Transcription of Table of Contents - Maryland

1 Table of Contents Section 1 Introduction .. 1 Section 2 Register of Wills .. 1 Section 3 Orphans Court .. 2 Section 4 Definitions .. 3 Section 5 Regular Estates .. 6 Section 6 Small Estates .. 12 Section 7 Limited Orders .. 16 Section 8 Modified Administration .. 17 Section 9 Inheritance Tax .. 19 Section 10 Distribution .. 21 Section 11 Fees .. 22 Section 12 Important Dates .. 23 Section 13 Responsibilities of a Personal Representative .. 24 Section 14 Powers and Duties of a Personal Representative .. 24 Section 15 Questions and Answers .. 25 Words of Warning! The Register of Wills Office is restricted from giving legal advice. This book is intended to help assist in the preparation of administrative probate. If you have additional questions or a specific situation not addressed in this book, consult with your attorney or the Register of Wills before you proceed.

2 Revised October 20171 Section 1: Introduction The Maryland Court of Appeals has adopted rules and forms to be used in settling a decedent s estate. The purpose of this booklet is to inform you about this procedure and how to prepare the necessary forms in the event that you are selected to act as a personal representative of an estate. The booklet only discusses the most common forms used in administrative probate. All forms for settling a decedent s estate are available in the Office of the Register of Wills in the county where the decedent lived. More information about the forms discussed in this booklet, along with other forms, can be found in the Maryland Rules of Procedure, Title 6, available at most public libraries. Both the Maryland Rules and the Annotated Code of Maryland - Estates and Trusts Article ( ET ) can be accessed online at the Maryland General Assembly website: This booklet addresses only aspects of estate administration in the State of Maryland .

3 It does not include any information about state or federal income tax or estate tax returns. It also does not address the administration of estates with property located outside of the State of Maryland that may be subject to another state s jurisdiction or laws. This guide will not answer all questions related to the administering of estates in Maryland and it is not intended as a substitute for professional legal or financial advice which may be important to the administration of estates. Section 2: Register of Wills The Register of Wills is a public office established under the Constitution of Maryland . The Constitution provides for a Register of Wills in each county and Baltimore City. The Register is elected every four years. The Register of Wills, or designated employee, may assist and advise any person in the preparation of forms for administrative probate; but are prohibited from rendering legal advice.

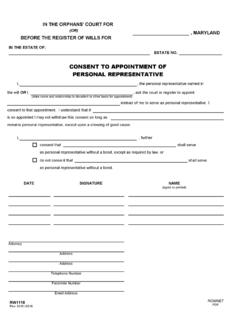

4 All forms referred to in this book may be obtained from the Register of Wills office or web site. (select FORMS tab or link). Forms may be downloaded as required or completed online and printed individually. Please note that the forms are in PDF format, thereby requiring Adobe Reader software to be installed on your computer. 2 Section 3: Orphans Court The Orphans Court, located in each county and Baltimore City, has jurisdiction over estates of deceased persons. The Orphans Court hears all matters involving contested estates and supervises all estates that are probated judicially. Judicial probate is a proceeding that takes place when matters cannot be handled administratively. The Orphans Court resolves matters involving the validity of wills and the transfer of property in which legal questions and disputes occur. Because the Orphans Court has limited jurisdiction, generally questions of legal title must be determined by the circuit court.

5 An Orphans Court has jurisdiction to determine whether personal property, not exceeding $50,000 in value, is includable in the estate, subject to a proceeding before the Court. The Orphans Court approves accounts personal representative commissions and attorney s fees for services rendered in connection with the administration of the estate. ET Title 2, subtitle 13 Section 4: Definitions of an estate: themanagement of a decedent'sassets, which includes thecollection of property, payment ofexpenses and debts, anddistribution to the heirs Probate: aproceeding that is initiated by aninterested person with theRegister of Wills for theappointment of a personalrepresentative and for theprobate of a will, or thedetermination of intestacy of (or children): a child whois a legitimate child, an adoptedchild, an illegitimate child to theextent provided by law, and achild conceived from the geneticmaterial of a person after thedeath of the person to the extentprovided by : a person (or entity)who files a claim against adecedent's of record: a recorded debt,such as a mortgage on realproperty that is recorded in : a deceased : one who is in thebloodline of an ancestor.

6 (Descendants include child,grandchild, great grandchild, etc.) : the place where aperson has physically beenpresent with the intention to makethe place a permanent home. (Inother words, domicile is the placeone would return to or intend to return to when away.) against the will: theright provided by statute to aspouse that allows him/her toreceive a statutory share, even ifit is more than the will Encumbrance: a lien or claimattached to property, such as amortgage on real Estate: the property of Family allowance: an allowancein addition to property passingunder the will or by the laws ofintestacy, not subject toinheritance tax, payable to asurviving spouse or survivingminor (under the age of 18) Fiduciary: a person or institutionthat manages and administersmoney and other assets ofanother. A fiduciary includestrustee, receiver, custodian,guardian, executor, administrator,or personal Gross estate: the actual value ofthe estate assets without thededuction of liens, debts Heir: a family member whoinherits from an estate under thelaws of intestacy (decedent diedwithout a will).

7 16. Information Report: thedocument that reports all non-probate property (property thatpasses outside the probateestate). (Non-Probate propertyincludes, but not limited to, jointlyheld assets, life estate orremainder interests in a trust or4 deed, trusts in which the decedent had an interest, payable on death ( ) assets, and pension and benefit plans including IRAs with named beneficiaries.) 17. Inheritance tax: a tax imposedon the privilege of receivingproperty from a decedent' Interested person: the person(s)serving (or petitioning to serve)as personal representative(s),legatees, heirs (even if thedecedent died testate), trustee(s)of a testamentary trust, trustee(s)of a living trust, if applicable, andcourt appointed guardian(s) forminors and disabled adults whoare interested Intestate: without a Issue: every living linealdescendant except a linealdescendant of a living linealdescendant, including alegitimate child, an adopted child,an illegitimate child to the extentprovided by law, and a childconceived from the geneticmaterial of a person after thedeath of the person to the extentprovided by law.

8 Issue does notinclude a stepchild or a Joint tenancy: a type ofownership where personal or realproperty is held jointly by two ormore persons in undivided(equal) shares with the right ofsurvivorship. When a joint tenantdies, his/her share passesautomatically by operation of lawto the survivor(s).22. Judicial probate: a probateproceeding conducted by theOrphans' Court (as opposed tothe Register of Wills) when thesituation prohibits administrativeprobate (such as, validity of thewill is questioned, will isdamaged, or more than onequalified person applies forpersonal representative).23. Legatee: a person named in awill to Letter of Administration: adocument issued by the Registerof Wills that authorizes apersonal representative toadminister an Limited Order: an orderallowing for the search of assetsin the decedent s name alone orthe will located in a safe depositbox in the name of the Lineal heir or legatee: one who isof the direct line of the Modified Administration: astreamlined version ofadministrative probate availableto the personal representative (inestates where the decedent diedon or after October 1, 1997).

9 Inlieu of an inventory and anaccount, the personalrepresentative is required to file afinal report within 10 months fromthe date of appointment. (SeeSection 8 of this booklet fordetails.)28. Net estate: property remainingafter the deduction of liens, debtsand Non-probate estate: propertythat passes outside the probateestate, includes, but not limited5 to: jointly held assets, life estate or remainder interests in a trust or deed, trusts in which the decedent had an interest, payable on death ( ) assets, and pension and benefit plans including IRAs with named beneficiaries. 30. Personal Representative: theperson appointed to administerthe estate (often referred to asexecutor or administrator).31. Petition for Probate: thedocument required to initiate aprobate Pour-over Will: a will givingmoney or property to an Probate estate: property ownedsolely by the decedent or as atenant in Regular estate: the estateprocedure for a decedent whoowned probate assets with agross value in excess of $50,000(or $100,000 if the sole heir orlegatee is the surviving spouse).

10 *35. Residence: living in a specificarea without necessarily havingthe intent to indefinitely staythere. See Domicile Small estate: the estateprocedure for a decedent whoowned probate assets with agross value of $50,000 or less (or$100,000 or less if the sole heiror legatee is the survivingspouse). *37. Special Administrator: anadministrator of an estateappointed by the court when it isnecessary to protect and manageproperty prior to the appointment of a personal representative. (A special administrator has limited powers.) 38. Tenants by the entirety: a typeof ownership that is created onlybetween husband and wife wherethey hold title to an interest inproperty together, with the right ofsurvivorship upon the death ofthe first to Tenants in common: a type ofownership where two or morepersons each hold an undividedinterest in a piece of property withno right of survivorship. Upon thedeath of an owner, his/herinterest passes to the heirs underthe laws of intestacy, or inaccordance with the terms of Testamentary Trust: a trust thatis created by a will and takeseffect when the settlor(testator/testrix) Testate: dying with a Testator/testatrix: male/femalewho makes a Trust, also living trust or intervivos trust: real and/or personalproperty held by one party(trustee) for the benefit of another(beneficiary).