Dividend Received

Found 9 free book(s)TAX TREATMENT OF DIVIDEND RECEIVED FROM COMPANY

www.incometaxindia.gov.inThus, dividend received during the financial year 2020-21 and onwards shall now be taxable in the hands of the shareholders. Consequently, Section 115BBDA which provides for taxability of dividend in excess of Rs. 10 lakh has no relevance as the entire amount of dividend shall be

Reinvesting Your Company Stock Dividends

workplaceservices.fidelity.comReinvest in Security: Any dividend or capital gain paid will be used to purchase additional stock. Deposit to Core Account: Any dividend received will …

U.S. GAAP vs. IFRS: Statement of cash flows - RSM US

rsmus.comDividends received are classified as operating activities. Dividends paid are classified as financing activities. Interest and dividends received or paid are classified in a consistent manner as either operating, investing or financing cash activities. Interest paid and interest and dividends received are usually classified in operating cash flows

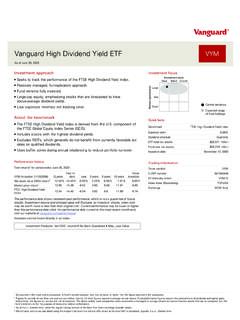

High Dividend Yield ETF - The Vanguard Group

institutional.vanguard.comHigh Dividend Yield ETF FTSE High Dividend Yield Index Number of stocks 412 411 Median market cap $148.0B $148.0B Price/earnings ratio 17.9x 17.9x ... Turnover rate excludes the value of portfolio securities received or delivered as aresult in-kind purchases redemptions fund’s capital shares, including

Corporations: Earnings & Profits & Dividend Distr.

isu.indstate.edu• Dividends received deduction • Calculation generally begins with taxable income, plus or minus certain adjustments – Add previously excluded items back to taxable ... Dividend: 20,000 20,000 5,000 *Since there is a current deficit, current and accumulated E & P are netted before determining treatment of distribution. ...

ANZ 2021 Final Dividend

www.anz.comthe DRP or BOP for the 2021 Final Dividend must be received by ANZ’s Share Registrar, Computershare, by 5.00pm (Australian Eastern Daylight Time) on 10 November 2021. Computershare can be contacted: • by phone on the numbers set out at …

The Capital Dividend Account - Sun Life Financial

www.sunnet.sunlife.comJun 21, 2021 · to allow tax-free amounts received by a private corporation to be distributed tax-free to shareholders of the corporation. ... A capital dividend paid to a non-resident shareholder is subject to a federal withholding tax of 25%. 7 (or a lower rate if specified by tax treaty). Therefore, if a private corporation

Dividend Reinvestment Program - TD Ameritrade

www.tdameritrade.comDividend reinvestment prices on such transactions will be obtained from DTC and will be distributed to clients when shares have been received from DTC, in most cases 7-10 business days following the payable date.

Dividend Appreciation ETF - The Vanguard Group

advisors.vanguard.comVanguard Dividend Appreciation ETF VIG As of December 31, 2021 Investment approach ... Turnover rate excludes the value of portfolio securities received or delivered as aresult in-kind purchases redemptions fund’s capital shares, including Vanguard ETF Creation Units.