2 correcting 2015 form w 2

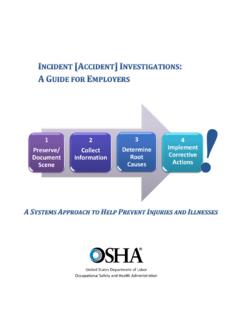

Found 7 free book(s)1 2 3 4 Determine Implement Root Corrective Causes Actions

www.osha.govThis process is supported by an Incident Investigation Form, found in Appendix A, which employers can use to be sure all details of the incident investigation are covered. ... December 2015 2 ... Incident investigations that focus on identifying and correcting root causes, not on finding fault or blame, also improve workplace morale and ...

Instructions for Form 943-X (Rev. February 2021)

www.irs.govChanges to Form 943-X for COVID-19 related employ-ment tax credits and other tax relief. Form 943-X has been significantly revised to allow for correcting COVID-19 related employment tax credits and other tax relief related to COVID-19 reported on Form 943. You may now use Form 943-X to report corrections to the following items reported on Form ...

Instructions for Form 941-X (Rev. October 2020)

www.narts.orgthe amount of wages you reported on Form 941 and Form W-2, Wage and Tax Statement, for a prior year by filing Form 941-X and Form W-2c, Corrected Wage and Tax Statement. You will report the correct wages on Form 941-X, line 6, column 1. The amount actually withheld is reflected on payroll information or on Form W-2 which can be

Amended and Prior Year Returns - Internal Revenue Service

apps.irs.govTwo weeks after Bernard’s current-year tax return was filed, he received another Form W-2 in the mail. The volunteer tax preparer reviews Bernard’s file to be sure the Form W-2 wasn’t included on the original return. The volunteer then helps Bernard prepare Form 1040-X to include the additional Form W-2 on the current-year return.

BY ORDER OF THE AIR FORCE INSTRUCTION 32-1015 …

static.e-publishing.af.milResponsibility listed above using the AF Form 847, Recommendation for Change of Publication; route AF Forms 847 from the field through the appropriate chain of command. The authorities to waive wing/unit level requirements in this publication are identified with a Tier (“T-0, T-1, T-2, T-3”) number following the compliance statement.

READING LITERARY (RL) READING INFORMATIONAL (RI) Key …

www.georgiastandards.orgrelevant to a grade 2 topic or subject area. ELAGSE2RL5: Describe the overall structure of a story including describing how the beginning introduces the story, the middle provides major events and challenges, and the ending concludes the action. facts. ELAGSE2RI5: Know and use various text features (e.g., captions, bold print,

Colorado Income Tax Withholding Tables For Employers

spl.cde.state.co.usCorrecting Returns and Withholding Refund Requirements Claim Refunds on the DR 1094 — Overpayments of withholding for the current year only should first be deducted from the subsequent month(s) DR 1094 returns, zeroing out these returns until the overpayment is satisfied. Wage (W-2) Withholding Refunds — The department