500 Corporation Income

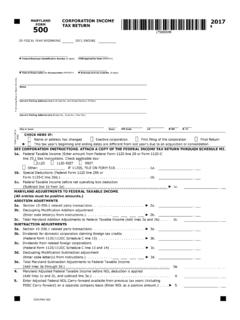

Found 9 free book(s)MARYLAND CORPORATION INCOME 2017 TA RETURN 500

forms.marylandtaxes.govMARYLAND FORM 500 CORPORATION INCOME TA RETURN COM/RAD001 NAME FEIN 2017 page 2 6. Maryland Adjusted Federal Taxable Income (If line 4 is less than or equal to zero,

2016 S Corporation Return Form M8 Instructions

www.revenue.state.mn.us3. General Information (continued) Composite Income Tax. An S corporation may pay composite Min-nesota income tax on behalf of its nonresi-dent shareholders who elect to be included

2016 S Corporation Return Form M8 Instructions

www.revenue.state.mn.us3 General Information (continued) Nonresident Withholding S corporations are required to withhold Minnesota income tax for a nonresident shareholder if the shareholder:

Information about Form 4466 and its instructions is ...

www.irs.govThe overpayment is the excess of the estimated income tax the corporation paid during the tax year over the final income tax liability expected for the tax year, at the time this application is filed.

MN 2017 - Maryland Tax Forms and Instructions

forms.marylandtaxes.gov1 GENERAL INSTRUCTIONS FILING FORM 500 Form 500 must be filed electronically if the corporation plans to claim a business income tax credit from Form 500CR or the Heri-

Corporation Income Tax

tax.idaho.govInstructions for: Form 41 Form 42 Corporation Income Tax Return Idaho Apportionment and Combined Reporting Adjustments Form 41S Form 44 S Corporation Income Tax Return Idaho Business Income …

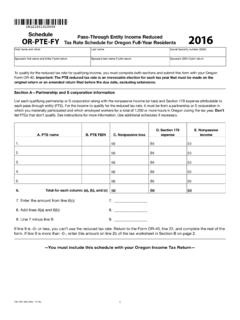

2016, Schedule OR-PTE-FY, Pass-through entity income ...

www.oregon.gov150-101-365 (Rev. 12-16) 3 Tiered entities. If you received nonpassive income that passed-through a PTE to you from another qualifying PTE, that income qualifies for the reduced tax rate if the lower-tier

Fundamentals Level – Skills Module Paper F6 (ZWE)

www.accaglobal.com2 Maureen is a sole trader and is registered for corporation tax. She has been specified by the Zimbabwe Revenue Authority (ZIMRA) to be taxed under the self-assessment system. On 10 August 2016, Maureen received an estimated assessment dated 31 July 2016 in respect of the year ended

2018 Instructions for Form 1120-W

www.irs.govSchedule A!.....