Transcription of GST and Fertiliser Sector - The Fertiliser Association …

1 GST and Fertiliser SectorThe Goods and Service Tax (GST) is a long pendingindirect tax reform which India has been waitingfor quite some time. The intent of the governmentto put in place GST was announced in the UnionBudget 2006-07. Since then there have beenprolonged discussions between centre and stategovernments regarding the contours of itsformulation and implementation. Thiscomprehensive tax policy is expected to be one ofthe most important reforms in contributing to theIndian growth is hoped to remove the cascading effect ofvarious taxes and simplify the existing tax introduced, GST will not only make the taxsystem simpler, but will also help in increasedcompliance, boost tax revenues, reduce the taxoutflow in the hands of the consumers and makeexports competitive.

2 With a simpler taxadministration, foreign investments are alsoexpected to improve significantly. According to areport by the National Council of Applied EconomicResearch, GST is expected to increase economicgrowth by between per cent and per aims to get rid of the current patchwork ofindirect taxes that are partial and suffer frominfirmities such as multiplicity of taxes and alsoexemptions. It aims to replace the existing multiplestructure of central and state taxes with a singleunified tax rate across the country covering bothgoods and services. GST, being a destination basedconsumption tax based on VAT principle, wouldhelp in removing economic distortions and indevelopment of common market in India.

3 It impliesvalue addition at each stage of production andsupply chain with the set off benefits accruing fromthe producer s/service provider s point up to theretailer s level. The final consumer will thus bearonly the GST charged at the last point of supplychain with set off benefits at all previous has been found an effective system worldwideand it is being used in more than 140 countries,with rates varying between 15% and 20%. It is fastbecoming the preferred form of indirect tax in theAsia-Pacific region. It is interesting to note thatthere are 40 models of GST currently in forceworldwide, each with its own peculiarities.

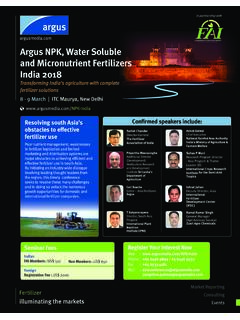

4 Somecountries have single rate of GST applicable to allproducts and some others have multiple rates withconcessions to some products and exemptions tosome other essential products and is heartening to note that the present Indiangovernment is very keen to implement GST at theearliest. In May 2015, the lower house (Lok Sabha)of the parliament already passed the ConstitutionAmendment Bill for GST. It is now pending in theUpper House (Rajya Sabha). Meanwhile, steps forcreating IT infrastructure and formulating GSTlaws are also being taken. The government has alsoinitiated the process of industry consultation andis collecting the data regarding the impact ofvarious tax structures on various us examine how GST will work and what arethe advantages and some shortcomings of the GSTmechanism for the Fertiliser has special significance for the Fertiliser sectorwhich is currently allowed a number of taxconcessions/exemptions both at input and outputlevels and there is also heavy subsidy on sale offertilisers.

5 The impact on Fertiliser industry willdepend on how these elements are treated underthe proposed GST the impact of proposed GST onfertiliser industry, the Fertiliser Association of India(FAI) had proactively flagged the issues impactingthe Fertiliser industry to the government as earlyas 2011. FAI has commissioned a study recentlyon likely impact of proposed GST on Fertiliser {} Fertiliser productsare likely to sufferfrom higherincidence of taxeswith implementationof GST. There is aneed for thegovernment to payspecial attention tofertiliser by a professional taxconsultant. Fertiliser industrythrough this study has alreadygenerated the type of informationbeing currently collected by theFinance Ministry from otherindustries.

6 Perusal of data &information and its analysis willhelp to formulate oursuggestions to the governmentfor implementation of GST. Butfew issues at macro level are veryclear at this industry is going to beimpacted adversely underproposed GST regime. Presently, Fertiliser industry enjoys thesupport of Union and StateGovernments by way of taxconcession / exemptions oninputs as well as on finishedfertiliser products. This inter-aliaincludes concessional rate /exemption from excise andcustoms duties on inputs formanufacture of fertilisers,concessional rate of excise dutyon finished fertilisers, concession/ exemption from state VAT onfertilisers.

7 Further, subsidy paidby Government on fertilisers iscurrently exempt from all combined impact of theseexemptions / concessions hasbeen that the total incidence oftax on Fertiliser products hasbeen reduced significantly andis about 5-10% of the value ofproducts. If these exemptions /concessions are withdrawnunder GST and the rate of GSTis kept, say, at a level of 18%, theincidence of tax on fertilisers willincrease significantly. This in turnwill either increase the retailprices of fertilisers or increase thefertiliser subsidy or likely issue is that thecurrent incidence of tax oninputs is higher than theincidence of tax on finishedfertilisers due to subsidy element,which is currently exempted,and taxing the subsidy in anycase is not desirable even infuture.

8 Thus, it will result inaccumulation of large amount ofunutilised input tax creditblocking industry s funds withtax authorities on a portion of fertilisers aremoved from one state to other onstock transfer basis based on thegovernment directive undermonthly supply plan. Thus, thepoint of taxation on stocktransfer and effective mechanismfor refund of tax credit also needsattention of the Government forthe Fertiliser Sector . There wouldbe need for regular monthlypayments of unutilised input taxcredit to address the issue ofhigher incidence of tax on inputsthan the finished over to direct benefittransfer (DBT) of subsidy tofarmers would mean sale offertilisers at full price.

9 Forexample, currently, there is asubsidy of almost 70% of cost ofurea. This is not taxed atpresent. On introduction ofDBT, the GST will also be leviedon 70% subsidy which iscurrently exempted. This willincrease the incidence of tax onthe Fertiliser , at present, major inputslike natural gas and petroleumproducts for production offertilisers are not proposed to becovered under GST. This means,levy of central and state taxes onthese inputs will continue asper current practice andfertiliser manufacturers will notget input tax credit against taxpaid on these inputs.

10 This willresult in cascading effect of taxon tax. This will also increaseincidence of tax on final productand the cost of fertilisers to is obvious from the above thatfertiliser products are likely tosuffer from higher incidence oftaxes with implementation ofGST. Therefore, it is strongly feltthat there is a need for thegovernment to pay specialattention to Fertiliser Sector ,keeping in view its direct linkagewith farmers and new tax regime should notdirectly or indirectly increase thecost of fertilisers to the farmers,especially when governmentcontinues to provide subsidy onfertiliser directly or facie, the governmentshould thus; either allow zero orconcessional rate of GST onfertilisers.