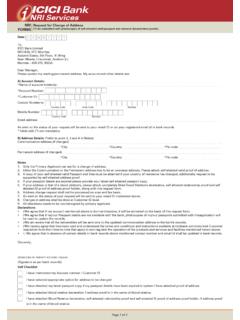

Transcription of SUPPLEMENTARY CREDIT CARD APPLICATION

1 SUPPLEMENTARY CARDHOLDER DETAILS:(Liability of the SUPPLEMENTARY CREDIT card will be on the Primary card Member)Signature of Primary card ApplicantDateSUPPLEMENTARY CREDIT card APPLICATIONPRIMARY CARDHOLDERS DETAILS:Name1. Self-attested copies of PAN card and Aadhaar card of the SUPPLEMENTARY card applicant is A maximum of up to 3 SUPPLEMENTARY cards can be issued to immediate family members (over 18 years of age) of the Primary card Member, including any SUPPLEMENTARY cards issued against any other ICICI Bank Primary card3. The spend limit set for the SUPPLEMENTARY card would be a subset of the CREDIT limit available on the primary CREDIT card . If not specified, the entire CREDIT limit of the primary CREDIT card would be shared with the SUPPLEMENTARY card4.

2 As per provisions of Reserve Bank of India Master Circular (RBI/2009-10/73; DBOD. AML. BC. No. 2/14. 01. 001/2009-10) on Know Your Customer (KYC) norms dated 01 July 2009, it is mandatory for all banks to update the customer identification documents (including photographs). Please submit the completed form along with the documents to the nearest ICICI Bank confirm that the information given is true and correct. We understand the Primary card Member will be liable for all the charges incurred with the Primary card and the SUPPLEMENTARY card . We jointly and severally agree to be bound by the Rules and Regulations of use of the CREDIT card , copy of which we have receivedand understood. In particular, we confirm the usage in strict accordance with the Exchange Control Regulations of the Reserve Bank of India.

3 We understand that in the event of failure to do so, we are liable for action under the Foreign Exchange Regulation Act, 1973 and may be debarred from holding the ICICI Bank CREDIT card , either at the instance of ICICI Bank or the RBI. We authorise ICICI Bank to verify information in this APPLICATION and to receive or exchange information about s with other banks, agencies, companies for marketing and administrative purpose or for prevention of frauds, etc.** Instructions Please enclose the following documents CREDIT card NumberPhoto of SupplementaryCard Applicant(To be cross-signed by the SUPPLEMENTARY card applicant)Name*Name as desired on the card *(Maximum 19 characters, including spaces)Mobile*MaleFemaleThird GenderDate of Birth* GenderE-mail ID (Personal)*Spend limit for SUPPLEMENTARY card ` (multiples of 000 only)RelationshipDaughterBrotherSisterFa therSpouseMotherSonGS_2017_JULY_ ICICI CREDIT CARD_CORP_10818140_SSUPPLEMENTARY CREDIT card APPLICATION FORM