Search results with tag "Charities"

Chapter 2: Due diligence, monitoring and verifying the …

assets.publishing.service.gov.ukgive grants to charities to deliver project work in the UK and internationally, so they understand what trustees' responsibilities are under charity law. The 'tools' are particularly aimed at smaller and medium sized charities. The guidance will also assist partner organisations and other delivery agents which charities

SMALL AND MEDIUM-SIZED CHARITIES

www.ippr.orgDefining ‘small and medium-sized charities’ For the purposes of this research, we define small or medium-sized charities as those with an annual turnover of between £25,000 and £1 million.

Amendments to Accounting and Reporting by Charities ...

charitiessorp.orgAccounting and reporting by charities Update Bulletin 2: October 018 Page 5 3. Clarifying amendments 3.1 The amendments set out in this section amend the Charities SORP (FRS 102) to ensure

Attorney General's Guide for Charities

www.oag.ca.govApr 14, 2021 · Charities represent an important economic sector in California and significantly impact the communities they serve. In January 2021, there were over 118,000 charitable organizations registered with the Attorney General’s Registry of Charitable Trusts. As of June 2019, these registered charities reported total revenues over $293 billion and total

Charitable Incorporated Organisations A Guide to ...

www2.deloitte.comand medium sized charities from adopting an incorporated structure. In order to address this, the Charities Act 2006 introduced a new legal structure exclusively for registered charities wishing to enjoy the benefits of incorporation without the dual regulation applicable to limited companies. This new legal form is called the

Guidance on audits for company charities - GOV.UK

assets.publishing.service.gov.ukCharities Act took effect for financial years beginning on or after 1 April 2008. If group accounts are prepared on a voluntary basis under the Companies Act then the group accounts must still be audited under Charities Act provisions irrespective of whether an audit is undertaken under

REPORT ON ABUSE OF CHARITIES FOR MONEY …

www.oecd.orgTax evasion and tax fraud through the abuse of charities is a serious and increasing risk in many countries although its impact is variable. Some countries estimate that the abuse of charities costs their treasury many hundreds of millions of dollars and is becoming more prevalent.

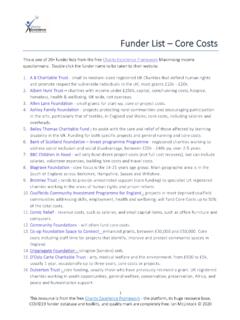

Funder List – Core Costs - The Clare Foundation

theclarefoundation.orgmedium-sized local charities helping people aged 17 years and older in England and Wales achieve positive change in complex social issues. 36. Lionel Wigram Memorial Trust - services for blind, deaf and disabled people in the UK, by volunteer run charities with income of less than £0.5m pa. Max value £3k, average £400. 37.

Factsheet – Charities and VAT - Torridge

www.torridgecvs.org.ukCharities and other not‐for‐profit organisations are generally subject to the same VAT rules as any other organisation. There are, however, a number of VAT reliefs and exemptions available specifically

Charity reporting and accounting: the essentials (CC15b)

assets.publishing.service.gov.uka balance sheet, a statement of financial activities and explanatory notes. These accounts are required in accountancy terms to show a ‘true and fair view’. 1.4 Audit or independent examination? Except for NHS charities, only those charities with gross income of more than £25,000 in their financial year

Conflicts of Interest Policies Under the Not-For-Profit ...

www.charitiesnys.comCharities Bureau . www.charitiesnys.com . Guidance Document . Issue date: September 2018 ... officers, and key persons act in the [nonprofit’s] best interest and comply with applicable legal requirements. ” ... specifically set forth in the nonprofit’s enabling legislation, charter or certificate of

Advisory on Imposter Scams and Money Mule Schemes …

www.fincen.govJul 07, 2020 · Imposter Scams and Money Mule Schemes Consumer frauds include imposter scams and money mule schemes, where actors deceive victims by impersonating federal government agencies, international organizations, or charities. FinCEN identified the financial red flag indicators described below to alert financial institutions to these

K. FOREIGN ACTIVITIES OF DOMESTIC CHARITIES AND …

www.irs.govApr 05, 2001 · Consequently, the nature of the activity, and not its locus, determines whether it is "charitable" for purposes of IRC 501(c)(3). For example, consider a foreign amateur sports organization that is the sole competent authority for the national organization and promotion of a particular sport for adults and youths in its native country.

The New Food Guide

www.canada.cahealth charities . 10 Submissions received during public consultations were . summarized in What We Heard reports available at Canada.ca. When Health Canada senior officials met with organizations to discuss the development of the Food Guide, details including the name of the

CHY4 ANNUAL CERTIFICATE SECTION 848A TAXES ... - Revenue

www.revenue.ieANNUAL CERTIFICATE SECTION 848A TAXES CONSOLIDATION ACT (TCA) 1997 TAX RELIEF FOR DONATIONS TO ELIGIBLE CHARITIES AND OTHER APPROVED BODIES This form should be completed by donors who are individuals. You should not complete a Form CHY4 for a tax year if you have completed, or intend to complete, a Form CHY3 (Enduring …

Ethical Egoism - University of Colorado Boulder

rintintin.colorado.eduam convinced that morality demands that I donate large portions of my money to charities (say to impoverished children), I might do this, even though I do not want to. My strongest desire might be to keep the money for myself, but I give it to the children anyway, out of a sense of duty. I WANT to keep the money, but I do not.

Wolfsberg Group Principles On A Risk Based Approach For ...

www.wolfsberg-principles.comMoney laundering risks may be measured using various categories, which may be modified by ... Unregulated charities and other unregulated “not for profit” organisations (especially those operating on a “cross-border” basis). Dealers in high value or precious goods (e.g. jewel, gem and precious metals dealers, art and ...

Principles and Procedures Management of Public Monies

circulars.gov.iecommittees, advisory groups, charities, or individuals, whether directly from the Votes of Government Departments/Offices or through an intermediary body or series of bodies. This circular supersedes previous Department of Finance Circular 17/2010.

Organisations working on donations of medical equipment

www.who.intCharities and non-profit organizations: Organizations which have 501(c)(3) not-for-profit status may join Med-Eq to become eligible to receive donations.” “As you have learned from these about pages, the REMEDY mission is changing. We are focusing our efforts on helping families that find themselves with excess medical supplies.”

CHARITY NAVIGATOR

www.charitynavigator.orgThis report represents Charity Navigator’s ninth CEO Compensation Study. This year’s study examined the compensation practices at 3,9461 mid to large sized U.S. based charities that de- …

New 1099 Requirements to Hit Charities Hard - Elliott Davis

www.elliottdavis.comThis publication is for informational purposes and does not contain or convey tax advice. The information should not be used or relied upon in regard to any particular situation or circumstances without first consulting a tax advisor.

Companion Guide for (IFRS for SMEs) - Home | ACCA Global

www.accaglobal.comSmall and Medium-sized Entities (IFRS for SMEs). NIGEL DAVIES – PRINCIPAL AUTHOR Nigel Davies, is Head of Accountancy Services at the Charity Commission and since July 2014 Joint Chair of the Charities SORP Committee. He regularly speaks at UK events and conferences on charity accounting issues and publishes articles on charity accountancy ...

SOUTH CAROLINA SECRETARY OF STATE - scsos.com

www.scsos.comAnnual Raffled Financial Report—Revised August 2016 Page 1 SOUTH CAROLINA . SECRETARY OF STATE. PUBLIC CHARITIES DIVISION . ANNUAL RAFFLE FINANCIAL REPORT

GUIDANCE The essential trustee: what you need to know ...

assets.publishing.service.gov.ukThis guidance explains the key duties of all trustees of charities in England and Wales, and what trustees need to do to carry out these duties competently. Trustees have independent control over, and legal responsibility for, a charity’s management and administration. They play a very important role, almost always unpaid, in a sector that ...

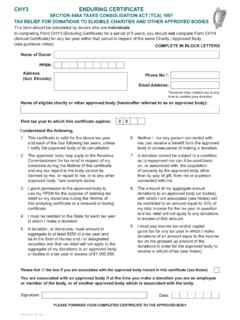

CHY3 ENDURING CERTIFICATE - Revenue

www.revenue.ieSECTION 848A TAXES CONSOLIDATION ACT (TCA) 1997 TAX RELIEF FOR DONATIONS TO ELIGIBLE CHARITIES AND OTHER APPROVED BODIES In completing Form CHY3 (Enduring Certificate) for a period of 5 years, you should not complete Form CHY4 (Annual Certificate) for any tax year within that period in respect of the same Charity / Approved Body.

SOCIAL VALUE POLICY (UK) - Balfour Beatty

www.balfourbeatty.comSupporting small, medium, micro-sized businesses, social enterprises and minority owned businesses to improve capability and grow sustainably Community Engagement: Carrying out volunteering activities that deliver benefits to local communities Partnering with national charities through our Trust Building Better

Charity sector guidance - GOV.UK

assets.publishing.service.gov.ukunder Section 19 of the Terrorism Act 2000 The humanitarian licence is the most common (TACT). For the purposes of section 19 (7B) of licence issued to charities and NGOs, but you TACT a constable is also defined as a National should review the full list of lic Crime Agency officer. Information about this is also published Financialby the ...

Functional Skills English - Reading Sample

www.gatewayqualifications.org.ukBy offering language skills, small and medium sized businesses could find their business growing. One solicitor’s firm has always welcomed bilingual employees – its staff includes French, German, Mandarin, Russian and Japanese speakers. So it was well-placed to respond when it was approached by Polish charities seeking help for clients who had

Charity Reserves Factsheet - OSCR

www.oscr.org.ukThis factsheet is aimed at charity trustees of small to medium sized charities looking to produce or update a reserves policy. It explains: • What is meant by the term reserves. • The charity trustee’s responsibility to consider whether their charity needs reserves. Key points to consider when developing a reserves policy.

Consultation on the introduction of Tenant Satisfaction ...

assets.publishing.service.gov.ukinclude the Charity Commission if the standard would apply to charities; and • section 216 of the Act requires that the regulator must ... Section 149 of the Equality Act 2010 sets out the public sector equality duty3.

Tax basics for non‑profit organisations

www.ato.gov.auABOUT THIS GUIDE Tax basics for non-profit organisations is a guide to tax issues which may affect non-profit organisations, such as charities, clubs, societies and associations. You should use this guide if you are a treasurer, office bearer or employee involved in the administration of a non‑profit organisation. This guide:

Coronavirus Aid, Relief, & Economic Security (CARES) Act ...

www.revenue.pa.govCoronavirus Aid, Relief, & Economic Security (CARES) Act: Pennsylvania Taxability The Coronavirus Aid, Relief, & Economic Security Act, more commonly known as the CARES Act, is a law that was established to help ... charities to be paid to employees do not constitute compensation for federal income tax purposes under IRC 139(a).

N. PRIVATE OPERATING FOUNDATIONS

www.irs.govDec 31, 1981 · the money to another organization to use in the second organization's program. Reg. 53.4942(b)-1(b)(1). Grants made to governments, public charities, or other operating foundations, although permissible, are not considered direct qualifying distributions and are not acceptable distributions for purposes of meeting the Income Test.

INSTRUCTIONS FOR ANNUAL FINANCIAL REPORT FOR …

sos.maryland.govINSTRUCTIONS FOR ANNUAL FINANCIAL REPORT FOR CHARITIES- FORM COF-85 ... 4, 5, 6c, 7c, 8c, and 9. Part II- Statement of Expenses: 11. The total cost of all program services expenses should be reported on line 11. Program services expenses are activities which the organization was created to conduct and which form the basis for the organization’s

tax guide for charities - Inland Revenue Department

www.ird.gov.hk(b) the advancement of education; (c) the advancement of religion; and (d) other purposes of a charitable nature beneficial to the community not falling under any of the preceding heads. 8. While the purposes under the first three heads (i.e. poverty, education and religion) may be in relation to activities carried on in any part of the world,

Attorney General's Guide for Charities

www.oag.ca.govApr 14, 2021 · received federal tax exemption under Inter nal Revenue Code section 501(c)(3), it is considered a charity. Note, however, this guide frequently uses the term charity to include other legal forms of charitable organizations, such as charitable trustees …

History of U.S. Children’s Policy, 1900-Present

firstfocus.orglegislation to create a federal Children’s Bureau, first in 1906 and again after the 1909 White House Conference. Its proposed mission was to monitor state legislation affecting children, and to gather and disseminate data on child welfare. Earlier, private charities and …

'KNOW YOUR CUSTOMER' (KYC) POLICY AS PER ANTI …

www.iiflwealth.comLaundering Act, 2002 read with the Prevention of Money-laundering (Maintenance of Records) Rules, 2005 with any further amendments/ re-enactments thereof issued from time to time, is adopting the ... charities, NGOs and organizations receiving donations, (c)

CHARITIES SORP (FRS 102)

charitiessorp.orgCHARITIES SORP (FRS 102) Amendments to Accounting and Reporting by Charities: Statement of Recommended Practice applicable to charities preparing their accounts in

Charities Governance Code

www.charitiesregulator.ieLegal Disclaimer . This governance code is issued by the Charities Regulator under section 14(1)(i) of the Charities Act 2009, to encourage and facilitate the better administration and management

Charities and the Equality Act 2010: what charity trustees

oscr.org.ukV1.1_Charities and the Equality Act 2010 Charities and the Equality Act 2010: what charity trustees should consider ... For a general introduction to the Equality Act 2010 (the 2010 Act), please see the guidance from the EHRC or the easy read guide from GEO. If you are an

CHARITIES AND NONPROFIT ORGANIZATIONS

www.ffiec.govlower ML/TF risk. However, those U.S. charities that operate abroad, or that provide funding to, or have affiliated organizations in conflict regions can face potentially higher ML/TF risks. 3 1 See “Joint Fact Sheet on Bank Secrecy Act Due Diligence Requirements for Charities and Non-Profit Organizations” issued by the federal banking agencies

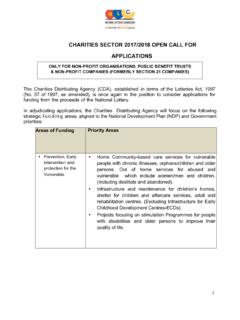

CHARITIES SECTOR 2017/2018 OPEN CALL FOR …

www.nlcsa.org.za1 charities sector 2017/2018 open call for applications only for non-profit organisations, public benefit trusts & non-profit companies (formerly section 21 companies)

Charities Toolkit - Kingston Smith | Chartered Accountants ...

www.kingstonsmith.co.ukRisk management should be embedded in the strategic planning of all charities. Without it, trustees cannot make effective decisions to meet their charitable objectives and to

CHARITIES SECTOR 2021 / 2022 CALL FOR APPLICATIONS ...

www.nlcsa.org.zaAFS must be for two consecutive financial years i.e. following each other and without interruption (e.g. FY 2019/2020 and FY 2020/2021) 4.3 Annual Financial Statements must include comparatives figures for the previous financial year. 4.4 Annual Financial Statements must be approved within six months of the

Similar queries

Chapter 2: Due diligence, monitoring and verifying the, CHARITIES, Medium sized charities, Small and medium-sized charities, Small, Medium, Sized, Charitable Incorporated Organisations, Charities Act, OF CHARITIES FOR MONEY, Fraud, List – Core Costs, Charities and, Statement of financial activities, Financial, Legislation, Money, FOREIGN ACTIVITIES OF DOMESTIC CHARITIES AND, Activity, Food Guide, CHY4, Ethical Egoism, Circular, Charity Navigator, 1099 Requirements to Hit Charities Hard, Of charities, CHY3, SOCIAL VALUE POLICY UK, Charity sector, Functional Skills English - Reading, Small and medium sized, Charity, Equality Act 2010, Equality, Tax basics for, Organisations, GUIDE Tax basics for, Guide, N. PRIVATE OPERATING FOUNDATIONS, Statement, Activities, Tax guide for charities, Advancement, Guide for Charities, Inter nal Revenue, CHARITIES SORP FRS 102, Charities and the Equality Act 2010: what charity, Charities and the Equality Act 2010 Charities and the Equality Act 2010: what charity, 2010 Act, Guidance, CHARITIES SECTOR 2017/2018 OPEN CALL FOR, Charities sector 2017/2018 open call for applications, Charities Toolkit