Transcription of R-1A SOCIAL SECURITY SYSTEM EMPLOYMENT …

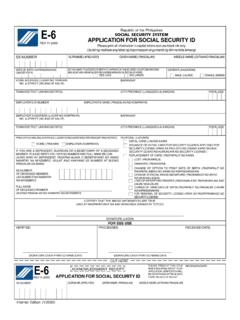

1 R-1A(REV. 01-2001) republic of the PhilippinesSOCIAL SECURITY SYSTEMEMPLOYMENT report (Please print all information in black ink)EMPLOYER ID NUMBERREGISTERED EMPLOYER NAMETAXPAYER IDENTIFICATION CODESS NumberName of Employee(Surname)(Given Name)(MI)Date of Birth(MM DD YYYY)PositionMonthly SalaryDate of EMPLOYMENT (MM DD YYYY)RemarksFOR SSS USE 1. 2. 3. 4. 5. 6. 7. 8. NO. OFREPORTEDEMPLOYEESPage of Page/su CERTIFIED CORRECT:FOR SSS USEPROCESSED BY/DATE:Signature Over Printed NameSignature Over Printed NameSignature Over Printed NameREVIEWED BY/DATE:ENCODED BY/DATE:RECEIVED BY/DATE: Signature Over Printed Name of Authorized Signatory Official DesignationDateInternet Edition (9/2002)INSTRUCTIONS/REMINDERS1.

2 Submit in two (2) copies with properly accomplished SS Form R-1 (Employer Registration), if theemployer is not yet registered with the Submit in two (2) copies to report newly hired/rehired employee/s and present SS Employer IDCard, if the employer is already registered with the The employer is obliged to report all its employees for coverage through this form regardless oftheir actual amount of monthly earnings rounded off to the last The owner of a single proprietorship business is disqualified to be reported as employee , he may register as self-employed, provided he is not over 60 years old and is currentlynot an employee Write Nothing Follows immediately after the last reported employee.