Charitable Trusts

Found 8 free book(s)Breaking the Plastic Wave - The Pew Charitable Trusts

www.pewtrusts.orgThe Pew Charitable Trusts is driven by the power of . knowledge to solve today’s most challenging problems. Pew applies a rigorous, analytical approach to improve public policy, inform the public, and invigorate civic life. As the United States and the world have evolved, we

Understanding Trusts - Pages - CT Probate Courts

www.ctprobate.govCharitable trusts often last indefinitely — for as long as there are assets to manage and distribute. Testamentary Trust: A trust created within and as part of a person's will. Testator: The person executing a will, with or without a testamentary trust.

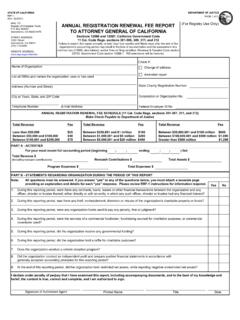

RRF-1, Annual Registration Renewal Fee Report and Instructions

oag.ca.govThe State Charity Registration Number is the Charitable Trust (CT) number assigned to an organization by the Registry of Charitable Trusts at the time of registration. If you do not know the organization's State Charity Registration Number, you may look it up using the Registry Search feature on the Attorney General's website at

Audit of Charitable & Religious Institutions

www.voiceofca.inreligious & Charitable Trust Rule 16CC under section 10(23C) Meaning Audit report u/s 12A (b) of the Income Tax Act, 1961 in the case of charitable or religious trusts or institutions. Audit report under section 10(23C) of the Income-tax Act, 1961, in the case of any fund or trust or institution or any university or other educational institution or

Frequently Asked Questions about Real Estate Investment …

media2.mofo.comcharitable purposes described in Code Section 642(c), is normally treated as a single individual (Code Section 542(a)(2)). However, a special look-through rule applies to “qualified trusts” (generally, tax-exempt pensions or profit sharing plans and technically, trusts described in …

tax guide for charities - Inland Revenue Department

www.ird.gov.hk1. Exemption of charitable institutions and trusts of a public character (i.e. charities) from tax is granted by the legislature. Section 88 of the Inland Revenue Ordinance (Cap 112) (the IRO) provides that a charity is exempt from profits tax subject to …

MODIFYING AND TERMINATING IRREVOCABLE TRUSTS

texasprobate.netTrusts, being creatures of equity, are subject to the equitable powers of the courts even when they are irrevocable and unamendable by their own terms. This paper examines the ways in which irrevocable trusts can be modified or terminated, whether judicially or nonjudicially, whether according to the trusts’ express terms or otherwise.

Informal Trusts - BMO

nesbittburns.bmo.comtwo trusts for her late husband’s grandchildren as they were left out of his will. They were to receive the trust proceeds at age 18. The first grandchild to turn 18 received his account, but before the second grandchild turned 18 the second wife cashed in her plan and used the funds for her own family. The court