Alert Tax

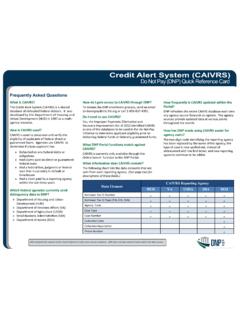

Found 7 free book(s)Credit Alert System (CAIVRS)

fiscal.treasury.govAug 04, 2017 · The redit Alert System ( AIVRS) is a shared database of defaulted federal debtors. It was developed by the Department of Housing and Urban Development (HUD) in 1987 as a multi-agency resource. How is CAIVRS used? AIVRS is used to prescreen and verify the ... orrower Tax ID Number ...

Florida AnnualResaleCertificate R. 04/19 for Sales Tax

www.floridarevenue.comServices Tax (see Florida’s Communications Services Tax brochure GT-800011). An Annual Resale Certificate willallow you to make tax-exempt purchases or rentals of property or services ... authorization number or alert the seller that the purchaser does not have a …

COVID-19 Withholding Requirements for teleworking …

www.marylandtaxes.govThe following tax alert addresses withholding questions received by the Office of the Comptroller of Maryland due to the unprecedented situation caused by the COVID-19 pandemic. Employer Withholding Requirements Maryland employer withholding requirements are not affected by the current shift from working

2019 PA Corporate Net Income Tax - CT-1 Instructions (REV ...

www.revenue.pa.gova PA Tax Update e-alert. RCT-101 – PA CORPORATE NET INCOME TAX REPORT, RCT-101-I – INACTIVE PA CORPORATE NET INCOME TAX REPORT, RCT-101D – DECLARATION OF DE MINIMIS ACTIVITY AND RCT-128C – REPORTS OF CHANGE IN CORPORATE NET INCOME TAX If you are including payment, please use the following address:

Form IT-225-I:2014:Instructions for Form IT-225 New York ...

www.tax.ny.govThe following symbols alert you to important information and filing shortcuts. Caution Time-saving tip Line instructions Enter the name and social security number (SSN) or employer identification number (EIN) as shown on Form IT-201, IT-203, IT-204 or IT-205. If …

Notice 2014-21 SECTION 1. PURPOSE - IRS tax forms

www.irs.govAct (FICA) tax, and Federal Unemployment Tax Act (FUTA) tax and must be reported on Form W-2, Wage and Tax Statement. See Publication 15 (Circular E), Employer’s Tax Guide, for information on the withholding, depositing, reporting, and paying of employment taxes.

Chapter 10 Schedule M-1 Audit Techniques ... - IRS tax forms

www.irs.govCHAPTER 10 SCHEDULE M-1 AUDIT TECHNIQUES Page 10-4 Basic Information Link or Bridge Schedule M-1 of the Corporate Income Tax Return, Form 1120 is the link or bridge between financial accounting and tax reporting. The tax return is prepared after completing Schedule M-1 …