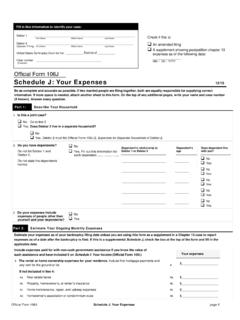

Transcription of Official Form 425C

1 Official Form 425C Monthly Operating Report for Small Business Under Chapter 11 page 1 Official Form 425C Monthly Operating Report for Small Business Under Chapter 11 12/17 Month: _____ Date report filed: _____ MM / DD / YYYY Line of business: _____ NAISC code: _____ In accordance with title 28, section 1746, of the United States Code, I declare under penalty of perjury that I have examined the following small business monthly operating report and the accompanying attachments and, to the best of my knowledge, these documents are true, correct, and complete.

2 Responsible party: _____ Original signature of responsible party _____ Printed name of responsible party _____ 1. Questionnaire Answer all questions on behalf of the debtor for the period covered by this report, unless otherwise indicated. Yes No N/A If you answer No to any of the questions in lines 1-9, attach an explanation and label it Exhibit A. 1. Did the business operate during the entire reporting period? 2. Do you plan to continue to operate the business next month? 3. Have you paid all of your bills on time? 4. Did you pay your employees on time? 5. Have you deposited all the receipts for your business into debtor in possession (DIP) accounts? 6. Have you timely filed your tax returns and paid all of your taxes?

3 7. Have you timely filed all other required government filings? 8. Are you current on your quarterly fee payments to the Trustee or Bankruptcy Administrator? 9. Have you timely paid all of your insurance premiums? If you answer Yes to any of the questions in lines 10-18, attach an explanation and label it Exhibit B. 10. Do you have any bank accounts open other than the DIP accounts? 11. Have you sold any assets other than inventory? 12. Have you sold or transferred any assets or provided services to anyone related to the DIP in any way? 13. Did any insurance company cancel your policy? 14. Did you have any unusual or significant unanticipated expenses? 15.

4 Have you borrowed money from anyone or has anyone made any payments on your behalf? 16. Has anyone made an investment in your business? Check if this is an amended filing Debtor Name _____ United States Bankruptcy Court for the: _____ District of _____ Case number: _____ Fill in this information to identify the case: Debtor Name _____ Case number_____ Official Form 425C Monthly Operating Report for Small Business Under Chapter 11 page 2 17. Have you paid any bills you owed before you filed bankruptcy? 18. Have you allowed any checks to clear the bank that were issued before you filed bankruptcy?

5 2. Summary of Cash Activity for All Accounts 19. Total opening balance of all accounts This amount must equal what you reported as the cash on hand at the end of the month in the previous month. If this is your first report, report the total cash on hand as of the date of the filing of this case. $ _____ 20. Total cash receipts Attach a listing of all cash received for the month and label it Exhibit C. Include all cash received even if you have not deposited it at the bank, collections on receivables, credit card deposits, cash received from other parties, or loans, gifts, or payments made by other parties on your behalf. Do not attach bank statements in lieu of Exhibit C. Report the total from Exhibit C here. $ _____ 21.

6 Total cash disbursements Attach a listing of all payments you made in the month and label it Exhibit D. List the date paid, payee, purpose, and amount. Include all cash payments, debit card transactions, checks issued even if they have not cleared the bank, outstanding checks issued before the bankruptcy was filed that were allowed to clear this month, and payments made by other parties on your behalf. Do not attach bank statements in lieu of Exhibit D. Report the total from Exhibit D here. - $ _____ 22. Net cash flow Subtract line 21 from line 20 and report the result here. This amount may be different from what you may have calculated as net profit. +$ _____ 23. Cash on hand at the end of the month Add line 22 + line 19.

7 Report the result here. Report this figure as the cash on hand at the beginning of the month on your next operating report. This amount may not match your bank account balance because you may have outstanding checks that have not cleared the bank or deposits in transit. =$ _____ 3. Unpaid Bills Attach a list of all debts (including taxes) which you have incurred since the date you filed bankruptcy but have not paid. Label it Exhibit E. Include the date the debt was incurred, who is owed the money, the purpose of the debt, and when the debt is due. Report the total from Exhibit E here. 24. Total payables $ _____ (Exhibit E) Debtor Name _____ Case number_____ Official Form 425C Monthly Operating Report for Small Business Under Chapter 11 page 3 4.

8 Money Owed to You Attach a list of all amounts owed to you by your customers for work you have done or merchandise you have sold. Include amounts owed to you both before, and after you filed bankruptcy. Label it Exhibit F. Identify who owes you money, how much is owed, and when payment is due. Report the total from Exhibit F here. 25. Total receivables $ _____ (Exhibit F) 5. Employees 26. What was the number of employees when the case was filed? _____ 27. What is the number of employees as of the date of this monthly report? _____ 6. Professional Fees 28. How much have you paid this month in professional fees related to this bankruptcy case? $ _____ 29. How much have you paid in professional fees related to this bankruptcy case since the case was filed?

9 $ _____ 30. How much have you paid this month in other professional fees? $ _____ 31. How much have you paid in total other professional fees since filing the case? $ _____ 7. Projections Compare your actual cash receipts and disbursements to what you projected in the previous month. Projected figures in the first month should match those provided at the initial debtor interview, if any. Column A Column B Column C Projected Actual = Difference Copy lines 35-37 from the previous month s report. Copy lines 20-22 of this report. Subtract Column B from Column A. 32. cash receipts $ _____ $ _____ = $ _____ 33. Cash disbursements $ _____ $ _____ = $ _____ 34. Net cash flow $ _____ $ _____ = $ _____ 35.

10 Total projected cash receipts for the next month: $ _____ 36. Total projected cash disbursements for the next month: - $ _____ 37. Total projected net cash flow for the next month: = $ _____ Debtor Name _____ Case number_____ Official Form 425C Monthly Operating Report for Small Business Under Chapter 11 page 4 8. Additional Information If available, check the box to the left and attach copies of the following documents. 38. Bank statements for each open account (redact all but the last 4 digits of account numbers). 39. Bank reconciliation reports for each account. 40. Financial reports such as an income statement (profit & loss) and/or balance sheet.