Transcription of How to be - Federal Retirement

1 How to beFinanciallyPrepared WhenYou RetireBy Dennis V. DampHost of V. Damp is an author, retired Federal manager, businessowner, career counselor and veteran. He retired in 2005 at age 55with 35 years 7 months of government service. Dennis is the authorof 26 books including The Book of Government Jobs 11thedition, and has been a guest on hundreds of radio talk shows,CNN s Your Money shows, lectured at universities and colleges,produced Internet web sites and training videos, and has writtenhundreds of articles for national magazines, newspapers and Websites. His books have been featured in the Wall Street Journal,Washington Post, New York Times and News & World joined the Air Force in 1968 and spent over three years and four months on active dutyand an additional seven years with the Air National Guard. He was hired by the Department ofDefense (DOD) after leaving active duty and transferred to the Federal Aviation Administration(FAA) in 1975. He spent the remainder of his career in various positions with the FAA were heworked as an electronics technician, training instructor, project engineer, computer-basedinstruction administrator, training program manager, program support manager, andenvironmental health and safety program manager.

2 His last government position was technicaloperations manager at the Pittsburgh International Airport's air traffic control report and the web site was developed by Dennis Damp to helpfederal employees and retirees find the information they need to make informed decisions abouttheir Retirement and benefits. Books by Dennis Damp:The Book of Government Jobs - 11th editionTake Charge of Your Federal Career - 2nd editionPost Office Jobs - 6th editionHealth Care Job Explosion - out of printDollars & Sense: Safe Investment Strategies for Small Investors - out of printWeb sites developed and hosted by the Copyright 2017 by Dennis V. Damp1 Are You Financially Prepared to RetireMost feds obtain annuity estimates prior to retiring and have a sense of what they need to live onafter they leave. It s advisable to throughly evaluate your total expenses and income, pre and postretirement, so that you and your spouse will know how much you will be living on in report will help you analyze your personal situation and determine what you will have leftafter paying for the necessities of life.

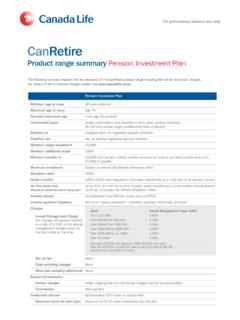

3 You will be able to determine if your lifestyle will need tochange dramatically or if you will need to work part time to supplement your start the process locate household receipts, pay statements, utility bills, insurance policies,loans and bank account information. Gather Up the following information in preparation forevaluating your personal situation:!Pay Stubs !Other income sources"Stock Dividends"Savings Bonds"Earned Interest"Rental Income"Spouse Income"Other!Insurance Policies "Life"Auto "Home"Umbrella"Long Term Care!Loans "Car 1"Car 2"Mortgage"Home Equity"Other!Utility costs"Phone"Gas"Light"Cable "Water "Garbage Pickup!Other Expense Items "Cell Phones"Internet Provider!Last Years Taxes" Federal "State"LocalA sample Retirement analysis chart starts on page 5. Use the free downloadable Excel spreadsheetat to start your evaluation. Save the spreadsheet toyour computer and work on it off line. The sample spreadsheet shows approximately what theretiree will have remaining after they pay all of their bills before and after Retirement .

4 The table isnot all inclusive and you can add or remove items as necessary. The sample shows a GS-11 step6, CSRS employee with 35 years service who plans to retire at age NOTE: The example doesn t include the spouse s income. A spouse could be laid off or stopworking for other reasons. This example shows that the total expenses pre Retirement aregreater than the employee's gross pay and can be typical with working couples that havechildren still in school. Just one more reason to plan ahead for Retirement . The differences would be even greater for a FERS retiree. Their annuity would beapproximately half. The FERS Social Security Supplement and their THRIFT savingsplan could add substantially to their Retirement income if they plan effectively. 2 Expenses are listed on the chart for pre and post Retirement per year and month. The last columnpresents what your spouse will have to live on when your estate is settled. This is a veryrevealing analysis. In Retirement this person will be living on an annuity of approximately$36,985.

5 His total expenses after Retirement are $33,835 leaving him with a buffer of just over$3,000 a year for emergencies. If there are unanticipated expenses or increased costs this personwill need to be able to tap other Retirement savings. The other option, if you don't have much inyour other savings plans, is to continue to work at least part time some where. You can explorejobs best suited to Federal retirees at After completing this chart you may determine that it isn t feasible for you to retire if you weredepending 100% on annuity income. Most in the Federal sector have the Thrift savings planwhich can substantially augment your Retirement income or other investment income. You andyour spouse may also be eligible for social security when you reach age 62 or older. If you are inthe FERS system and retire at or after your eligibility date social security offset will help youmake ends meet if you are under age 62. In this example, the surviving CSRS spouse's annuityreduces to 55 percent of the retiree's annuity, or $20,341.

6 The survivor has expenses totaling$19,680, way to close for comfort. Ideally, insurance or an annuity would add a blanket ofsecurity for the survivor along with social security, Thrift Savings and other investment analysis and discussion will show you where you need to go from here. There are additionalservices and software available that can assist you with your personal situation:!Visit for detailed Retirement and estateplanning guidance. This 11 part series will help you prepare for Retirement , understand basicestate planning techniques, and compile a "Survivor's Guide" for your spouse. !Download software from Decision Support Software that will estimate your Federal annuityand benefits at to retire Mortgage FREE and Boost Your SavingsMost will have to learn to live on less in Retirement , a fact of life these days. And one way tobecome accustomed to less is to start putting away more when you are still working. I startedsaving my annual pay increases through Credit Union allotments and savings bond deductions 20years before I retired.

7 When I retired, my take home pay was the same amount it was in 1995. Icontributed the maximum allowed to my TSP through catch-up contributions when I turned 50and when I did retire my monthly annuity check was larger than what I was taking home when Iwas working full time. Use this process to pay off your mortgage early and retire mortgage freeor take a one-time TSP withdrawal after your retire to pay off your mortgage to free up cash forretirement. Planning is the key and when you learn to live on less you won t miss Retirement Cost Analysis Spreadsheet R-1 Download this spreadsheet to prepare your personal 4 Sample Retirement Cost Analysis Spreadsheet R-1(Continued)5