Tax code declaration

Found 7 free book(s)Tax rate notification for contractors - Inland Revenue

www.ird.govt.nz1 IR330C Tax rate notification for contractors March 2017 Use this form if you’re a contractor receiving schedular payments. Don’t use this form if you’re receiving salary or wages as an employee, you’ll need to use the Tax code declaration (IR330) form. Once completed:

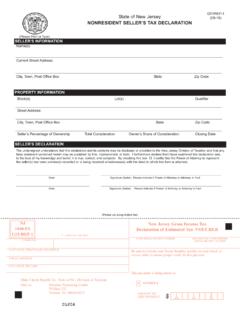

NONRESIDENT SELLER’S TAX DECLARATION - New Jersey

www.state.nj.usNonresident Seller’s Tax Declaration Instructions A nonresident individual, estate, or trust that is selling or transferring property in New Jersey and has not made the required gross

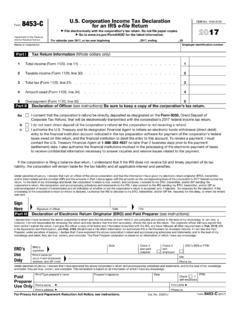

8453-C U.S. Corporation Income Tax Declaration

www.irs.govForm 8453-C Department of the Treasury Internal Revenue Service U.S. Corporation Income Tax Declaration for an IRS e-file Return File electronically with the corporation's tax return.

Supplementary KYC Information & FATCA-CRS Declaration ...

www.karvymfs.comCountry Tax Identification Number% Identification Type (TIN or Other %, please specify) %In case Tax Identification Number is not available, kindly provide its functional equivalent or Company Identification Number or Global Entity Identification Number. Please tick the applicable tax resident declaration - 1. Is “Entity” a tax resident of any country other than India Yes No

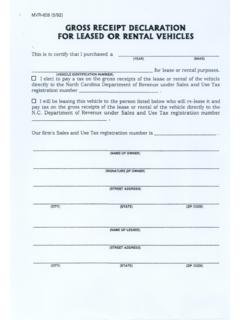

GROSS RECEIPT DECLARATION FOR LEASED OR RENTAL …

www.ncdot.govMVR-60B (5/92) GROSS RECEIPT DECLARATION FOR LEASED OR RENTAL VEHICLES This is to certify that I purchased a (YEAR) (MAKE) for lease or rental purposes. (VEHICLE IDENTIACATION NUMBER) 0 I elect to pay a tax on the gross receipts of the lease or rental of the vehicle

PENNSYLVANIA EXEMPTION CERTIFICATE This formcannot …

www.eastcoastnurseries.comREV-1715 AS (8-98) (I) INSTRUCTIONS: Vendors may use this declaration to document purchases of tax free items by tax exempt organizations (charitable, religious and

Form 729 Revised 12-2015 Oklahoma Tax Commission Motor ...

www.ok.govOklahoma Tax Commission Motor Vehicle Division Odometer Disclosure Statement Federal law (and State law, if applicable) requires that you state the mileage upon transfer of ownership.

Similar queries

Tax rate notification for contractors, Tax code declaration, Tax Declaration, New Jersey, Corporation Income Tax Declaration, Internal Revenue Service, FATCA-CRS Declaration, Declaration, PENNSYLVANIA EXEMPTION CERTIFICATE This formcannot, Oklahoma Tax, Motor Vehicle Division Odometer Disclosure Statement