Transcription of SECTION 7. MILES PER GALLON CALCULATION

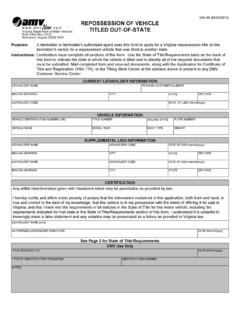

1 1. CARRIER NAME AND MAILING ADDRESS3. VIRGINIAMCS NUMBER4. IFTA ACCOUNT NUMBERIMPORTANT NOTE: Refer to instructions (form RDT 121 I) before completing this return. Failure to correctly complete this return may subject the carrier to penalty and interest. For assistance please contact DMV Motor Carrier Services at: (804) 249-5130 (Voice) (800) 272-9268 (deaf or hearing impaired) (804) 367-1073 (Fax) (email)INTERNATIONAL FUEL TAX AGREEMENT (IFTA) QUARTERLY TAX RETURN2. REPORTING PERIOD AND YEAR5. FLEET IDENTIFIERDUE DATERDT 121 (05/15/2021)NOTICE OF CHANGE (CHECK THE FOLLOWING BOXES IF ANY APPLY TO THIS RETURN)AMENDED RETURN (REFILE ALL INFORMATION, NOT JUST ADDITIONS)CLOSE IFTA ACCOUNT/CANCEL LICENSE (I have destroyed all IFTA decalsand licenses)NAME AND/OR ADDRESS CHANGE ENCLOSEDFUEL TYPE CODES:Gasoline - GGasohol - HDiesel - DBiodiesel - BPropane - PEthanol - E Methanol - MCompressed Natural Gas - CElectric - XM85 - TLiquid Natural Gas - NHydrogen - YE85 - FA55 - ASurtax - STSECTION 7.

2 MILES PER GALLON CALCULATION7 AFUEL TYPE CODE7B ALL DISTANCE TRAVELED (IFTA + NON-IFTA) (ROUNDED)7C TOTAL GALLONS PLACED IN ALL QUALIFIED VEHICLES7D AVERAGE MILES PER GALLON (MPG)DGTOTALSSECTION 8. FUEL TAX CALCULATION8A8B8C8D8E8F8G8H8I8J8 KJURIS TYPE CODETOTAL DISTANCETAXABLE DISTANCETAXABLE GALLONS (8D DIVIDED BY 7D)GALLONS PURCHASED AND PLACED IN VEHICLESNET TAXABLE GALLONS (8E MINUS 8F)TAX RATETAX DUE/REFUND (8G TIMES 8H)INTEREST DUETOTAL DUE/ REFUND (8I PLUS 8J) ROUND TO THE NEAREST WHOLE GALLON AND DISTANCEVAD$$$VAST-D0$$$VAG$$$VAST-G0$$$ $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$( 8M) SUBTOTALS THIS PAGE$$$JURISDICTIONEXEMPTIONJURISDICTION EXEMPTIONCHECK ONE (if applicable)6A CHECK IF YOU DID NOT OPERATE TAX-QUALIFIED MOTOR VEHICLES THIS QUARTER IN ANY IFTA CHECK IF YOU OPERATED IN A JURISDICTION WHERE A TAXABLE MILEAGE EXEMPTION APPLIES.

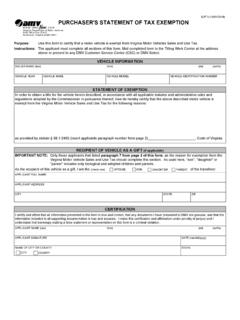

3 (ENTER JURISDICTION & EXEMPTION)5. FLEET IDENTIFIER4. IFTA ACCOUNT NUMBER2. QUARTERLY REPORTING PERIOD AND YEAR1. CARRIER NAMEQUARTERLY TAX RETURNRDT 121 (05/15/2021) -- Page 28. FUEL TAX CALCULATION - CHART B (MAKE ADDITIONAL COPIES OF THIS PAGE IF NEEDED)8A8B8C8D8E8F8G8H8I8J8 KJURIS TYPE CODETOTAL DISTANCETAXABLE DISTANCETAXABLE GALLONS (8D DIVIDED BY 7D)GALLONS PURCHASED AND PLACED IN VEHICLESNET TAXABLE GALLONS (8E MINUS 8F)TAX RATETAX DUE/REFUND (8G TIMES 8H)INTEREST DUETOTAL DUE/ REFUND (8I PLUS 8J) ROUND TO THE NEAREST WHOLE GALLON AND DISTANCE$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ $$$$$$$$$$$$$$$$$$$$$$(8L)NON-IFTADNON-I FTA DISTANCEGGALLONS(8M) SUBTOTALS THIS PAGE$$$(8N) SUBTOTALS ALL ADDITIONAL PAGES$$$(8O) SUBTOTALS FROM FRONT PAGE$$$MUST EQUAL 7 BSHOULD EQUAL 7C(8P) TOTALS$$$MAIL RETURN WITH PAYMENT TO:DEPARTMENT OF MOTOR VEHICLES MOTOR CARRIER SERVICES POST OFFICE BOX 27412 RICHMOND, VA 23269-0001(8R) LATE FEE -- SEE INSTRUCTIONS(8S) GRAND TOTAL DUE/REFUND$$PAYMENT METHODSA uthorization ACH DEBIT and E-CHECK ONLYCHECK / MONEY ORDER -- Made payable to DMVACH DEBIT -- Complete "Authorization" SECTION belowE-CHECK -- Complete "E-Check Information" SECTION AND "Authorization" SECTION belowBANK ACCOUNT NUMBER ROUTING NUMBER E-Check Information ACCOUNT TYPESAVINGCHECKINGCHECK ONE:CONTACT NAME (print)SIGNATURENOTE: In our continuing effort to safeguard customer information, DMV does not accept credit card payments by mail or email.

4 Credit card payments may be made online at or by calling the Motor Carrier IFTA/IRP Work Center. We accept E-checks, checks and money orders via NUMBER DATE (mm/dd/yyyy)CERTIFICATIONPRINT NAMEPRINT TITLEI certify and affirm that all information presented in this return is true, correct and complete and that any documents I have presented to DMV are genuine, and that the information included in all supporting documentation is true and accurate. I make this certification and affirmation under penalty of perjury and I understand that knowingly making a false statement or representation on this return is a criminal NUMBER DATE (mm/dd/yyyy)SIGNATUREEMAIL ADDRESSFAX NUMBER ( )