Transcription of Section C. Streamline Refinances Overview - HUD | …

1 HUD 6, Section C6-C-1 Section C. Streamline RefinancesOverviewIn This SectionThis Section contains the topics listed in the table NameSee Page1 Requirements for Streamline Refinances6-C-22 Credit Qualifying Streamline Refinances6-C-63 Streamline refinance Borrower and PropertyRelated Requirements6-C-84 Types of Permissible Streamline Refinances6-C-115 Establishing Net Tangible Benefit of StreamlineRefinance6-C-16 HUD 6, Section C6-C-21. Requirements for Streamline RefinancesIntroductionThis topic contains information on requirements for Streamline Refinances ,including a description of a Streamline refinance permissible geographic areas use of appraisals ignoring or setting aside an appraisal reviewing CAIVRS, LDP and GSA exclusion lists credit report and credit score requirements for Streamline Refinances use of TOTAL Scorecard on Streamline Refinances payoff statement requirement on Streamline Refinances , and loan application on Streamline DateMarch 24.

2 Of aStreamlineRefinanceStreamline Refinances are designed to lower the monthly principal and interest payments on acurrent FHA-insured mortgage, and must involve no cash back to the borrower, except for minor adjustments atclosing that are not to exceed $ forStreamlineRefinancesLenders may solicit and process Streamline refinance applications from anyarea of the country, provided the lender is approved for Direct Endorsement(DE) by at least one Homeownership Center (HOC), and, where necessary,licensed to do business in the state in which the property is : For information on DE Lender Program application and approval, see HUD , and HUD , and HOC jurisdictions, see HUD on next pageHUD 6, Section C6-C-31.

3 Requirements for Streamline Refinances , onStreamlineRefinancesFHA does notrequirean appraisal on a Streamline refinance . Thesetransactions can be made with or without an doesnotrequire repairs to be completed on Streamline Refinances withappraisals, with the exception of lead-based paint repairs. However, thelender may require completion of repairs as a condition of the : For information on Streamline Refinances with an appraisal (non-credit qualifying), see HUD , and without an appraisal, see HUD . orSetting Asidean Appraisal ona StreamlineRefinanceIf an appraisal has been performed on a property, and the appraised value issuch that the borrower would be better advised to proceed as if no appraisalhad been made, then the appraisal may be ignored and not used, and lender must notate this decision on the HUD-92900-LT,FHA LoanUnderwriting and Transmittal , LDPand GSAE xclusion Listson StreamlineRefinancesThe Credit Alert Interactive Voice Response System (CAIVRS) does notneed to be checked for Streamline Refinances , but the lender must review, forall borrowers, the HUD Limited Denial of Participation(LDP)

4 List, and General Services Administration (GSA)List of Parties Excluded fromFederal Procurement or Non-procurement : For more information on HUD s LDP List, GSA exclusion lists,and using CAIVRS to check borrower eligibility for Federally-related credit,see HUD , and HUD on next pageHUD 6, Section C6-C-41. Requirements for Streamline Refinances , Reportand CreditScoreRequirementsfor StreamlineRefinancesExcept for credit qualifying Streamline Refinances , FHA doesnotrequire acredit report. The lender, however, may require this as part of its a credit score is available, the lender must enter it into FHA Connection(FHAC).

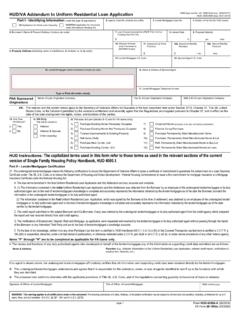

5 If more than one credit score is available, the lender must enterallavailable credit scores into of TOTALS corecard onStreamlineRefinancesEffective with case numbers assigned on or after April 18, 2011, FHA nolonger requires lenders to certify employment and income on streamlinerefinance transactions. As a result, lenders will not have sufficient data toscore Streamline Refinances through the Technology Open to ApprovedLenders (TOTAL) Scorecard. The TOTAL Scorecard was never intended tobe used for streamlines and the results are not considered lender who inadvertently uses TOTAL must not enter ZFHA as theunderwriter in FHA Connection (FHAC) but must instead use its DirectEndorsement (DE) underwriter designation, and the DEunderwriter must sign and use his/her Computerized HomeUnderwriting Management System (CHUMS) identification numberon page 3 of the HUD 92900-A,HUD/VA Addendum to Uniform ResidentialLoan Application, and page 1 of the HUD-92900-LT,FHA Loan Underwriting and on next pageHUD 6, Section C6-C-51.

6 Requirements for Streamline Refinances , StreamlineRefinancesThe lendermust obtain payoff statements for all liens to be satisfied from theproceeds of the Streamline refinance transaction, and include copies in thecase binder submitted for : For more information on obtaining payoff statements forrefinances, see HUD onStreamlineRefinancesEffective with case numbers assigned on or after April 18, 2011, lenders mayuse an abbreviated Uniform Residential Loan Application (URLA) on non-credit qualifying Streamline are not required to complete sections IV, V, VI, and VIII (k) on anabbreviatedURLA, provided all other required information is to various disclosure requirements, the application for mortgageinsurance must be signed and dated by the borrower(s) before the loan isunderwritten.

7 Lenders are permitted to process and underwrite the loan afterthe borrower(s) and interviewer complete the initial URLA and initial formHUD 92900-A,HUD/VA Addendum to Uniform Residential lender must continue to ensure compliance with the Equal CreditOpportunity Act (ECOA) and all other regulatory : For information on ECOA and other regulations, see 6, Section C6-C-62. Credit Qualifying Streamline RefinancesIntroductionThis topic contains information on credit qualifying Streamline Refinances ,including features of a credit qualifying Streamline refinance the maximum mortgage amount required documentation on a credit qualifying Streamline refinance , and required usage of a credit qualifying Streamline DateMarch 24, of aCreditQualifyingStreamlineRefinanceCred it qualifying Streamline Refinances contain all the normal features of astreamline refinance .

8 But provide a level of assurance for continuedperformance on the lender must provide evidence that the remaining borrowers have anacceptable credit history and ability to make onCreditQualifyingStreamlineRefinance(Re ference)References to the guidelines for calculating the maximum mortgage amounton credit qualifying Streamline Refinances are found in the table the credit qualifying streamlinerefinance is made ..Then the maximum mortgageamount is calculated as describedin ..withan appraisalHUD appraisalHUD on next pageHUD 6, Section C6-C-72. Credit Qualifying Streamline Refinances , CreditQualifyingStreamlineRefinanceFor credit qualifying Streamline Refinances , the lender must verify the borrower s income and credit report compute the debt-to-income ratios.

9 And determine that the borrower will continue to make mortgage Usageof a CreditQualifyingStreamlineRefinanceA credit qualifying Streamline refinance must be considered when a change in the mortgage term will result in an increase in themortgage payment of more than 20% when deletion of a borrower or borrowers will trigger the due-on-sale clause following the assumption of a mortgage that occurred less than six months previously, and doesnotcontain restrictions ( due-on-sale clause) limiting assumptiononly to a creditworthy borrower, or following the assumption of a mortgage that occurred less than six months previously, and didnottrigger the transferability restriction (that is, the due-on-saleclause), such as in a property transfer resulting from a divorce decree orby devise or.

10 The use of a credit qualifying Streamline refinance for situations inwhich the change in mortgage term will result in an increase in the mortgagepayment isonlypermissible for owner-occupied principal residences secondary residences meeting the requirements of HUD , and investment properties owned by governmental agencies and eligiblenonprofit organizations as described in HUD 6, Section C6-C-83. Streamline refinance Borrower and Property RelatedRequirementsIntroductionThis topic contains information on borrower and property relatedrequirements for Streamline Refinances , including borrower cash to close assuming borrower eligibility for Streamline refinance without creditqualifying borrower additions or deletions to title withdrawn condominium approvals seven unit exemptions for investors seasoning requirement for a Streamline refinance , and mortgage payment history requirement for a Streamline DateMarch 24, Cashto Close on aStreamlineRefinanceIf assets are needed to close, the lender must verify, document.