Transcription of Plum Super

1 Plum SuperProduct Disclosure StatementThis Product Disclosure Statement (PDS or Statement) is a summary of significant informationand contains a number of references to further important information in the FeeBrochure, Investment Menu for your Plan and Plum Personal Plan (Investment Menus),Insurance Guide for your Plan and Plum Personal Plan (Insurance Guides) and the ClaimsGuide (each of which forms part of the PDS). You should consider all this information beforemaking a decision about the product. This document has been prepared on behalf of NULISN ominees (Australia) Limited, ABN 80 008 515 633, AFSL 236465 (NULIS) as Trustee of theMLC Super fund , ABN 70 732 426 024 (the fund ). NULIS is part of the group of companiescomprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate(Insignia Financial Group).

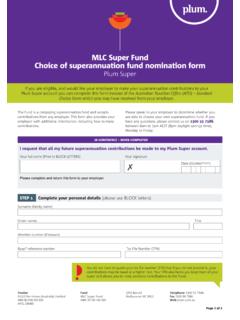

2 The information in this PDS is general in nature and doesn t takeinto account your objectives, financial situation or individual needs. Before acting on anyof this information you should consider whether it is appropriate for you. You should considerobtaining financial advice before making any decisions based on this information. Referencesto we , us or our are references to the Trustee, unless otherwise stated. This offer is madein Australia in accordance with Australian FundMLC Super FundABN 70 732 426 024 Issued by the TrusteeNULIS Nominees (Australia) LimitedABN 80 008 515 633 AFSL 236465 Preparation date20 June Plum Super of investing with of we invest your and Super is in your to open an accountGet in touchCall us on 1300 55 7586 within Australia. Chat with us at to us:Plum SuperGPO Box 63 Melbourne VIC 3001 You can keep up to date with your superaccount by going onto use your Member number and PINto log About Plum SuperYou can use this Product Disclosure Statement(PDS) to find what you need to know about yoursuper and how we can help you reach yourretirement goalsWe've worked with your employer to provideyou a Super account which gives you a greatopportunity to grow and protect your Plum Super , a part of the fund , you haveaccess to a broad range of investment options,allowing you to customise your investmentportfolio.

3 If you haven t chosen an investmentoption, your Super will be invested inMySuper. See Section 5 for details of MySuperand go to MySuper Product members have been provided with anInsurance Only account. If you are anInsurance Only member you only have accessto death and/or disability insurance cover. See Section 8 Insurance in your Super andyour Insurance Guide for further can find more information on the fund ,the Trustee and executive remuneration, andother fund documents at How Super worksWhat you need to know about superYou generally have the choice where youremployer makes your Super contributions. Ifyou don t have an existing Super fund (stapledfund) and don t choose a Super fund , youremployer will pay your Super into yourPlumSuper account. It s compulsory forcontributions to be made to Super for mostworking Australians.

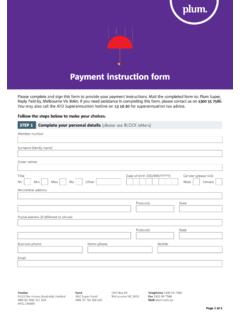

4 Super is generally atax-effective way to save for yourretirement tax concessions and othergovernment benefits can make it one of thebest long-term investments you to your superRegular contributions are a great way to helpyour Super grow. Your employer generallymakes Super guarantee contributions (alsoknown as employer contributions), and yoursuper can be boosted with other types ofcontributions, if eligible, including:salary sacrifice contributionspersonal after-tax contributionsspouse contributions (made to your accountby your spouse), Government co-contributions, anddownsizer can make additional personalcontributions to your account by orcheque. There are caps on the amount youcan contribute to Super . If you exceed thesecaps you may pay additional tax. Registered to BPAY Pty Ltd ABN 69 079 137 5182 Bringing all your Super togetherKeeping your Super in one place can makesense.

5 You can generally transfer any othersuper accounts you have into your PlumSuper account. Doing this gives you a singleview of your Super , helps you keep track ofyour investments, and means you only payone set of fees. Before consolidating, youshould check if there are any costs involved,loss of insurance that s important to you, anydifference in fees charged or any benefits youwish to keep. You should consider speakingwith a financial adviser to make sure it s theright decision for you. Accessing your superSuper is designed to support you inretirement, so there are restrictions on whenyou can access it. To access your Super , youmust meet a condition of release, such as:reaching age 65reaching your preservation age (betweenage 55 and 60 depending on your date ofbirth) and permanently retiringceasing an employment arrangement on orafter the age of 60reaching your preservation age and startinga transition-to-retirement pensionbecoming permanently incapacitated, orhaving a terminal medical you meet a condition of release, you reable to withdraw your Super as a lump sumor transfer your Super to a pension accountto start an income are other circumstances where you maybe able to access your Super including.

6 Under the First Home Super Saver Schemeif you re a temporary resident and youpermanently leave Australia once your visahas expiredsevere financial hardship, orcompassionate law defines your eligibility tocontribute, types of contributions you canmake (or others can make on your behalf),and limits on contributions, including themaximum amount you can contributebefore paying additional tax. It also setsstrict limitations on when you canwithdraw your Super . Generally, you canaccess your Super after you reach yourpreservation age and retire, or if you satisfyanother condition of release. What happens to your Super if you passaway?Your Super and any insurance you hold in thePlan can be paid to your beneficiaries or estateif you pass are two types of beneficiarynominations we offer: binding andnon-binding. A binding beneficiarynomination, if valid, allows you to decideexactly where your benefit is paid.

7 With a non-binding nomination, we'll consideryour nomination and your personalcircumstances before making a decision onwhere to pay your benefit. If you make aninvalid nomination, or no nomination at all,we'll decide where your benefit is paid. Your account balance will be switched intothe Cash fund on the date we receivenotification of your 'll switch off any Adviser Service Fees beingpaid to your adviser and stop charginginsurance premiums once we're notified ofyour death. Any Adviser Service Fees andinsurance premium charged between the dateof death and the notification of death will berefunded along with the final benefit ll continue to charge all other fees andcosts set out in section 6 until your DeathBenefit is paid to your estate and/orbeneficiaries. You should speak with your financial or legaladviser for more information on can view the Beneficiary Nominationform available at for more Benefits of investing withPlum SuperWhat we offer in your Super accountA wide range of investment options:Customise your investment portfolio to howyou like it, using our world-class : Easy-to-manage investing, for allstages in : Tax-effective cover to protect youand your , tools and calculators: Helping youunderstand your Super , when it s convenientfor benefits program: Access todiscounts, lifestyle offers, popular events,travel offers, savings on health insurance, access: Stay on top of yoursuper wherever you you informedWe'll be in touch regularly with any importantinformation about your account.

8 We'll provideyou with:a statement of your account each financial yearinformation in relation to any material changesto your account, andconfirmation of changes you make to youraccount such as personal contributions,investment switches, updating your details,rollovers, or 'll send you an email to let you know whenthere's something for you to read ordownload in your online member accountat than sending it to youin the mail. You can switch your preferenceto mail at any time. Our default online communications willinclude your Welcome Kit, AnnualStatement and, where we can, notices of anymaterial changes to your Super . We llcontinue to mail you some communicationsthat aren t available with us when you leave youremployerIf you leave your current employer, we llgenerally move your account balance into thePlum Personal Plan.

9 If you have insurancecover when you leave your employer, you'llgenerally be able to keep it. Furtherinformation outlining what you ll need to do(if anything) to keep your cover, including thetype and amount of cover that can be kept,will be provided to you in the materialssupplied to you at the time you leave youremployer. The fees, costs, and insurancepremiums are generally higher after youmove. All charges will be deducted from youraccount and any employer subsidies will nolonger apply. You can see the fees and costsfor the Plum Personal Plan in the Fees andcosts section. If you are an Insurance Onlymember, your insurance cover will cease. TheinformationinthisPDSmaychangefromtime totime. Any updates that aren tmaterially adversewillbeavailable bylogging in to your account Youcanobtaina papercopyofanyofthese Risks of superLike any investment, Super has risksBefore you invest, there are some things youneed to consider.

10 How much risk you reprepared to accept is determined by variousfactors, including:your investment goalsthe savings you'll need to reach these goalsyour age and how many years you have toinvestwhere your other assets are investedthe return you may expect from yourinvestments, andhow comfortable you are with riskAll investments come with some risk. Someinvestment options will have more risk thanothers, as it depends on an option'sinvestment strategy and value of an investment with a higher levelof risk will tend to rise and fall more often andby greater amounts than investments withlower levels of risk, ie it's more it may seem confronting, investmentrisk is a normal part of investing. Without ityou may not get the returns you need to reachyour investment goals. This is known as therisk/return choosing your investment option, it'simportant to understand that:its value and returns will vary over timeassets with higher long-term returnpotential usually have higher levels ofshort-term riskreturns aren't guaranteed and you may losemoneyfuture returns will differ from past returns,andyour future Super balance (includingcontributions and returns) may not beenough to provide sufficiently for affecting Super may change, impactingyour retirement financial adviser can help you respond toany changes to laws on Super , social securityand other retirement should read the important informationabout the risks of investing inthe Investment Menu before making adecision.