8937

Found 10 free book(s)When To File - IRS tax forms

www.irs.gov8937 to the holder. You are considered to have given a copy of Form 8937 to all holders and nominees if you post a completed Form 8937 to your primary public website under the rules listed under Public reporting, earlier. You are not required to, but may, give a copy of Form 8937 to a holder or nominee if the holder is an exempt recipient.

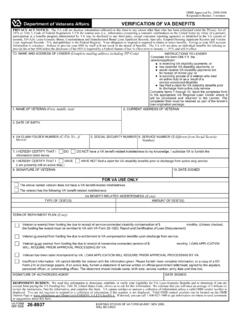

OMB Control No. 2900-0406 Respondent Burden: 5 Minutes ...

www.vba.va.govSUPERSEDES VA FORM 26-8937, JUN 2016, WHICH WILL NOT BE USED. 26-8937. AMOUNT OF DEBT(S) 9. SIGNATURE OF VETERAN (Sign in ink) Insufficient information. VA cannot identify the veteran with the information given. Please furnish more complete information, or a copy of a DD Form 214 or discharge papers.

VERIFICATION OF VA BENEFITS

homeloans.va.govEXISTING STOCKS OF VA FORM 26-8937, NOV 2005, WILL BE USED. 26-8937. AMOUNT OF DEBT(S) 9. SIGNATURE OF VETERAN. Insufficient information. VA cannot identify the veteran with the information given. Please furnish more complete information, or a copy of a DD Form 214 or discharge papers.

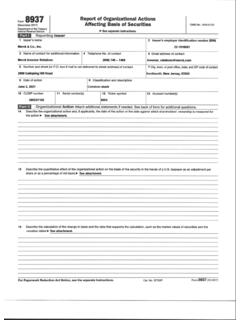

Merck & Co., Inc.

www.merck.comAttachment to Form 8937 . Disclaimer: The information in Form 8937 and this attachment does not constitute tax advice and does not purport to take into account the specific circumstances that may apply to particular categories of Merck & Co., Inc. (“Merck”) shareholders. Each Merck shareholder is urged to consult his, her or its own tax

1 3 Name of contact for additional information Telephone ...

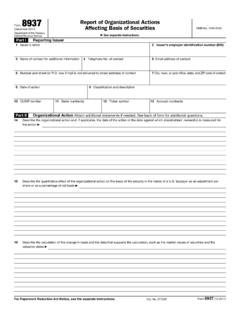

www.irs.govForm 8937 (12-2017) Page . 2 Part II Organizational Action (continued) 17. List the applicable Internal Revenue Code section(s) and subsection(s) upon which the tax treatment is based 18. Can any resulting loss be recognized? 19. Provide any other information necessary to implement the adjustment, such as the reportable tax year Sign Here

Report of Organizational Actions Affecting Basis of Securities

s23.q4cdn.comForm 8937 (12-2017) Page 2 Part II Organizational Action (continued) 17 List the applicable Internal Revenue Code section(s) and subsection(s) upon which the tax treatment is based 18 Can any resulting loss be recognized? Sign Here Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my …

CHALLENGES OF CONSTRUCTION INDUSTRIES IN …

www.irbnet.de(a) increased value for money to industry clients as well as environmental responsibility in the delivery process; and (b) the viability and competitiveness of domestic construction enterprises.

HYPONATRAEMIA IN ADULTS (ON OR AFTER 16TH …

www.rqia.org.uk4 INTRODUCTION Hyponatraemia is a disorder of sodium and water metabolism and is the most common electrolyte abnormality in hospitalised patients.

www.ibm.com

www.ibm.comCreated Date: 11/18/2021 11:55:29 AM

Part I - Reporting Issuer Part II - Organization Action 1 ...

www.fidelity.ca1 2 3 4 5 6 7 8 9 10 111213 1416 17 18 19 Issuer's name Issuer's EIN Name of contact for additional information Telephone number of contact E-mail address of