2012 Federal Employee S Payroll Calendar

Found 9 free book(s)HERO (Helping Employees Reach Out)

forms.matchinggifts.comOn-Going Payroll Deduction (Minimum $25.00) – Active Employees Only . On-going payroll deductions begin in January of the year following the open enrollment period. The end date represents when the deduction will stop. If left blank will continue through the calendar year. End Date __/__/__ One-Time Payroll Deduction (Minimum is $25.00)

Accessing PeopleSoft Employee Self Service

dcps.dc.gov(Amount based on school year calendar and employee hire date.) Employees . do not pay . the amounts listed in the . Employer Paid . Benefits column. Current – Earnings, Taxes, & Deductions for this pay period. YTD - Earnings, Taxes, & Deductions for the calendar year. If you began working on 8 /20/2012, you will be paid for 80 . regular hours ...

RETURN THIS FORM

services.des.nc.govITEM 1: For each month in the calendar quarter, enter the number of all full-time and part-time workers who worked during or received pay for the payroll period which includes the 12th of the month. ITEM 2: Enter all wages paid to all employees, including part-time and temporary, in this calendar quarter. If the legal business is:

Quick Guide: Payroll tips

http-download.intuit.com2. Double-click an employee’s name in the left-hand list to open the employee’s information, and then click the . Payroll Info. tab on the left. 3. Click the Payroll Schedule drop-down arrow and choose the payroll schedule you want to pay this employee on. Tip: You can also change the payroll schedule for this employee by choosing a different

UC-018-Unemployment Tax and Wage Report - Arizona

des.az.gov– Calculate for each employee how much, if any, of the total wages paid to that employee in the quarter are in excess of the first $7,000 paid to that employee in the same calendar year (such “excess wages” must be reported in the quarter earned, but are not taxable). Add together all excess wages paid to all your

12. Filing Form 941 or Form 944 What's New 27

www.irs.govthe amount to add to a nonresident alien employee's wa-ges for figuring income tax withholding are included in Pub. 15-T, Federal Income Tax Withholding Methods, available at IRS.gov/Pub15T. You may also use the In-come Tax Withholding Assistant for Employers at IRS.gov/ITWA to help you figure federal income tax with-holding.

EMPLOYEE RIGHTS - Home | U.S. Department of Labor

www.dol.govUp to two weeks (80 hours, or a part-time employee’s two-week equivalent) of paid sick leave based on the higher of their regular rate of pay, or the applicable state or Federal minimum wage, paid at: • 100% for qualifying reasons #1-3 below, up to $511 daily and $5,110 total;

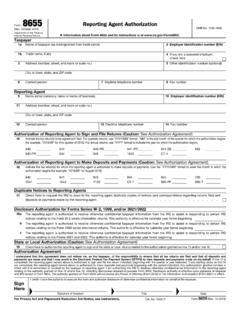

Form 8655 Reporting Agent Authorization

www.irs.govall federal tax deposits (FTDs) and federal tax payments (FTPs) are made timely. A reporting agent must notify its client of that fact and must recommend that it enroll in the Electronic Federal Tax Payment System (EFTPS) to view EFTPS deposits …

Description of each box on form W2

www.foundation.sdsu.edusecurity wage amount for 2012 is $110,100. Box 4 "Social security tax withheld": This is social security tax withheld from your pay. For 2012, the amount should not exceed $4,624.20 ($110,100 X 4.2%). Box 5 "Medicare wages and tips": This is total wages and tips subject to the Medicare component of social security taxes.