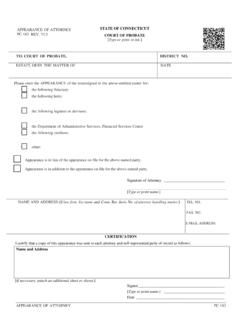

Transcription of Petition for Certificate Releasing Liens PC-205B REV. 1/19 ...

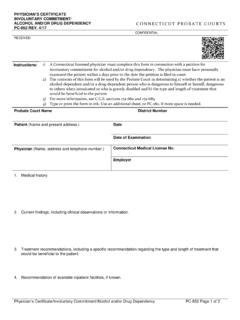

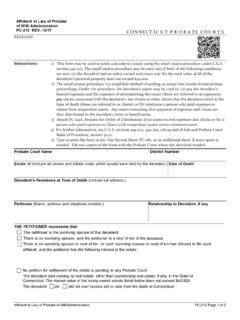

1 RESET. Petition for Certificate Releasing Liens PC-205B REV. 1/19 CONNECTICUT PROBATE COURTS. CONFIDENTIAL. RECEIVED: Instructions: 1). Any authorized representative for the estate may use this form to request a release of the Connecticut estate tax lien and/or the probate fee lien for a decedent's estate from the Probate Court before filing the estate tax return or payment of the probate fee. If there is more than one fiduciary, each co- fiduciary must sign the Petition . 2) Include the address of the real property being sold, transferred or mortgaged for which a release of lien is requested. 3) Type or print the form in ink. Probate Court Name District Number Estate of Date of Death Property Address Street City State Zip Code More Particularly Described at Volume Page of the Land Records Estimated Connecticut Estate Tax Information 1. Estimated gross estate for estate tax purposes as provided in Ch.

2 217 and 218 of the Conn. $. General Statutes 2. Estimated Connecticut taxable estate $. 3. Estimated amount passing to spouse $. 4. Connecticut Residents Only: Estimated value of out-of-state real property and tangible $. personal property 5. Nonresidents Only: Estimated value of Connecticut real property and tangible personal property $. Lien to be released: Lien for estate tax due the State of Connecticut Lien for statutory probate fees due the State of Connecticut (Please check one of the following.). The statutory probate fee or estimated fee has been paid. The real estate is the sole asset of the estate, and the statutory probate fee will be paid directly from the proceeds of the sale of the real property. The statutory probate fee will be paid in the manner described on an attachment to this form. The representations made in this Petition are made under penalty of false statement.

3 Signature of Fiduciary/Survivor Date Signature of Attorney/Authorized Representative Date Type or Print Name Type or Print Name Street Address Street Address City State Zip City State Zip Telephone Number(s) Telephone Number(s). Petition for Certificate Releasing Liens PC-205B .