Charities Act

Found 9 free book(s)Guidance on audits for company charities - GOV.UK

assets.publishing.service.gov.ukCharities Act took effect for financial years beginning on or after 1 April 2008. If group accounts are prepared on a voluntary basis under the Companies Act then the group accounts must still be audited under Charities Act provisions irrespective of whether an audit is undertaken under

Attorney General's Guide for Charities

www.oag.ca.govApr 14, 2021 · Charities represent an important economic sector in California and significantly impact the communities they serve. In January 2021, there were over 118,000 charitable organizations registered with the Attorney General’s Registry of Charitable Trusts. As of June 2019, these registered charities reported total revenues over $293 billion and total

CHY4 ANNUAL CERTIFICATE SECTION 848A TAXES ... - Revenue

www.revenue.ieANNUAL CERTIFICATE SECTION 848A TAXES CONSOLIDATION ACT (TCA) 1997 TAX RELIEF FOR DONATIONS TO ELIGIBLE CHARITIES AND OTHER APPROVED BODIES This form should be completed by donors who are individuals. You should not complete a Form CHY4 for a tax year if you have completed, or intend to complete, a Form CHY3 (Enduring …

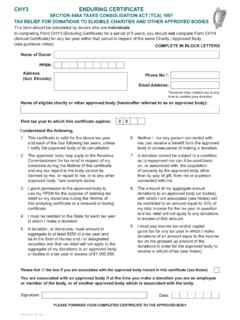

CHY3 ENDURING CERTIFICATE - Revenue

www.revenue.ieSECTION 848A TAXES CONSOLIDATION ACT (TCA) 1997 TAX RELIEF FOR DONATIONS TO ELIGIBLE CHARITIES AND OTHER APPROVED BODIES In completing Form CHY3 (Enduring Certificate) for a period of 5 years, you should not complete Form CHY4 (Annual Certificate) for any tax year within that period in respect of the same Charity / Approved Body.

Coronavirus Aid, Relief, & Economic Security (CARES) Act ...

www.revenue.pa.govCoronavirus Aid, Relief, & Economic Security (CARES) Act: Pennsylvania Taxability The Coronavirus Aid, Relief, & Economic Security Act, more commonly known as the CARES Act, is a law that was established to help ... charities to be paid to employees do not constitute compensation for federal income tax purposes under IRC 139(a).

Charity sector guidance - GOV.UK

assets.publishing.service.gov.ukunder Section 19 of the Terrorism Act 2000 The humanitarian licence is the most common (TACT). For the purposes of section 19 (7B) of licence issued to charities and NGOs, but you TACT a constable is also defined as a National should review the full list of lic Crime Agency officer. Information about this is also published Financialby the ...

CHARITIES AND NONPROFIT ORGANIZATIONS

www.ffiec.govlower ML/TF risk. However, those U.S. charities that operate abroad, or that provide funding to, or have affiliated organizations in conflict regions can face potentially higher ML/TF risks. 3 1 See “Joint Fact Sheet on Bank Secrecy Act Due Diligence Requirements for Charities and Non-Profit Organizations” issued by the federal banking agencies

4720 Return of Certain Excise Taxes Under Chapters

www.irs.govapplicable to the act (f) Amount involved in act (g) Initial tax on self-dealer (10% of col. (f)) (h) Tax on foundation managers (if applicable) (lesser of $20,000 or 5% of col. (f)) Part II: Summary of Tax Liability of Self-Dealers and Proration of Payments (a) Names of self-dealers liable for tax (b)

STREET ADDRESS: STATE OF CALIFORNIA OFFICE OF THE …

oag.ca.govFor additional information, please refer to the Supervision of Trustees and Fundraisers for Charitable Purposes Act (Government Code sections 12580-12599.8) and the Administrative Rules and Regulations pursuant to the Act (California Code of Regulations, Title 11, Sections 300-312.1), and