medical copayments, deductibles and out-of-pocket expenses Dental and orthodontia charges not covered by insurance Vision and hearing charges, including glasses, contacts,Lasiksurgeryand hearing aids Pharmacy expenses, including prescription charges and diabetic supplies.(restrictions apply) Over-the-counter medications (Effective January 1, 2011, supporting documentation such as aprescriptionor physician s statement mustbe submitted at time of claim.)

5 Examples include cold,cough, and flumedicine, acid controllers, painrelief, allergy and sinus medications, etc.) Other miscellaneous expenses including durable medical equipment, speech, occupational, and physicaltherapy, mental health and substance abuse counseling, transportation for medical care , etc. Purchase and/or view eligible expenses online through the FSA Store. Access the site by care FSAE ligible ExpensesBy enrolling in aDependent care FSAyou are able to pay for expenses associated with daycare for your eligible dependents with pre-tax dollars. The following stipulations apply to dependent care accounts: The dependent mustbe under the age of 13 andconsideredyour dependent underfederal tax rules. The expenses must enable you (and your spouse,if married) to work, actively seek work,or attend school full-time.

6 The child- care provider cannot be someone who is consideredyour child or stepchildand is under the age of 19 or if you claim the provider as a dependentfor tax-purposes. Only expenses deemed essential to the care of the dependent are eligible. Expenses formeals, diapers, registration fees, late charges, not eligible. Costs for the care of a mentally or physically disabled spouse or other adult dependentare eligible if you claim them on yourfederal tax return as a a FSAG ross Monthly Income5, $Tax Withholding (est. 25%)1, $Spendable Income3, $* Qualified $Net Spendable Income3, $With a FSAG ross Monthly Income5, $* Qualified $Taxable Income4, $Tax Withholding (est. 25%)1, $Spendable Income3, $Net Spendable Income3, $Increase in Spendable Income (monthly) $Page4 HOW MUCH SHOULD I CONTRIBUTE?

7 Medical FSAC ontributionsYouremployerwill determine the maximum annual contribution that you can make to yourMedical determining yourannual contributionthe key is to not overestimate your expenses. Take into consideration the expenses you know you and yourdependents will you know that you take 2 prescriptions monthly,go tothe doctor once a year and always get a new pair of glasses then include assume that you will meet your deductible or out-of-pocket chart belowmay be usedto help youcalculateyour of Physician Copayments:$Cost of Prescription Copayments/Deductible:$Dental / Orthodontia Expenses:$Vision Expenses (glasses/contacts):$Over-the-Counter Medications:$Other MedicalExpenses:$Total Expenses:$Total Expenses$divided by # of pay periods=deduction per pay cycle$ dependent care FSAC ontributionsThe annual maximum contribution is $5,000 (or $2,500 if married but filing separately),andcannot exceed the earned income ofeither you or your spouse, whichever is sure to include before and after school care , summer programs, vacation, holidayand sick days if Daycare Expense$divided by # of pay periods=deduction per pay cycle$USE-IT OR LOSE-IT RULEIf the contributions made into a FSA are not used by the end of the plan year and corresponding grace period, you will lose the remaining 90-days fromthe end of your plan year to file claims for reimbursementCAN I CHANGE MY ELECTION MID-YEAR?

8 Your annual election is irrevocable unless you have an IRS approvedQualifying Event. Typically this includes marriage, divorce, birth, adoption ordeath ofa dependent , change in the employment status of the employee,spouse or dependent , or change in the eligibility of a in daycare providers, daycare rates, or a childreachingage 13 allallow for a change in your FSA dependent care contribution. Other changesmay be eligible but will require DEBIT CARDT hemySourceCardis a MasterCard debit card that may be used to purchase eligible expenses from qualified merchants. It can beused to pay for things likephysician copays, hospital charges, prescriptions, dental expenses, glassesandcontacts. In some cases, itcan even be used to pay for daycare January 1, 2011 it can no longer be used to purchase over-the-counter drugsand Can I Use the Card?

9 ThemySourceCard operates through programmed merchant codes. Each providerthat accepts MasterCard is assigned a Merchant Category Code. There are over500 such codes; however, only those codes related to eligible expensesunderyour plan are programmed on the card. Qualified merchants include: Doctors Hospitals Dentists / Orthodontists Vision Providers Pharmacies Retail merchants using the IIAS (Inventory Information Approval System)How Does the Card Work?Simply present themySourceCard when purchasing eligible expenses from qualified merchants; the funds will be paid directly fromyour reimbursement account. The available credit on your card will be the available balance in your account up to a dailymaximumwithdrawal amount of $5, works just like any other debit card; but, there are 5 major differences: Limited to specific merchants deemed eligible by your plan Limited to expenses deemed eligible by your plan Cardcannotbe used atthe ATM Card will not allow cash back with a purchase There is no PINR eceipts may or may not be required.

10 Some card swipes for eligible purchases may auto-substantiate which alleviates you fromhaving to submit additional documentation. However, ifany card transaction does not auto-substantiate, theIRS requires additionaldocumentation to be will be notified via e-mail(if you have provided this information to BCI)if you need to to Remember: Keepall your receipts. You might be requiredto submit receipts to verify expenseeligibility. The card is only valid at eligible merchants. Card can be used up to the amount available in your account upto a daily maximum withdrawal limit of $5,000. Transactions over the available amount will be denied. 24/7 access to account information *Please note, not all employers elect for their employees to have access to the mySource FILINGINSTRUCTIONSWhen submitting paper claims you must completetheFSA claim form andsubmit it along with the documentationforyour can alsocomplete your claim form online, then print and submit claims can be faxed, emailed or can alsosubmit your claims through the newmyRSC mobile app on your claims are processed within24-36hours of receipt and can beviewed include.