Companies Income Tax Computation And

Found 9 free book(s)Basic Format of Tax Computation for an Investment Holding ...

www.iras.gov.sgEXPLANATORY NOTES. Companies which have been incorporated with the object of holding investments and deriving investment income are advised to prepare the tax computation …

COMPANIES INCOME TAX COMPUTATION AND …

ppspeakprofessional.comcompanies income tax computation and treatment in financial statements presented by olufunke sodipo tax manager: peak professional services in house seminar series no 4

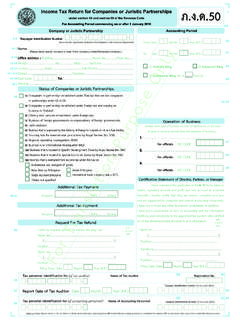

Income Tax Return for Companies or Juristic Partnerships ภ.ง.ด

www.rd.go.thหน้า 3Page For companies granted priviledges under investment promotion schemes (full income tax exemption) or companies granted income tax exemption on tax able net profit in accordance with the law, please fill in items in columns and For general companies, companies granted reduction of income tax rate or companies granted priviledges under investment promotion schemes (reduction

Depreciation Chart: Income Tax

taxclubindia.comDepreciation Chart: Income Tax Block Nature of Asset Rate of Depreciation Building Block-1 Residential building other than hotels and boarding houses 5

Minimum Alternate Tax - MCA

www.mca.co.inObjective of MAT Companies make huge money But due to exemptions and deductions available , pay negligible or nil taxes to IT Dept To bring them in tax net, MAT is applied

INCOME TAX MANUAL PART- 1 - National Board of Revenue

nbr.gov.bdgovernment of the people's republic of bangladesh national board of revenue income tax manual part- 1 the income tax ordinance, 1984 (xxxvi of 1984)

INCOME-TAX ACT, 1961 - International Center for Not-for ...

www.icnl.orgINCOME-TAX ACT, 1961 * [43 OF 1961] [AS AMENDED BY FINANCE ACT, 2008] An Act to consolidate and amend the law relating to income-tax and super-tax BE it enacted by Parliament in the Twelfth Year of the Republic of India as follows :—

INCOME TAX ORDINANCE, 2001 AMENDED UPTO 30.06.2017 …

download1.fbr.gov.pkINCOME TAX ORDINANCE, 2001 AMENDED UPTO 30.06.2017 TABLE OF CONTENTS SECTIONS CHAPTER 1 PRELIMINARY PAGE NO. 1. Short title, extent and commencement 1

Income Tax 2010-21 - Laws of Gibraltar

www.gibraltarlaws.gov.giIncome Tax © Government of Gibraltar (w ww.gibraltarlaws.gov.gi) 2010-21 ARRANGEMENT OF SECTIONS Section 1. Short title and commencement. Part I-Administration

Similar queries

Basic Format of Tax Computation for an Investment Holding, Companies, Income, Tax computation, COMPANIES INCOME TAX COMPUTATION AND, Companies income tax computation and treatment in financial, Income Tax, Depreciation, Minimum Alternate Tax, Income tax manual part- 1, INCOME-TAX ACT, 1961, INCOME TAX ORDINANCE, 2001, Income Tax 2010-21