Allowance For Loan Losses

Found 8 free book(s)Asset-Based Lending, Comptroller's Handbook

www.occ.treas.govAllowance for Loan and Lease Losses ... Loan Act, an FSA may designate under which section the loan has been made. Such a loan may be apportioned among appropriate categories. 3 12 USC 1464(c)(2)(B). This statute generally limits nonresidential real …

Joint Guidance on Overdraft Protection Programs

www.federalreserve.govAccordingly, overdraft losses should be charged off against the allowance for loan and tease losses. The Agencies expect all institutions to adopt rigorous loss estimation processes to ensure that overdraft fee income is accurately measured. Such methods man include providing loss allowances for uncollectible fees or, alternatively, only

“HOW YOUR RENT IS DETERMINED” - HUD

www.hud.govloan proceeds for the purpose of determining income. Assets Include: Stocks, bonds, Treasury bills, certificates of deposit, ... settlement for personal or property losses refunds or rebates under State of local law for ... Any allowance paid under the provisions of

Company Losses Toolkit - GOV.UK

assets.publishing.service.gov.ukThe use of restricted losses will take effect from the first accounting period ending after 1 April 2017. The use of losses more flexibly will take effect from the accounting period that follows this. The carried forward losses affected are: • Trading losses • Non-trading loan relationship deficits • Management expenses

FHA Single Family Housing Policy Handbook GLOSSARY

www.hud.govAutomobile Allowance Automobile Allowance refers to the funds provided by the Borrower’s employer for automobile related expenses. Base Loan Amount The Base Loan Amount is the mortgage amount prior to the addition of any financed Upfront Mortgage Insurance Premium (UFMIP). Unless otherwise stated in this SF Handbook, all

Tax code declaration - ird.govt.nz

www.ird.govt.nzIf you have a student loan and you choose “SB SL” or “S SL” for your tax code, you may pay more towards your student loan than you need to. If you earn under the pay period repayment threshold from your main job, you can apply for a special deduction rate to reduce your student loan repayment deductions on your secondary earnings.

2021 Instructions for Form 8606 - IRS tax forms

www.irs.govb. Student loan interest deduction from Schedule 1 (Form 1040), line 21. c. Reserved for future use. d. Exclusion of interest from Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989. e. Exclusion of employer-provided adoption benefits from Form 8839, Qualified Adoption Expenses. f. Foreign earned income ...

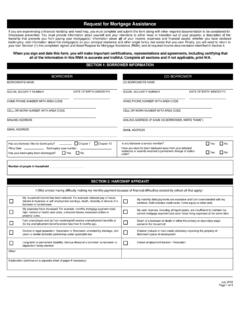

Request for Mortgage Assistance

www.usbank.comyour loan Servicer (1) this completed, signed and dated Request for Mortgage Assistance (RMA); and all required income documentation identified in Section 4. When you sign and date this form, you will make important certifications, representations and agreements, including certifying that all of the information in this RMA is accurate and truthful.