Transcription of Managing Risks of Electronic Banking, Direct Debit and ...

1 Issued on: 24 December 2014 Managing Risks of Electronic banking , Direct Debit and Risks Associated with Payment Instruments Circular BNM/RH/CIR 028-6 Payment Systems Policy Department Consumer and Market Conduct Department Managing Risks of Electronic banking , Direct Debit and Risks Associated with Payment Instruments 1. INTRODUCTION .. 1 2. APPLICABILITY .. 2 3. ISSUANCE AND EFFECTIVE DATE .. 3 4. INTERPRETATION .. 3 5. SUPERVISORY EXPECTATIONS .. 5 BNM/RH/CIR 028-6 Payment Systems Policy Department Consumer and Market Conduct Department Managing Risks of Electronic banking , Direct Debit and Risks Associated with Payment Instruments Page 1/11 1.

2 INTRODUCTION Electronic banking As provided in the Guidelines on the Provision of Electronic banking (e- banking ) Services by Financial Institutions (FIs) issued on 30 March 2010, the board of directors and senior management of FIs are responsible to address the Risks associated with the security, integrity and availability of the FIs e- banking products and services. In this regard, FIs amongst others, should continuously assess the effectiveness of their risk mitigation measures and take proactive measures on a timely basis in addressing new security threats that may result in financial losses to the FIs and their customers, and would undermine customer confidence and the FIs reputation.

3 The recent cases of malware attacks on internet banking customers accounts where fraudsters have been able to steal confidential banking information such as the victim s login credentials, password and transaction authentication code is a concern. As new malware virus variants are introduced, anti-virus software are likely to lag behind, thus undermining the effectiveness of using mobile devices for the purpose of second factor authentication of internet banking transactions.

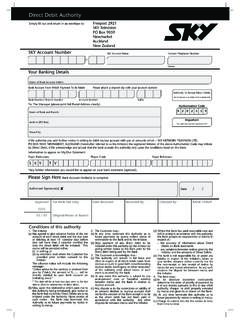

4 Consequently, there is a need for FIs and issuers of designated payment instruments to review the adequacy of their second factor authentication method. Direct Debit The exposure of customers account details ( bank account details or designated payment instrument account details) may increase the risk of such information being misused to create unauthorised Direct Debit transactions. With the increasing use of Electronic payments, it is important to further strengthen the risk mitigation measures to counter any misuse of customers account details.

5 BNM/RH/CIR 028-6 Payment Systems Policy Department Consumer and Market Conduct Department Managing Risks of Electronic banking , Direct Debit and Risks Associated with Payment Instruments Page 2/11 Card-not-present and overseas transactions for designated payment instruments With the growth of Debit and prepaid cards that allow consumers to conduct face-to-face (card present) transactions both locally and abroad, as well as, non-face-to-face (card-not-present) transactions, there is a need to implement adequate risk management measures and controls, and to educate customers of the safe practices in order to mitigate the Risks of unauthorised transactions, in particular for card-not-present and overseas transactions.

6 Customer Confidence Following the recent cases of malware attacks, it is important to enhance the protection of consumers and strengthen consumer confidence by clearly stating the circumstances in which customers can be held liable for unauthorised transactions and facilitating the efficient resolution of disputed transactions. In addition, with the anticipated growth in Electronic payment transactions and increase in the usage of payment cards, particularly the Debit card, FIs and issuers should take proactive measures to ensure that their risk mitigation mechanisms remain effective to safeguard their customers account balances.

7 The requirements in this Circular are in addition to the consumer protection measures provided in the Guidelines on the Provision of E- banking Services by Financial Institutions, Guidelines on Complaints Handling and the policy documents on credit card/credit card-i, charge card/charge card-i and Debit card/ Debit card-i. 2. APPLICABILITY This Circular is applicable to all FIs and issuers of designated payment instruments. BNM/RH/CIR 028-6 Payment Systems Policy Department Consumer and Market Conduct Department Managing Risks of Electronic banking , Direct Debit and Risks Associated with Payment Instruments Page 3/11 Except for paragraphs to , the requirements in this Circular shall apply to transactions performed by individuals, micro and small enterprises.

8 The requirements under paragraphs to are applicable to e- banking transactions, Direct Debit transactions and card-not-present transactions using designated payment instruments, as the case may be. The requirements under paragraphs to are applicable to card-not-present and overseas transactions using Debit card, Debit card-i and prepaid card. The requirements under paragraphs to are applicable to financial products and services where funds are drawn from customers savings, current or prepaid account balances.

9 3. ISSUANCE AND EFFECTIVE DATE Unless otherwise stated, the requirements in this Circular come into effect on: (a) 2 February 2015 with respect to all the requirements except the requirements set out in paragraphs and below; and (b) 1 June 2015 with respect to the requirements set out in paragraphs and below. 4. INTERPRETATION For the purpose of this Circular: e- banking means the provision of banking products and services through Electronic channels, including via the internet, mobile devices, telephone, automated teller machines (ATM), and any other Electronic channel.

10 Financial institution or FI means any person licensed under the Financial Services Act 2013 (FSA) or the Islamic Financial Services Act BNM/RH/CIR 028-6 Payment Systems Policy Department Consumer and Market Conduct Department Managing Risks of Electronic banking , Direct Debit and Risks Associated with Payment Instruments Page 4/11 2013 (IFSA) or prescribed under the Development Financial Institutions Act 2002 (DFIA). issuer of designated payment instrument or issuer means any person who has obtained approval from Bank Negara Malaysia (BNM) under the FSA or the IFSA to issue a designated payment instrument.