Search results with tag "Dividend"

S&P 500 Buybacks & Dividends - Yardeni Research

www.yardeni.comS&P 500 YIELD FROM BUYBACKS & DIVIDENDS Buybacks + Dividends (billion dollars, trailing four-quarter) (1393.07) Yield (%) Buybacks (2.18) Dividends (1.37) Buybacks + Dividends (3.45) Source: Standard & Poor’s Corporation. yardeni.com Figure 10. 0 50 100 150 200 250 300 0 50 100 150 200 250 300 Q4

DT-GEN-01-G03 - A Quick Guide to Dividends Tax - External ...

www.sars.gov.zaDividends Tax is a withholding tax and should be withheld from dividend distributions and paid to SARS by the company paying the dividend or, where a regulated intermediary is involved, by the latter. The person liable for the Dividends Tax retains the ultimate

Vanguard mutual fund investors 2019 Form 1099-DIV ...

personal.vanguard.comYou must report ordinary dividends on line 3b of Form 1040. If the total of all ordinary dividends (Box 1a) received from all your taxable investments is more than $1,500, you must list each ordinary dividend income source on Schedule B of Form 1040. Box 1b (Qualified dividends) Box 1b shows the portion of the amount in Box 1a (Total ordinary

Comprehensive Guide to Dividends Tax

www.sars.gov.za3.1.2 Dividends paid by headquarter companies [s 64E(1)]..... 59 3.1.3 Dividends paid by oil and gas companies [s 26B(2)]..... 60 3.1.4 Dividends or interest paid by a REIT or a controlled company [s 25BB(6)(a) and (b

COMMON TRANSACTION REQUEST - NON FINANCIAL …

files.hdfcfund.comUnitholders will receive redemption/ dividend proceeds directly into their bank account via Direct Credit/ NEFT/ECS facility. I/We want to receive the redemption / dividend proceeds (if any) by way of a cheque / demand draft instead of direct credit / credit through NEFT system / credit through ECS (only for dividend) into my / our bank account.

LAS POLÍTICAS DE DIVIDENDOS - Comillas

repositorio.comillas.eduDividend policy is a strategic key challenge for the success of companies. Indeed companies have to find the optimal system that satisfies both the expectations of its shareholders and the needs of the own business. This dissertation aims to expound, in the most complete and simple way possible, the topic of dividend policies.

Corporations: Earnings & Profits & Dividend Distr.

isu.indstate.edu• Dividends received deduction • Calculation generally begins with taxable income, plus or minus certain adjustments – Add previously excluded items back to taxable ... Dividend: 20,000 20,000 5,000 *Since there is a current deficit, current and accumulated E & P are netted before determining treatment of distribution. ...

Tax-exempt interest dividends by state for Vanguard ...

personal.vanguard.comTax-exempt interest dividends from these funds, as reported on Form 1099-DIV, Box 11, are taxed differently at the federal, state, and local levels, and may be subject to the alternative minimum tax. Federal tax treatment. The tax-exempt interest dividends are 100% exempt from federal income tax. State and local tax treatment.

BP cash dividends -ordinary shareholders

www.bp.comBP cash dividends -ordinary shareholders . The following table reflects the cash dividends paid per ordinary share by BP since 1993 . Figures have been restated to reflect the subdivision of BP ordinary shares on 4th October

Dividents and Capital Gains Information

static1.st8fm.comSome of the dividends you receive and all net long term capital gains you recognize may qualify for a federal income tax rate lower than your federal ordinary marginal rate. Qualified Dividends Qualified dividends received by you may qualify for a 20%, 15% or 0% tax rate depending on your adjusted gross income (or AGI) and filing status.

Qualified Dividends and Capital Gain Tax Worksheet: An ...

www.irs.govrates to qualified dividends received after 2002 and before 2009. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the different rates that apply during 2003 and to include the dividend tax break. Schedule D will be much shorter for 2004, when one set of rates will apply for the whole year. Worksheet Alternative

Tax Treatment of Distributions Mutual Fund Distributions

www.irs.govsist of ordinary dividends, capital gain distri-butions, undistributed capital gains, or return of capital like any other mutual fund. These distributions generally are treated the same as distributions from a regular mutual fund. Distributions designated as exempt-interest dividends are not taxable. (See Exempt-Interest Dividends, later.)

Standard Account Application-TDI 0122 - TDA Institutional

veoone.tdainstitutional.comAgreement for a complete description of the Cash Sweep program. DIVIDEND & INTEREST PREFERENCES (PLEASE SELECT ONLY ONE OPTION FOR DIVIDEND & INTEREST DELIVERY) Please select one of the below choices. If no selection is made TD Ameritrade will default to holding all dividends and interest at TD Ameritrade.

2021 Estimated Dividends and Distribution Information as ...

www.alger.comOrdinary Income Dividends (derived from net investment income) Ordinary Income Dividends (derived from net short-term gains) Net Long-Term Gains Total Distributions Percentage of NAV NAV Alger Capital Appreciation Fund (A) $0.0000 $0.5545 $6.8155 $7.3700 18.8% $39.16

PwC ReportingPerspectives

www.pwc.inThe Auditing and Assurance Standards Board of ICAI has recently brought out ... dividend is declared. When impairment indicators exist, a test for impairment should be performed. An impairment loss ... dividends from the subsidiary. The above is true if the subsidiary has no debt. Otherwise, the present ...

Savings and Investments - La Capitale

www.lacapitale.comValue Fidelity Dividend Fund, Series A 0% 2.29%4 High total investment return Canadian Equity Income (Dynamic) Canadian Dividend and Income Equity Blend Dynamic Equity Income Fund, Series A 0% 2.13%5 Long-term capital growth High income Canadian Equity (Dynamic) Canadian Focused Equity

Claim for refund of Dividend Withholding Tax (DWT)

www.revenue.ieclaimant’s country of residence tax reference no. in country of residence amount of dwt claimed (see dividend schedule overleaf) agent’s reference number relevant to this claim (this number must be quoted inall correspondence relating to this claim) name, telephone number & email address of the person/agentyou would like us to

FORM DP-10 INTEREST AND DIVIDENDS TAX RETURN …

www.revenue.nh.govInterest and Dividends Tax estimates, extensions and returns. MAIL TO: Calendar Year: If your return is based on a calendar year, it must be postmarked on or before April 15, 2003. Fiscal Year: If your return is based on a taxable period other than a calendar year, it must be postmarked on or before the 15th day of the fourth month following

FUND FACTS - RBC Select Growth Portfolio - Series A

funds.rbcgam.comJun 30, 2021 · 5.RBC Global Dividend Growth Fund - Series O 5.1% 6.RBC Global Equity Focus Fund - Series O 5.0% 7.RBC Private Canadian Equity Pool - Series O 4.9% 8.RBC Global Corporate Bond Fund - Series O 4.9% 9.RBC Emerging Markets Equity Fund - Series O 4.2% 10.RBC U.S. Dividend Fund - Series O 3.8% Total percentage of top 10 investments 53.3%. …

INTEREST AND DIVIDENDS TAX RETURN

www.revenue.nh.govINTEREST & DIVIDENDS FROM ALL SOURCES Round to the nearest whole dollar 4 Total Non-Taxable Income (Sum of Line 4(c) plus Line 4(d)) 4 5 Gross Taxable Income (Line 3 minus Line 4) 5 6 Less: $2,400 for Individual, Partnership and Estate; $4,800 for Joint filers 6 7 Adjusted Taxable Income (Line 5 minus Line 6) If less than zero, use minus sign. ...

E-DIVIDEND MANDATE ACTIVATION FORM

interstatesecurities.comAffix Current Passport (T o be stamped by Bankers) Write your name at the back of your passport photograph. E-DIVIDEND MANDATE ACTIVATION FORM. Instruction. Only Clearing Banks are acceptable. Please complete all section of this form to make it eligible for processing and return to the address below The Registrar, Apel Capital & Trust Ltd. 8 ...

RBC Canadian Dividend Fund

funds.rbcgam.comRBC Canadian Dividend Fund These pages are not complete without the disclosure page. For more details visit rbcgam.com Disclosure RBC Funds, BlueBay Funds, PH&N Funds and RBC Corporate Class Funds are offered by RBC Global Asset Management Inc. and distributed

VanguardEquity Income Fund - The Vanguard Group

institutional.vanguard.comSpliced Equity Income Index: Russell 1000 Value Index through July 31, 2007; FTSE High Dividend Yield Index thereafter. F0565 122021 Investment strategy The fund invests mainly in common stocks of medium-size and large companies whose stocks pay above-average levels of dividend income and are considered to have the potential for capital

The Capital Dividend Account - Sun Life Financial

www.sunnet.sunlife.comJun 21, 2021 · to allow tax-free amounts received by a private corporation to be distributed tax-free to shareholders of the corporation. ... A capital dividend paid to a non-resident shareholder is subject to a federal withholding tax of 25%. 7 (or a lower rate if specified by tax treaty). Therefore, if a private corporation

Buy back of shares Key considerations - Deloitte

www2.deloitte.com• Dividends can be declared out of the profits of the company for that year, after providing for depreciation; or • Out of the profits of the company for any previous financial year arrived at after providing for depreciation A Co. Dividend / Buy-back Promoter individuals

Q4 2021 - youinvest.co.uk

www.youinvest.co.ukpay-out, excluding special dividends, is expected to reach £81.8 billion in 2021, a 32% increase compared to £61.8 billion in 2020. Growth then slows considerable into 2022 with total dividend payments forecast to come in at £83.7 billion, an increase of just £1.9 billion or 2%. A drop in industrial and precious metal

SCHEDULE D Capital Gains and Losses - IRS tax forms

www.irs.govCapital Gains and Losses ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 11a (or in the instructions for Form 1040NR, line 42). No. Complete the rest of Form 1040 or Form 1040NR. Schedule D (Form 1040) 2018 : Title:

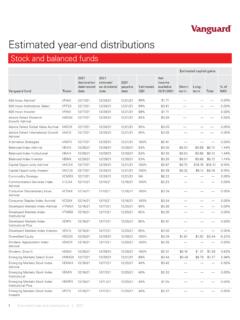

Estimated year-end distributions - personal.vanguard.com

personal.vanguard.comVanguard fund Ticker 2021 declaration date/record date 2021 reinvest/ ex-dividend date 2021 payable date Estimated QDI Net income available 12/31/2021 Short-term Long-term Total % of NAV Energy Admiral VGELX 12/28/21 12/29/21 12/30/21 96% $2.50 — — — 0.00%

Vanguard Energy ETF VDE

institutional.vanguard.comDividend schedule Quarterly ETF total net assets $5,854 million Fund total net assets $7,085 million Inception date September 23, 2004 ... For more information about Vanguard ETF Shares, visit vanguard.com ,call 866-499-8473, or contact your broker to obtain aprospectus or, if …

Page 40 of 117 - IRS tax forms

apps.irs.govQualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

2021 Ordinary Income and Capital Gain Distributions - FINAL

etfs.ark-funds.com2021 Ordinary Income and Capital Gain Distributions – Based on NAV and shares outstanding as of 12/29/2021 - FINAL ... The actual source amounts of all fund dividends will be included in the fund’s annual or semiannual reports. In addition, the tax treatment may differ from the accounting treatment used to calculate the source of the fund ...

CLAIM FOR REAL PROPERTY TAX DEDUCTION ON …

www.state.nj.usRealized capital gains, except for capital gain from the sale or exchange of real property owned and used by the claimant as his principal residence, dividends, interest, pensions, annuities and retirement benefits must be included in full without deductions even though they may be wholly or

Annuity withdrawal - MetLife

eforms.metlife.comSECTION 4: Special instructions (Optional) This section allows the check to be mailed to MetLife for a Long Term Care Payment, Premium for a Life ... as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

Long Division Practice Sheets - Miss Leary's 4th Grade Class

learylearning.weebly.com(dividend) Steps: Divide Multiply Bring Down Divide Multiply Subtract Divide Multiply Subtract Check It Name _____ Date _____ Divide 3-digit by 2- digit w/remainders ©2014LAHinGA 0 A _____-_____ A A A A Steps: Divide Multiply Subtract Bring Down Divide Multiply Subtract Divide Multiply Subtract Check It 15 ...

THE TOP PLAYS THAT WILL POWER BLOCKCHAIN’S …

scdn.palmbeachgroup.comToday, the internet is a global network linking millions of computers. There are over 4.5 billion ... Meanwhile, global investment bank RBC Capital Markets estimates the blockchain ecosystem ... 1.2% dividend to boot. That’s just about unheard of from a growth stock. With ICE, you have all the upside of the crypto ...

Whitepaper

f.hubspotusercontent30.net2.5 Existing Technology 13 2.6 CENTRE Nodes 14 ... structured debt, loans, dividend rights, and other investment offerings benefit from stable price-pegging for both price and investment return. ... is not tied to the policy of an issuing sovereign, but rather value based on the processing power, work, stake, and markets that support it. ...

MUTUAL FUND Investor Guide THE ETF Investor Guide

mutualfundinvestorguide.comThe ETF Balanced Growth Portfolio decreased 0.02 percent last month. It has risen 7.48 percent this year. Vanguard Dividend Appreciation (VIG) rallied 1.58 percent. iShares High Yield Corporate Bond (HYG) added 0.05 percent. The ETF Conservative Income Portfo-lio dipped 0.03 percent last month. It has advanced 5.44 percent in 2021. Vanguard

Putnam Mortgage Opportunities Fund

www.putnam.com(Y shares, based on total return) 1 year 86% (272/329) Expense ratio (Y shares) Total expense ratio 0.78% What you pay 0.51% (A shares) Total expense ratio 1.03% What you pay 0.76% “What you pay” reflects Putnam Management’s decision to contractually limit expenses through 9/30/22. Net assets $156.46M Number of holdings 686 Dividend ...

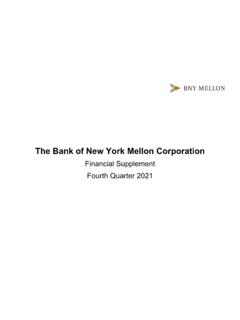

4Q21 Financial Supplement

www.bnymellon.comCommon dividend payout ratio (c) 34% 34% 28% 32% 40% ... Includes the AUC/A of CIBC Mellon Global Securities Services Company ("CIBC Mellon"), a joint venture with the Canadian Imperial Bank of Commerce, of $1.7 trillion at Dec. 31, 2021, Sept. 30,

Scotia Canadian Dividend Fund Series A

www.scotiabank.comTom Dicker is a Vice President and Portfolio Manager at 1832 Asset Management L.P. He is co-manager of several funds and covers a number of areas, including U.S. equities, small cap equities and real estate securities. Tom has over 13 years of investment industry experience, initially as an analyst and then portfolio manager, with LDIC Inc.

Return of Capital Distributions Demystified

funds.eatonvance.comThe tax character of a fund’s distributions tells little about whether the distributions are supported by fund returns – dividends and capital gains distributions may be unearned and return of capital distributions can be earned. The best measure of whether a fund has earned its distributions is the change in its NAV net of distributions.

How do mutual fund distributions work? - TD

www.td.comdeferred when ROC distributions are received, will be payable when the units of the fund are sold or when their adjusted cost base goes below zero. Types of Distributions Dividends Return of Capital Non- $100 Taxable* $66 $34 Interest Capital Gains $50 GIC $50 $75 $25

FUND FACTS - RBC Select Conservative Portfolio - Series A

funds.rbcgam.comJun 30, 2021 · 3.RBC Canadian Short-Term Income Fund - Series O 7.4% 4.RBC European Equity Fund - Series O 7.3% 5.RBC Global Corporate Bond Fund - Series O 6.3% 6.RBC Global Bond Fund - Series O 6.1% 7.Phillips, Hager & North U.S. Multi-Style All-Cap Equity Fund - Series O 5.7% 8.RBC Canadian Dividend Fund - Series O 4.4% 9.Phillips, Hager & North ...

Dividend Appreciation ETF - The Vanguard Group

advisors.vanguard.comVanguard Dividend Appreciation ETF VIG As of December 31, 2021 Investment approach •Seeks to track the performance of the S&P U.S. Dividend Growers Index. •Passively managed, full-replication approach. •Fund remains fully invested. •Large-cap equity, emphasizing stocks with arecord of growing their dividends year over year.

Dividends Ordinary Interest and - IRS tax forms

www.irs.govOrdinary Dividends Use Schedule B (Form 1040) if any of the following applies. •You had over $1,500 of taxable interest or ordinary dividends. •You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. •You …

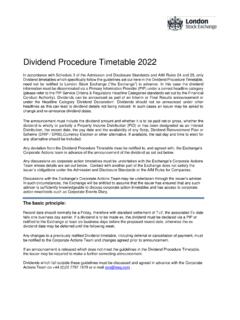

Dividend Procedure Timetable 2022

docs.londonstockexchange.comdividend amount and whether it is to be paid net or gross, the record date, the pay date, the availability of any Scrip, DRIP or Currency Elections and the relevant Election date. Advance notice should be given of any election date, which should fall at least ten business days after the

Dividend and Capital Gains Distributions Income PA ...

www.revenue.pa.govgains distributions income is equal to the amount reported on the estate or trust’s federal Form 1041 and there are no amounts for Lines 2 through 12 (not including subtotal Line 6) of Schedule B, the estate or trust must report the dividends and capital gains distributions income on Line 2

Dividend Reinvestment Plan Rules - CommBank

www.commbank.com.auPage 3 Term Meaning under these Rules. Business Day a day which is a business day within the meaning of the Listing Rules. CBA Commonwealth Bank of Australia (ABN 48 123 123 124). Chi‐X Chi‐X Australia Pty Ltd (ABN 47 129 584 667) or the securities market operated by Chi‐X Australia Pty Ltd (as the case may be).

Similar queries

500 Buybacks & Dividends, Dividends, Ordinary dividends, Ordinary, Dividend, LAS POLÍTICAS DE DIVIDENDOS, Dividend policy, Received, BP cash dividends -ordinary shareholders, Qualified Dividends and Capital Gain, Distributions, Distri-butions, Sweep, OPTION, PwC ReportingPerspectives, Recently, Declared, Dividend Fund, Total, Dynamic, Fund, AND DIVIDENDS, Growth, Global Dividend Growth Fund, Global, DIVIDEND MANDATE, Affix Current Passport, Passport, RBC Global, VanguardEquity Income Fund, Vanguard, Index, High Dividend Yield Index, The Capital Dividend Account, Special dividends, Capital Gains, IRS tax forms, Dividends and Capital, Vanguard Energy ETF VDE, Qualified Dividends and Capital, PROPERTY TAX DEDUCTION, Capital, Special, Long Division, Policy, Vanguard Dividend, High Yield, CIBC, Canadian Imperial Bank of Commerce, Scotia Canadian Dividend Fund Series A, Portfolio, Return of capital distributions, How do mutual fund distributions work, Distributions Dividends, RBC Select Conservative, RBC European, Dividend Appreciation ETF, Vanguard Dividend Appreciation ETF VIG, Dividends Ordinary, Dividend Reinvestment Plan Rules