Customs Import Duties

Found 11 free book(s)Paying Import Customs Charges - DPD

www.dpd.co.ukThese import charges are normally calculated based on the type of product and the value that has been declared from the Customs information supplied by the sender of the goods. HM Revenue and Customs have provided a useful guide on understanding more about Duties and Taxes on goods sent from abroad, which you can access here .

THE CUSTOMS ACT

www.jacustoms.gov.jmCustoms duties. Exemption from import duties. Minister may make interim order. Interim order to be confirmed amended or revoked by House of Representatives. Excess duty to be refunded when order expires. Refund of deposit. Restriction on delivery of goods to counteract evasion. Minister may remit duties. [Repealed bvAct 45 of 1975.1

Philippines Import Shipments Clearance Tips

www.fedex.comPhilippines Import Shipments Clearance Tips ... Customs require it. • Duties and Taxes is not paid within 15 days from date of posting of the Final Assessment Notice. • Package is not claimed within 30 days upon settlement of Duties and Taxes. …

TARIFF AND CUSTOMS CODE OF THE PHILIPPINES (TCCP) …

customs.gov.phascertained duties, taxes and other charges thereon, conditioned for the exportation thereof or payment of .corresponding duties, taxes and other charges within six (6) months from the date of acceptance of the import entry: Provided, That the Collector of Customs may extend the time

Explanatory Notes on

ec.europa.euTAXATION AND CUSTOMS UNION Indirect Taxation and Tax administration Value Added Tax Published September 2020 ... 3.5 THE IMPORT SCHEME ... the VAT Directive), except for goods subject to excise duties; 2) Intra-Community distance sales of goods carried out by suppliers or deemed suppliers ...

Customs/import duties - National Treasury

www.treasury.gov.za1 Table 5.1.1: Customs/Import duties: Customs value, Customs VAT, Customs duty, Duty 1-2B, 2005/06 – 2007/08 Customs and Excise Chapters 2005/06 2006/07 2007/08 R million Chapter Customs value Customs VAT 2 Customs dut y 2 Duty 1-2B 2 Customs value Customs VAT 2 …

Customs Manual on Import VAT - Customs Manual relating …

www.revenue.ieCustoms duties or repayment or remission of Customs duties do NOT apply to Import VAT.44 An example would be where the goods qualify for non payment of Customs duty because they are for use in a private aircraft - the End-Use Authorisation relieves them of Customs duty, but Import VAT remains payable. However, an End-use Authorisation to cover ...

CUSTOMS (Import/Export) POWER OF ATTORNEY

www.ups.comIn accordance with 19 CFR 111.29, the following paragraph explains your rights regarding method of payment of Customs charges: If you are the importer of record, payment to the broker will not relieve you of liability for Customs charges (duties, taxes, or other debts owed Customs) in the event the charges are not paid by the broker.

Guide to Import and Export - Lao Trade Portal

www.laotradeportal.gov.laYou may engage a Customs Broker to carry out the import formalities on your behalf. For information pertaining to brokers see Section Customs Broker below. Classification and Value Customs duty is payable on imported goods as a percentage of their declared value. The rate of

Import & Export Procedures Manual

skncustoms.comcustoms to determine true value of the imported goods, for assessment of duties and taxes. Transit shed - an approved place situated within a Customs port or airport and used for the temporary storage of cargo unloaded from an aircraft or ship.

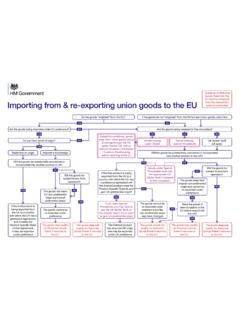

Importing from and re-exporting union goods to the EU ...

assets.publishing.service.gov.ukSpecial Procedures Customs special procedures allow you to store, temporarily use, process or repair your goods and get partial or full relief from import duty, or in some cases suspension of duty. UK Global Tariff The UK Global Tariff (UKGT) applies to all goods imported into the UK unless the country you’re importing from has a trade