Transcription of Part 9 Accounts and Audit - CR

1 part 9. Accounts and Audit INTRODUCTION 3. There are also initiatives to enhance corporate governance, namely . part 9 ( Accounts and Audit ) of the new Companies Ordinance (Cap. 622) ( new CO ) contains the (a) Requiring public companies and other accounting and auditing requirements, namely companies that do not qualify for simplified provisions in relation to the keeping of accounting reporting to prepare a business review . records, the preparation and circulation of within the directors' report, whilst allowing annual financial statements, directors' and private companies to opt out by special auditors' reports and the appointment and rights resolution (paragraphs 17 to 21);. of auditors. New provisions are introduced to facilitate small and medium-sized enterprises (b) Empowering auditors to obtain information ( SMEs ) to take advantage of simplified from a wider range of persons for the accounting and reporting, to require public and performance of their duties (paragraphs 22.)

2 Other large private companies to include an to 26); and analytical business review in directors' reports, and to enhance auditors' right to information. (c) Improving transparency with regard to circumstances of cessation of office of an auditor (paragraphs 27 to 31). POLICY OBJECTIVES AND. 4. This part also modernises and improves the MAJOR CHANGES. law by . 2. This part contains initiatives that aim at business facilitation, namely (a) Clarifying the financial year of a company, re q u i r i n g c o m p a n i e s t o h o l d a n n u a l (a) Relaxing the criteria for companies to general meetings ( AGMs ) and requiring prepare simplified financial and directors' public companies or companies limited by reports the reporting exemption guarantee to file annual returns in respect (paragraphs 5 to 10); and of every financial year of the company (paragraphs 11 to 16); and (b) Making the summary financial report provisions more user-friendly and extending (b) Streamlining disclosure requirements that their application to all companies (paragraphs overlap with the accounting standards 32 to 36).

3 (paragraphs 37 to 41). 44 Companies Registry Relaxing the criteria for companies to the Legislative Council noted the support for prepare simplified financial and directors' relaxation of the size criteria and the suggestion to reports the reporting exemption extend the use of SME-FRS to private companies /. (Sections 359 to 366 and Schedule 3 to the groups of any size when members holding certain new CO) voting rights in the company approve and no member objects. P o s i t i o n u n d e r t h e C o m p a n i e s O rd i n a n c e (Cap. 32) ( Cap. 32 ) . The Bills Committee supported allowing 7. private companies / groups meeting a higher size 5. Section 141D of Cap. 32 provides that a criteria to prepare simplified reports if members of private company (other than a company which has the company so resolve. a subsidiary or is a subsidiary of another company and certain companies specifically excluded, such . The criteria for simplified reporting are 8.)

4 As insurance and stock-broking companies) may, therefore relaxed by doubling the eligibility limits with the written agreement of all its shareholders, for automatic qualification, introducing a higher prepare simplified Accounts and simplified directors' size criteria for private companies / groups that reports in respect of one financial year at a opt for simplified reporting and retaining the time. According to the Small and Medium-sized exception in section 141D of Cap. 32. Entity-Financial Reporting Framework ( SME-FRF ). issued by the Hong Kong Institute of Certified Key provisions in the new CO. Public Accountants ( HKICPA ), a Hong Kong company qualifies for reporting based on the 9. Sections 359 to 366 and Schedule 3 set SME-Financial Reporting Standard ( SME-FRS ) if it out the qualifying conditions for companies to satisfies the requirement under section 141D. The prepare simplified financial and directors' reports SME-FRF is not applicable to groups of companies along the following lines.

5 Or guarantee companies at all under Cap. 32. (a) A small private company or a private Position under the new CO company that is the holding company of a group of small private companies that . The original draft Companies Bill ( CB ). 6 satisfies any two of the following conditions allowed private companies and groups of private is automatically qualified for simplified companies meeting the size criteria that qualify reporting . for financial reporting under the current SME-FRF. ( two out of three of the following eligibility (i) total (or aggregate total) annual revenue limits : HK$50 million assets, HK$50 million of not more than HK$100 million;. revenue and 50 employees) to be automatically (ii) total (or aggregate total) assets of not qualified for the preparation of simplified financial more than HK$100 million;. and directors' reports. The Bills Committee of (iii) no more than 100 employees. New Companies Ordinance (Chapter 622) - Highlights 45.

6 (for a small private company : sections (d) The option under section 141D of Cap. 32. 359(1)(a)(i), 361, Schedule 3 section 1(1), available to a private company not having (2)); any subsidiary and not being a subsidiary for a group of small private companies : of another company to adopt simplified sections 359(2)(a),(b) and (c)(i), 364, reporting with unanimous members' written Schedule 3 section 1(7), (8) and (9)) agreement is retained in section 359(1)(b). (b) An eligible private company or an 10. C o m p a n i e s w h i c h a r e q u a l i f i e d f o r eligible private company that is the holding simplified reporting are referred to in the new company of a group of eligible private CO as companies falling within the reporting companies that satisfies any two of the exemption . The reporting exemptions are in following conditions and has the approval of respect of the specific requirements relating to the members holding at least 75% of the voting preparation of financial statements and directors'.

7 Rights with no other members objecting, is reports. The exemptions are set out in the qualified for simplified reporting following sections . (i) total (or aggregate total) annual revenue Section 380(3) (no requirement to disclose . of not more than HK$200 million; auditor's remuneration in financial statements). (ii) total (or aggregate total) assets of not more than HK$200 million; Section 380(7) (no requirement for financial (iii) no more than 100 employees. statements to give a true and fair view ). (for an eligible private company : sections Section 381(2) (subsidiary undertakings 359(1)(c), 360(1), 362, Schedule 3 section may be excluded from consolidated financial 1(3) and (4); statements in accordance with applicable for a group of eligible private companies: accounting standards). sections 359(2)(a),(b) and (c)(ii), 360(2), 365, Schedule 3 section 1(10), (11) and Section 388(3)(a) (no requirement to (12)) include business review in directors' report).

8 (c) A small guarantee company or a guarantee Section 406(1)(b) (no requirement for company that is the holding company of auditor to express a true and fair view . a group of small guarantee companies opinion on the financial statements). is automatically qualified for simplified reporting if its total annual revenue or Sections 3(3A), 4(3), 8(3) and 10(7) of aggregate total annual revenue (as the case Companies (Directors' Report) Regulation may be) does not exceed HK$25 million. (Cap. 622D) (no requirement to disclose in the directors' report the following : directors'. (for a small guarantee company : sections interests in arrangements to enable directors 359(1)(a)(i), 363, Schedule 3 section 1(5) to acquire benefits by the acquisition of and (6); shares or debentures; donations; directors'. for a group of small guarantee companies: reasons for resignation or refusal to stand for sections 359(3), 366, Schedule 3 section re-election and material interests of directors 1(13) and (14)) in transactions, arrangements or contracts of significance entered into by a specified undertaking of the company).

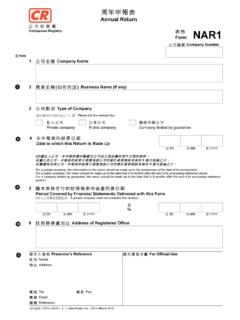

9 46 Companies Registry Section 23 of Companies (Disclosure of financial year is defined in section 2(1) of Cap. 32. Information about Benefits of Directors) as the period in respect of which the Accounts so Regulation (Cap. 622G) (no requirement to laid are made up. Section 111 of Cap. 32 requires disclose in the notes to financial statements every company to hold an AGM in each year and the material interests of directors in not more than 15 months is to elapse between transactions, arrangements or contracts of the date of one AGM and the next but there significance entered into by the company). are no rules on shorter accounting periods. In addition, there is no provision to regulate the first Under section 380(4)(b), the financial statements accounting period, except that the first AGM has of a company must be prepared in compliance to be held within 18 months of incorporation. with the applicable accounting standards.

10 The intention is that the accounting standards that 12. Section 109(1) of Cap. 32 provides that, will be applicable to a company falling within except where the company is a private company the reporting exemption is the SME-FRS and FRF having a share capital, the annual return is issued or specified by the HKICPA which is the required to be filed within 42 days after the AGM. body prescribed in the Companies (Accounting for the year. Section 109(3) of Cap. 32 further S t a n d a rd s ( P re s c r i b e d B o d y ) ) R e g u l a t i o n provides that, except where the company is a (Cap. 622C) for issuing or specifying the applicable private company, the annual return shall include accounting standards under section 380(8)(a). certified copies of the company's balance sheet The accounting standards applicable to companies and reports laid before the company in general that prepare simplified financial reports are less meeting to which the return relates.