Transcription of W-9 Request for Taxpayer - California

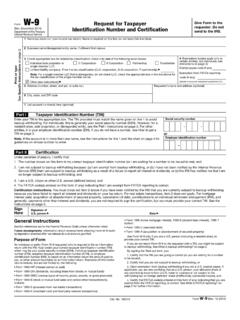

1 give form to therequester. Do notsend to the for TaxpayerIdentification Number and Certification(Rev. December 2000)Department of the TreasuryInternal Revenue ServiceName (See Specific Instructions on page 2.)List account number(s) here (optional)Address (number, street, and apt. or suite no.)City, state, and ZIP codePlease print or typeFor Payees Exempt FromBackup Withholding (See theinstructions on page 2.) Taxpayer Identification Number (TIN)Enter your TIN in the appropriate box. Forindividuals, this is your social security number(SSN). However, for a resident alien, soleproprietor, or disregarded entity, see the Part Iinstructions on page 2. For other entities, it is youremployer identification number (EIN). If you do nothave a number, see How to get a TIN on page security number orRequester s name and address (optional)Employer identification numberNote: If the account is in more than one name, seethe chart on page 2 for guidelines on whose numberto enter.

2 Number shown on this form is my correct Taxpayer identification number (or I am waiting for a number to be issued to me), andI am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the InternalRevenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS hasnotified me that I am no longer subject to backup withholding, instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backupwithholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirementarrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the Certification, but you mustprovide your correct TIN.

3 (See the instructions on page 2.)SignHereSignature person Date 3. The IRS tells the requester that youfurnished an incorrect TIN, or4. The IRS tells you that you are subject tobackup withholding because you did not reportall your interest and dividends on your tax return(for reportable interest and dividends only), orPurpose of Form5. You do not certify to the requester that youare not subject to backup withholding under 4above (for reportable interest and dividendaccounts opened after 1983 only).2. You do not certify your TIN when required(see the Part III instructions on page 2 fordetails), orNote: If a requester gives you a form other thanForm W-9 to Request your TIN, you must use therequester s form if it is substantially similar to thisForm you give the requester your correct TIN,make the proper certifications, and report allyour taxable interest and dividends on your taxreturn, payments you receive will not be subjectto backup withholding. Payments you receivewill be subject to backup withholding if:1.

4 You do not furnish your TIN to therequester, orFormW-9(Rev. 12-2000)Part IPart IIBusiness name, if different from above. (See Specific Instructions on page 2.)Cat. No. 10231 XCertain payees and payments are exemptfrom backup withholding. See the Part IIinstructions and the separate Instructions forthe Requester of form W-9. Check appropriate box:Individual/Sole proprietorCorporationPartnershipOther Under penalties of perjury, I certify that:Part IIIUse form W-9 only if you are a person(including a resident alien), to give your correctTIN to the person requesting it (the requester)and, when applicable, to:1. Certify the TIN you are giving is correct (oryou are waiting for a number to be issued),2. Certify you are not subject to backupwithholding, or3. Claim exemption from backup withholding ifyou are a exempt penalty for false information with respectto withholding. If you make a false statementwith no reasonable basis that results in nobackup withholding, you are subject to a $ penalty for falsifying falsifying certifications or affirmationsmay subject you to criminal penalties includingfines and/or to furnish TIN.

5 If you fail to furnish yourcorrect TIN to a requester, you are subject to apenalty of $50 for each such failure unless yourfailure is due to reasonable cause and not towillful of TINs. If the requester discloses oruses TINs in violation of Federal law, therequester may be subject to civil and you are a foreign person, use theappropriate form W-8. See Pub. 515,Withholding of Tax on Nonresident Aliens andForeign am a person (including a resident alien).What is backup withholding? Persons makingcertain payments to you must withhold and payto the IRS 31% of such payments under certainconditions. This is called backup withholding. Payments that may be subject to backupwithholding include interest, dividends, brokerand barter exchange transactions, rents,royalties, nonemployee pay, and certainpayments from fishing boat operators. Realestate transactions are not subject to person who is required to file an informationreturn with the IRS must get your correcttaxpayer identification number (TIN) to report, forexample, income paid to you, real estatetransactions, mortgage interest you paid,acquisition or abandonment of secured property,cancellation of debt, or contributions you madeto an W-9 (Rev.)

6 12-2000)Page2 What Name and Number ToGive the RequesterGive name and SSN of:For this type of account:The actual owner of theaccount or, if combinedfunds, the first individualon the account or moreindividuals (jointaccount)The minor account ofa minor (Uniform Giftto Minors Act)The grantor-trustee The usualrevocable savingstrust (grantor isalso trustee)1. Interest, dividend, and barter exchangeaccounts opened before 1984 and brokeraccounts considered active during 1983. Youmust give your correct TIN, but you do not haveto sign the actual owner 1b. So-called trustaccount that is nota legal or valid trustunder state law2. Interest, dividend, broker, and barterexchange accounts opened after 1983 andbroker accounts considered inactive during1983. You must sign the certification or backupwithholding will apply. If you are subject tobackup withholding and you are merely providingyour correct TIN to the requester, you mustcross out item 2 in the certification beforesigning the owner proprietorshipGive name and EIN of:For this type of account:3.

7 Real estate transactions. You must signthe certification. You may cross out item 2 of valid trust, estate, orpension entity 44. Other payments. You must give yourcorrect TIN, but you do not have to sign thecertification unless you have been notified thatyou have previously given an incorrect TIN. Other payments include payments made in thecourse of the requester s trade or business forrents, royalties, goods (other than bills formerchandise), medical and health care services(including payments to corporations), paymentsto a nonemployee for services, payments tocertain fishing boat crew members andfishermen, and gross proceeds paid to attorneys(including payments to corporations).The organizationAssociation, club,religious, charitable,educational, or Mortgage interest paid by you,acquisition or abandonment of securedproperty, cancellation of debt, qualified statetuition program payments, IRA or MSAcontributions or distributions, and pensiondistributions.

8 You must give your correct TIN,but you do not have to sign the broker or nomineeA broker or public entityAccount with theDepartment ofAgriculture in the nameof a public entity (suchas a state or localgovernment, schooldistrict, or prison) thatreceives agriculturalprogram Act Notice1 List first and circle the name of the person whosenumber you furnish. If only one person on a jointaccount has an SSN, that person s number must Circle the minor s name and furnish the minor s You must show your individual name, but you may alsoenter your business or DBA name. You may use eitheryour SSN or EIN (if you have one).4 List first and circle the name of the legal trust, estate,or pension trust. (Do not furnish the TIN of the personalrepresentative or trustee unless the legal entity itself isnot designated in the account title.)Note: If no name is circled when more than onename is listed, the number will be considered tobe that of the first name proprietor. Enter your individual nameas shown on your social security card on the Name line.

9 You may enter your business,trade, or doing business as (DBA) name on the Business name proprietorshipThe owner : Writing Applied For means that you havealready applied for a TIN or that you intend toapply for one I Taxpayer Identification Number (TIN)Enter your TIN in the appropriate II For Payees Exempt From BackupWithholdingIndividuals (including sole proprietors) are notexempt from backup withholding. Corporationsare exempt from backup withholding for certainpayments, such as interest and dividends. Formore information on exempt payees, see theseparate Instructions for the Requester ofForm III CertificationFor a joint account, only the person whoseTIN is shown in Part I should sign (whenrequired).If you are exempt from backup withholding,you should still complete this form to avoidpossible erroneous backup withholding. Enteryour correct TIN in Part I, write Exempt inPart II, and sign and date the you are a nonresident alien or a foreignentity not subject to backup withholding, givethe requester the appropriate completed entities.

10 Enter your business name asshown on required Federal tax documents onthe Name line. This name should match thename shown on the charter or other legaldocument creating the entity. You may enter anybusiness, trade, or DBA name on the Businessname to get a TIN. If you do not have a TIN,apply for one immediately. To apply for an SSN,get form SS-5, Application for a Social SecurityCard, from your local Social SecurityAdministration office. Get form W-7, Applicationfor IRS Individual Taxpayer IdentificationNumber, to apply for an ITIN or form SS-4,Application for Employer Identification Number,to apply for an EIN. You can get Forms W-7 andSS-4 from the IRS by calling 1-800-TAX- form (1-800-829-3676) or from the IRS s Internet WebSite at you do not have a TIN, write Applied For in the space for the TIN, sign and date the form ,and give it to the requester. For interest anddividend payments, and certain payments madewith respect to readily tradable instruments,generally you will have 60 days to get a TIN andgive it to the requester before you are subject tobackup withholding on payments.