Transcription of What Is Long-Term Care? COMPANY LOGO HERE

1 what IsLong-Term Care? Long-Term care (LTC) is what an individualneeds when he or she requires regular assis-tance with day-to-day functions like bathing,eating and/or dressing or supervision due tocognitive impairment. LTC insurance helps payfor care at home, in an adult day care center,assisted living facility, nursing home or hospice it s your you know that anaccident or illness cancause you or a familymember to need Long-Term care at any age?Why Long-Term With today s enhanced longevity, a growing number of Americans live, get sick, progressively losefunction, and then die. * When this happens, we not only lose thefreedom to care for ourselves, wemay be forced to completely depletea lifetime of savings unless specificLTC insurance is part of our personalfinancial plan for protection of assetswhen we grow older.*Aetna Chairman & CEO and gerontologist Dr. John W. Rowe, author of Successful Aging. care Insurance?0102030405060$ $ $ $ thousandsNursing HomeAssisted Living FacilityHome CareAdult CareSource: GE LTC Survey, 3/02; AmericanCouncil of Life Insurers, 4/00 LTC Costs Can Be DevastatingNational Average Costs (annual)Where Will the MoneyCome From?

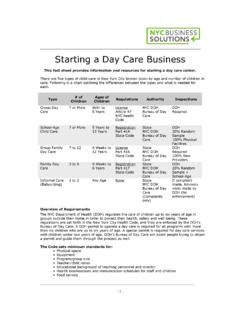

2 Long-Term care is: NOTcovered by your medical program. NOTcovered by disabilityinsurance. NOTcovered by Medicare to any substantial degree. NOTcovered by Medicaidunless one s assets have beenreduced to the poverty TenConditionsRequiring Long-Term CareSource: Aetna, LTC Claim History 1/021. Alzheimer s disease, related dementia2. Cancer3. Stroke4. Parkinson s disease, other neurological conditions5. Arthritis6. Heart attack7. Other injuries (fractures)8. Emphysema, other respiratory diseases9. , nervous, other Alzheimer s related conditionsCOMPANYLOGOHERELTC96 0104 State of Ohio Aetna Group long Term care Insurance Benefit Summary Service Reimbursement Plan State of Ohio is sponsoring a group long term care insurance plan underwritten by Aetna Life Insurance COMPANY . The chart below outlines some benefits and features of this coverage. For rates and more information, please review the Outline of Coverage document. Once you enroll for coverage, you will receive a Certificate of Coverage, which will specify in more detail the terms of this service reimbursement plan.

3 For more information, please call the LTC Hotline at 1-800-537-8521 or visit the State of Ohio LTC website at: 0698194 XXX_SOBTQX_SE_XX Who s Eligible (Eligible Class) EMPLOYEES: All regular full-time and part-time employees of Ohio who are eligible for Ohio s health care benefits and who work at least 20 hours per week are eligible to enroll. However, if you are ill, injured or on a medical leave of absence and away from work on the date that coverage would otherwise become effective for you, then the effective date of your coverage will be delayed to the first of the month following the date you return to work for at least 5 consecutive working days in an Eligible Class. Also, if your employment status changes after you submit your enrollment form, you must notify Aetna immediately, as this may affect your eligibility for coverage.

4 OTHER FAMILY MEMBERS: Employees spouses, adult children/spouses (Minimum age 18), parents/in-laws, grandparents/in-laws, siblings/spouses (Minimum age 18) are also eligible to apply for coverage. Completion of a medical questionnaire and approval by Aetna is necessary before coverage becomes effective. Enrollment Period Active employees who enroll during a special enrollment period of 04/24/06 05/12/06 may do so without providing proof of good health. New hires may enroll within 60 days of their date of hire without providing proof of good health. All other eligibles (listed above) may enroll anytime and are required to complete a medical questionnaire and be approved by Aetna before coverage becomes effective. Employees enrolling after the special enrollment period or after the new hire period may still enroll anytime, however, they will be required to complete a medical questionnaire and be approved by Aetna. Spouse Discount There is a 10% discount in premiums if an eligible individual (employees and other eligible family members) and his/her spouse both enroll and coverage becomes effective.

5 Daily Benefit Amount = Amount of Coverage Per Day You choose a Daily Benefit Amount (DBA) of $100, $150, or $200 (or any amount between $60 - $300 in $1 increments). The plan will reimburse you for covered expenses incurred up to a certain percentage of your DBA (see Expenses Covered). The DBA is the maximum amount of coverage your plan could reimburse each day. (Exception: The DBA for the Assistive Equipment & Technology Benefit is the amount paid once per month). How You Qualify for Claim (Receive Benefits) You qualify for claim when a Licensed Health care Practitioner (LHCP) certifies that you: (1) are unable to perform at least two of six activities of daily living: bathing, dressing, eating, transferring, toileting, continence for a period of at least 90 days; or (2) have a severe cognitive impairment, like Alzheimer s. A LHCP will prescribe a Plan of care that meets your needs. Single Deductible/Elimination Period Once you qualify for claim, only one 90-day deductible/elimination period needs to be met, regardless of how often and for what reason you qualify for claim.

6 Premiums Waived When in Claim After the 90-day deductible/elimination period, premiums are waived. You pay no premiums while you are in claim status. Expenses Covered The plan will reimburse you for bills submitted for covered expenses up to a percentage of your Daily Benefit Amount (DBA). Facility-Based care Nursing Home or Hospice Facility care Actual Expenses up to 100% of DBA. Assisted Living Facility care Actual Expenses up to 100% of DBA. Community-Based care Home Health care Actual Expenses up to 50% of DBA. Home Hospice care Actual Expenses up to 50% of DBA. Adult Day care Actual Expenses up to 50% of DBA. Home Modification 100% of actual expenses up to 10 times the DBA (or $1000, whichever amount is greater). Assistive Equipment & Technology 100% of actual expenses up to 50% of DBA amount paid once per month. Bed Reservation While you are receiving benefits in a covered facility and your stay is interrupted for any reason, the plan continues benefit payments if you are incurring charges to reserve a bed in such facility, up to 60 days per calendar year.

7 Additional benefits that do not reduce your Lifetime Maximum: Transitional care One time payment equal to 3 times your DBA. Informal care 25% of your DBA for up to 50 days per calendar year. Informal Caregiver Training One payment per claim period equal to cost of training, up to 3 times your DBA. Respite care 50% of your DBA for up to 21 days per calendar year State of Ohio Aetna Group long Term care Insurance Benefit Summary Service Reimbursement Plan State of Ohio is sponsoring a group long term care insurance plan underwritten by Aetna Life Insurance COMPANY . The chart below outlines some benefits and features of this coverage. For rates and more information, please review the Outline of Coverage document. Once you enroll for coverage, you will receive a Certificate of Coverage, which will specify in more detail the terms of this service reimbursement plan.

8 For more information, please call the LTC Hotline at 1-800-537-8521 or visit the State of Ohio LTC website at: 0698194 XXX_SOBTQX_SE_XX Alternate care Benefit The plan will reimburse you for bills submitted for covered expenses up to a percentage of your Daily Benefit Amount (DBA). For bills submitted for which no long Term care Benefit is otherwise payable under this Plan, Aetna at its discretion, may pay a benefit under the Alternate care Benefit. The benefit amount is: Actual expenses up to the Community-Based DBA Lifetime Maximum Benefit Amount = Total Coverage for Life of Plan You may select a 3 or 5 year Lifetime Maximum Benefit. Your Lifetime Maximum Benefit is determined by multiplying the number of days in 3 or 5 years by your Daily Benefit Amount.

9 The resulting dollar amount can be thought of as the pool of dollars which you can use to purchase care . Depending upon where and when you receive care , your Lifetime Maximum Benefit could be paid out in a minimum of 3 years or 5 years or a longer period of time. To determine the total amount of money that your coverage provides; , Lifetime Maximum Benefit: 1. Multiply the DBA you select by 365 (days in a year). 2. Multiply that result by the number of years your plan is based on 3 or 5 years. Example of Calculating the Lifetime Maximum Benefit: DBA = $100 Lifetime Maximum Benefit is based on 5 years. Therefore, your Lifetime Maximum Benefit is: $100 x 365 = $36,500 x 5 years = $182,500. Restoration of Benefits Your Lifetime Maximum Benefit is restored by the amount paid out in benefits once you are no longer in a claim status for a period of 90 consecutive days and resume premium payments. Future Purchase Inflation Protection Increases (to help keep pace with the rising cost of long term care ) Included in the plan: You may increase your coverage every 3 years without proof of good health.

10 Aetna will continue to offer you this increase opportunity every 3 years, even if you declined prior offers. The only time Aetna will not make you such offers is when you are in claim and you had declined any previous offer. The amount you will be able to purchase is $1 up to 5% per year of your current DBA the Plan Maximum DBA compounded annually for the previous 3 years. When you purchase more coverage, you will pay additional premium at a rate based on your age as of the date Aetna receives your request for the increased coverage amount. Automatic Inflation Protection Increases (Optional) Alternative to Future Purchase Inflation Protection: You may choose the Automatic Compound Inflation Option which will automatically increase your Daily Benefit Amount every year on an annual compounded basis. Please check the Rates in the last section of the Outline of Coverage for additional cost. Return of Contribution (Optional) If you die, even while in claim, a named beneficiary will receive 100% of premiums you have paid for LTC coverage.