2018 Premiums Monthly

Found 9 free book(s)New York State Health Insurance Program (NYSHIP) Annual ...

www.cs.ny.govthat you pay for your monthly Medicare premiums if you have higher annual earnings. ... 2019 and 2018. However, 2018 IRMAA applications must be received by April 15, 2022 or they will not be considered for reimbursement. The Employee Benefits Division (EBD) will notify you if your application is incomplete.

Appendix J: Eligibility Standards for MHABD - Missouri

dssmanuals.mo.govProgram Monthly income limit Effective date Asset maximum Effective date Blind Pension (BP) $ 7,630 (sighted spouse) 04-01-22 $ 29,999 2018 Supplemental Aid to the Blind (SAB) consolidated standard 908 01-0 1-2 2 5,035 individual 10,070 couple 07 -01 -21 Qualified Disabled and Working Individuals (QDWI) 1 person 2,265 04-0 1-2 2 4,000

Veterans’ Mortgage Life Insurance - Veterans Affairs

www.benefits.va.govVeterans must pay VMLI premiums by deduction from their monthly compensation. How Do You Apply for VMLI? You can apply for VMLI by completing VA …

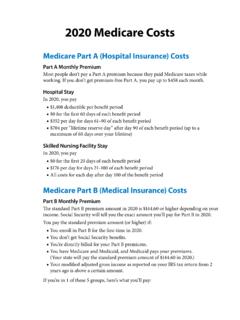

2022 Medicare Costs.

www.medicare.govMost people pay the standard Part B monthly premium amount ($170.10 in 2022). Social Security will tell you the exact amount you’ll pay for Part B in 2022. You pay the standard premium amount if: You enroll in Part B for the first time in 2022. You don’t get Social Security benefits. You’re directly billed for your Part B premiums.

What’s a Medicare Advantage Plan?

www.medicare.govYou pay a monthly premium to the private health insurance company that sells . you the policy. The premiums will be different for plans with different benefits (for example, Plan A compared to a Plan F), but will also differ among insurance companies selling the . same. plan. Therefore, it’s very important to compare policies and their costs ...

Retiree Chapter - nyscopba.org

www.nyscopba.orgMONTHLY COMMERCIAL CARRIER - DELTA PLATINUM ($1500 pp) Single $49.58 Member plus 1 $91.94 Family $134.28 • Commercial Insurance plan premiums will differ depending on age, gender, smoker/non-smoker and location. • Also, waiting periods of 18 months or longer, co-pays and co-insurance apply

What immigrants and refugees need to know about the ...

www.samhsa.govcredits. The tax credit can be used immediately to reduce monthly premiums for insurance bought in the Marketplace. 400% of the FPL is about $45,960 for an individual or $94,200 for a family of 4 according to the 2013 Poverty Guidelines. If you are a lawfully present individual with an estimated household income under 100% of the FPL in 2014 ...

The Social Security System (SSS) is pleased to present ...

www.sss.gov.ph2018 — a law repealing RA No. 1161, as amended by RA No. 8282, otherwise known as the Social Security Act of 1997. The grant of unemployment or involuntary separation benefits for the first time in this country, the mandatory coverage of Overseas Filipino Workers, the establishment of a Provident Fund exclusive to SSS members,

Form 9465 (Rev. February 2017) - IRS tax forms

www.irs.govForm 9465 (Rev. February 2017) Department of the Treasury Internal Revenue Service . Installment Agreement Request . OMB No. 1545-0074. Information about Form 9465 and its separate instructions is at