Application For Residential Homestead

Found 7 free book(s)Application for Appraisal District Residential …

www.hctax.netApplication for Residential Homestead Exemption •Re-filing: If the chief appraiser grants the exemptions, you do not need to reapply annually. You must reapply, however, if …

APPLICATION FOR RESIDENTIAL HOMESTEAD …

www.midlandtexashomes.comGeneral Residential Homestead Exemptions. You may only apply for residence homestead exemptions on one property in a tax year. Fill out the other side of this application completely.

APPLICATION FOR RESIDENTIAL HOMESTEAD …

www.collincountyappraisaldistrict.orgRESIDENTIAL HOMESTEAD APPLICATION INSTRUCTIONS Step 1: Owner’s name and address • Owner’s Name & current mailing address (if different than on the form), percent ownership, birth date, move‐in date and phone number.

Harris County Application for Appraisal District …

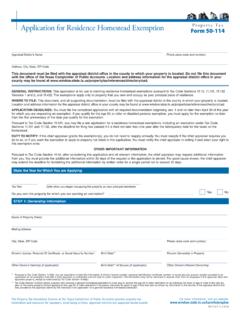

hcad.orgApplication for Residence Homestead Exemption Step 5: Application Documents Place an "x" or check mark beside the type of tax limitation or surviving spouse exemption transfer you seek from your previous homestead exemption:

APPRAISALS, EXEMPTIONS, AND FOR OLDER OR …

hcad.orgGENERAL RESIDENTIAL HOMESTEAD EXEMPTIONS. A homestead exemption reduces taxes by lowering a home’s taxable value. For example, if your $80,000 home

Application for Residence Homestead Exemption …

www.cameroncad.org(Tax Code Section 11 .13): You may qualify for this exemption if for the current year and, if filing a late application, for the year for which you are seeking an exemption: (1) you owned this property on January 1; (2) you occupied it as your principal

2368 Principal Residence Exemption (PRE) Affidavit

www.michigan.govGeneral Instructions Principal Residence Exemption (PRE) exempts a principal residence from the tax levied by a local school district for operating purposes, up to 18 mills.