Transcription of Mutual Evaluation Report - FATF-GAFI.ORG

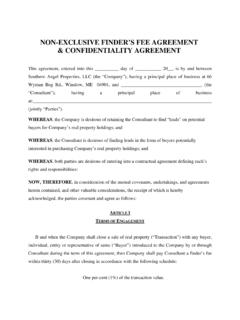

1 Financial Action Task Force Groupe d Action Financi re Middle East and North African Financial Action Task Force Mutual Evaluation Report Anti Money Laundering and Combating the Financing of Terrorism 9 April 2008 UNITED ARAB EMIRATES The United Arab Emirates is a member of the Middle East and North Africa Financial Action Task Force (MENAFATF). It is also a member of the Gulf Co operation Council, which is a member of the Financial Action Task Force (FATF). This Evaluation was conducted by the International Monetary Fund and was then discussed and adopted in Plenary as a Mutual Evaluation as follows: MENAFATF (1st Evaluation ) 9 April 2008 FATF (2nd Evaluation ) 20 June 2008 2008 MENAFATF, FATF and the International Monetary Fund. All rights reserved. No reproduction or translation of this publication may be made without prior written permission. Requests for permission to further disseminate, reproduce or translate all or part of this publication should be obtained from MENAFATF, Box 10881, Manama, Kingdom of Bahrain (fax: +973 17 53067; e mail: TABLE OF CONTENTS Acronyms.)

2 7 Preface .. 8 Executive Summary .. 9 1. GENERAL .. 14 General Information on the United Arab Emirates .. 14 General Situation of Money Laundering and Financing of Terrorism .. 15 Overview of the Financial Sector .. 15 Overview of the DNFBP Sector .. 17 Overview of Commercial Laws and Mechanisms Governing Legal Persons and Arrangements .. 17 Overview of strategy to prevent money laundering and terrorist financing .. 18 2. LEGAL SYSTEM AND RELATED INSTITUTIONAL MEASURES .. 22 Criminalization of Money Laundering ( & 2) .. 22 Description and Analysis .. 22 Recommendations and Comments .. 26 Compliance with Recommendations 1 & 2 .. 26 Criminalization of Terrorist Financing ( ) .. 27 Description and Analysis .. 27 Recommendations and Comments .. 29 Compliance with Special Recommendation II .. 29 Confiscation, freezing and seizing of proceeds of crime ( ) .. 29 Description and Analysis .. 29 Recommendations and Comments.

3 32 Compliance with Recommendation 3 .. 32 Freezing of funds used for terrorist financing ( ).. 32 Description and Analysis .. 32 Recommendations and Comments .. 37 Compliance with Special Recommendation III .. 37 The Financial Intelligence Unit and its Functions ( ) .. 37 Description and Analysis .. 37 Recommendations and Comments .. 44 Compliance with Recommendation 26 .. 45 Law enforcement, prosecution and other competent authorities - the framework for the investigation and prosecution of offenses, and for confiscation and freezing ( , & 28) .. 45 Description and Analysis .. 45 Recommendations and Comments .. 50 Compliance with Recommendations 27 & 28 .. 50 Cross Border Declaration or Disclosure ( ) .. 51 Description and Analysis .. 51 Recommendations and Comments .. 55 Compliance with Special Recommendation IX .. 56 3. PREVENTIVE MEASURES FINANCIAL INSTITUTIONS .. 57 Risk Of Money Laundering Or Terrorist Financing.

4 59 Customer Due Diligence, Including Enhanced or Reduced Measures ( To 8) .. 59 Description and Analysis .. 59 Recommendations and Comments .. 70 Compliance with Recommendations 5 to 8 .. 71 Third parties and introduced business ( ) .. 72 Description and Analysis .. 72 Recommendations and Comments .. 73 Compliance with Recommendation 9 .. 73 Financial Institution Secrecy or Confidentiality ( ) .. 73 Description and Analysis .. 73 Recommendations and Comments .. 74 Compliance with Recommendation 4 .. 74 Record-Keeping and Wire Transfer Rules ( & ) .. 74 Description and Analysis .. 74 Recommendations and Comments .. 76 Compliance with Recommendation 10 and SR. VII .. 76 Monitoring of Transactions and Relationships ( & 21) .. 77 Description and Analysis .. 77 Recommendations and Comments .. 78 Compliance with Recommendations 11 & 21 .. 78 Suspicious Transaction Reports and Other Reporting ( , 19, 25 & ).

5 78 Description and Analysis .. 78 Recommendations and Comments .. 83 Compliance with Recommendations 13, 14, 19 and 25 (criteria ), and Special Recommendation IV .. 84 Internal controls, compliance, audit and foreign branches ( & 22) .. 84 Description and Analysis .. 84 Recommendations and Comments .. 87 Compliance with Recommendations 15 & 22 .. 88 Shell Banks ( ) .. 88 Description and Analysis .. 88 Recommendations and Comments .. 88 Compliance with Recommendation 18 .. 88 The Supervisory and Oversight System Competent Authorities and SROs Role, Functions, Duties, and Powers (Including Sanctions) (R. 17, 23, 25 & 29) .. 89 Description and Analysis .. 89 Recommendations and Comments .. 103 Compliance with Recommendations 17, 23, 25 & 29 .. 104 Money or value transfer services ( ) .. 105 Description and Analysis .. 105 Recommendations and Comments .. 107 Compliance with Special Recommendation VI.

6 107 4. PREVENTIVE MEASURES DESIGNATED NON-FINANCIAL BUSINESSES AND PROFESSIONS .. 108 Customer due diligence and record-keeping ( ) .. 110 Description and Analysis .. 110 Recommendations and Comments .. 111 Compliance with Recommendation 12 .. 112 Suspicious transaction reporting ( ) .. 112 Description and Analysis .. 112 Recommendations and Comments .. 116 Compliance with Recommendation 16 .. 117 Regulation, supervision and monitoring ( ) .. 117 Description and Analysis .. 117 Recommendations and Comments .. 119 Domestic sector and the Commercial Free Zones .. 119 Other non-financial businesses and professions & Modern-secure transaction techniques ( ) .. 120 Description and Analysis .. 120 Recommendations and Comments .. 120 Compliance with Recommendation 20 .. 120 5. LEGAL PERSONS AND ARRANGEMENTS & NON-PROFIT ORGANISATIONS .. 121 Legal Persons Access to beneficial ownership and control information ( ).

7 121 Description and Analysis .. 121 Recommendations and Comments .. 122 Compliance with Recommendations 33 .. 123 Legal Arrangements Access to beneficial ownership and control information ( ) .. 123 Description and Analysis .. 123 Recommendations and Comments .. 124 Compliance with Recommendations 34 .. 124 Non-profit organisations ( ) .. 124 Description and Analysis .. 124 Recommendations and Comments .. 129 Compliance with Special Recommendation VIII .. 129 6. NATIONAL AND INTERNATIONAL CO-OPERATION .. 130 National co-operation and coordination ( ) .. 130 Description and Analysis .. 130 Recommendations and Comments .. 133 Compliance with Recommendation 31 .. 134 The Conventions and UN Special Resolutions ( & ) .. 135 Description and Analysis .. 135 Recommendations and Comments .. 135 Compliance with Recommendation 35 and Special Recommendation I . 136 Mutual Legal Assistance ( , ).

8 136 Description and Analysis .. 136 Recommendations and Comments .. 142 Compliance with Recommendations 36 38 and Special Recommendation V .. 142 Extradition .. 143 Description and Analysis .. 143 Recommendations and Comments .. 145 Compliance with Recommendations 37 and 39, and Special Recommendation V .. 145 Other Forms of International Co-operation ( & ) .. 145 Description and Analysis .. 145 Recommendations and Comments .. 150 Compliance with Recommendation 40 and Special Recommendation V .. 150 7. OTHER ISSUES .. 151 Resources and Statistics .. 151 Boxes 1. Legal Privilege .. 116 2. Judicial Cooperation Treaties Ratified by the UAE .. 140 Statistical Tables 1. Structure of the UAE domestic financial sector .. 16 2. Thresholds for CDD requirements .. 65 3. Coverage of DFSA rules and guidance .. 68 4. Number of STRs filed by Financial institutions (2004-2006) .. 82 5. STRs, tipping-off and legal protection related to DNFBPs.

9 112 6. Mutual assistance .. 136 Tables 1. Ratings of compliance with FATF 154 2. Recommended action plan to improve the AML/CFT .. 162 Annexes Annex 1. List of all Bodies met, the on-site mission .. 169 Annex 2. List of all laws, regulations and other material received .. 171 Annex 3. Copies of key laws, regulations and other measures .. 174 ACRONYMS ADSM - Abu Dhabi Securities Market AML/CFT - Anti-Money Laundering and Combating the Financing of Terrorism AMLSCU - Anti-Money Laundering and Suspicious Cases Unit ASP - Ancillary Service Provider ATM - Automated teller Machine BSED - Banking Supervision and Examination Department CDD - Customer Due Diligence DIACA - Department of Islamic Affairs and Charitable Activities DIFC - Dubai International Financial Center DIFCA - Dubai International Financial Center Authority DFM - Dubai Financial Market DFSA - Dubai Financial Services Authority DGCX - Dubai Gold and Commodities Exchange DMCC - Dubai Multi Commodities Center DNFBP - Designated Non-Financial Businesses and Professions ESCA - Emirates Securities and Commodities Authority FATF - Financial Action Task Force FCA - Federal Customs Authority FIU - Financial Intelligence Unit FSRB.

10 FATF-Style Regional Body FT - Financing of terrorism GCC - Gulf Cooperation Council ICSFT - International Convention for the Suppression of the Financing of Terrorism IOSCO - International Organization of Securities Commissioners JAFZA - Jebel Ali Free Zone Authority LLC - Limited Liability Company MENAFATF - Middle East and North Africa Financial Action Task Force ML - Money laundering MLA - Mutual legal assistance MLAT - Mutual Legal Assistance Treaty MLRO - Money Laundering Reporting Officer MOU - Memorandum of Understanding NAMLC - National Anti-Money Laundering Committee NCFCT - National Committee for Combating Terrorism NPO - Nonprofit organization OFAC - Office of Foreign Assets Control PEP - Politically-exposed person SRO - Self-regulatory organization STR - Suspicious Transaction Report TF - Terrorist Financing TSP - Trust Service Provider UNSCR - United Nations Security Council Resolution VAT - Value-Added Tax 7 1.