Philippines Tax Profile

Transfer of shares that are not listed and t raded on the Philippine Stock Exchange shall be subject to capital gains tax at the rate of 5% for the first Php 100,000 and 10% in excess thereof. Under Republic Act No. 10963 [or the Tax Reform for Acceleration and Inclusion (‘TRAIN’) law] effective 01 January 2018], if the

Tags:

Information

Domain:

Source:

Link to this page:

Please notify us if you found a problem with this document:

Documents from same domain

Guide to annual financial statements: IFRS 9 ...

assets.kpmgNotes Basis of preparation 16 1. Reporting entity 16 2. Basis of accounting 16 3. Functional and presentation currency 16 4. Use of judgements and estimates 16

Customer-led transformation in retail banking - assets.kpmg

assets.kpmgkpmg.com July, 2018. Retail banks can create superior customer experiences by balancing . the priorities of the 5Cs. Customer-led . transformation in retail banking

AASB 16 Leases - assets.kpmg

assets.kpmgAASB 16 Leases KPMG.com.au A fundamental overhaul of lessee accounting effective 2019

Accounting, Fundamentals, Overhaul, Aasb, Lessee, Kpmg, Aasb 16, Fundamental overhaul, Lessee accounting

UAE 2018 Food & Beverage report - assets.kpmg

assets.kpmgThis is the fourth edition of our annual series which examines the current state of the United Arab Emirate’s (UAE) Food & Beverage (F&B) industry.

ESG, strategy, and the long view - assets.kpmg

assets.kpmgFrom our perspective, many of these issues fall under the broad rubric of environmental, social, and governance (ESG), from climate change impacts and worker safety to …

The Power of Procurement - assets.kpmg

assets.kpmgAnd as the world continues to wade through its fi nancial morass, the Procurement function will also fi nd itself under increasing pressure in areas currently considered

IFRS compared to US GAAP - assets.kpmg

assets.kpmgA changing focus. Both the FASB and the IASB believe that the era of sweeping accounting change has come to an end, for now, and both are committed to helping companies

Modular Construction Report - assets.kpmg

assets.kpmgForeword Many construction projects have a reputation for being completed behind schedule and over budget. While these companies have tried to improve project time, cost and

Example Public Company Limited - assets.kpmg

assets.kpmgf | Example Public Company Limited – illustrative disclosures Contents From implementation to disclosure b How to use this guide c Further KPMG Guidance d What’s new?

Cloud Economics: Making the Business Case for Cloud

assets.kpmg2 Making the Business Case for Cloud Cloud computing can enable innovation, dramatically reduce capital and operating costs, increase agility, and reduce time to market for new products and services.

Related documents

COVID-19 Impact: Philippine Business Enterprise Survey

www.adb.orgCOVID-19 impact on Philippine business, the effects of the quarantine and lockdown measures, and what is needed to help the government develop economic bounce-back strategies as the crisis recedes. The report provides a rich set of initial facts and ideas for the government to develop evidence-based policymaking

Sample Sec Cert - First Philippine Holdings Corporation

www.fphc.comof Philippine laws (the “Corporation”), do hereby certify that: I am familiar with the facts herein certified and duly authorized to certify the same; At the meeting of Board of Directors of the Corporation duly held and convened on _____ at which meeting a …

Legal and Judicial Ethics - irp-cdn.multiscreensite.com

irp-cdn.multiscreensite.comPayment of professional tax 6. ... FACTS: Christian Monsod was nominated by President Corazon C. Aquino to the position of Chairman of the COMELEC in a letter received by the Secretariat of the Commission ... member of the Philippine Bar, having passed the bar examinations of 1960 with the

SLOCPI Request for Fund Withdrawal 30Sept2014 - Sun Life

www.sunlife.com.phChanges to Material Facts or Personal Information ... tax reporting and withholding requirements under local and/or foreign laws applicable to you or your property. There is a change in your ... please have the form authenticated by the nearest Philippine Consul in your locality. If any of the irrevocable beneficiaries is a minor (less than 18 ...

Fact, Request, Fund, Withdrawal, Philippine, Polsci, Slocpi request for fund withdrawal

BPI INVEST BALANCED FUND

www.bpiassetmanagement.comApr 04, 2005 · * Benchmark is 50% PSEi, 50% return of the BPI Philippine Government Bond 1-5 Year Index, net of tax (*Effective February 1, 2022) 135 155 175 195 Feb-17 Feb-18 Feb-19 Feb-20 Feb-21 Feb-22 Fund Benchmark

Department of Labor and Employment

www.dole.gov.phPhilippine Health Insurance Corporation (PhilHealth), and Home Development Mutual Fund (Pag-lBlG) covering the maternity period. 3. Determine the amount of SSS maternity leave benefit of the female worker based on the prescribed formula and computation by the SSS. 4. Deduct from the amount of full pay the total amount of employee's

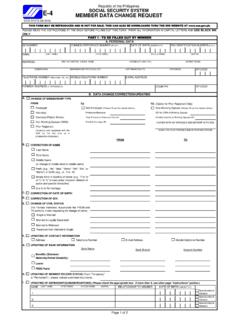

Republic of the Philippines E-4 SOCIAL SECURITY SYSTEM ...

www.sss.gov.ph(mmddyyyy) tax identification number (if any) name (last name) (first name) (middle name) (suffix) address zip code telephone number (area code + tel. no.) mobile/cellphone number e-mail address foreign address (if applicable) country zip code a. change of membership type from to to employed self-employed (please fill-out the details below.)non ...