Special Dividends

Found 6 free book(s)Q4 2021 - youinvest.co.uk

www.youinvest.co.ukpay-out, excluding special dividends, is expected to reach £81.8 billion in 2021, a 32% increase compared to £61.8 billion in 2020. Growth then slows considerable into 2022 with total dividend payments forecast to come in at £83.7 billion, an increase of just £1.9 billion or 2%. A drop in industrial and precious metal

2021 Form 1120 - IRS tax forms

www.irs.govForm 1120 (2021) Page . 2 Schedule C Dividends, Inclusions, and Special Deductions (see instructions) (a) Dividends and inclusions

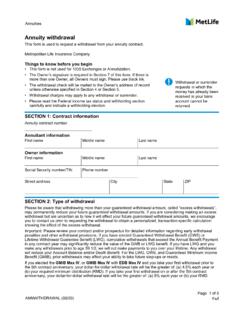

Annuity withdrawal - MetLife

eforms.metlife.comSECTION 4: Special instructions (Optional) This section allows the check to be mailed to MetLife for a Long Term Care Payment, Premium for a Life ... as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

Convention Signed at London December 31, 1975; Exchange …

www.irs.govwith the United Kingdom which require special comment. Article 10 (Dividends) represents a new approach to meshing, by treaty, two tax systems which differ sharply in their treatment of corporations and their shareholders - the "classical system" in the

California Courts - Home

www.courts.ca.govDividends, interest, rents, royalties, and residuals; Patent rights and mineral or other natural resource rights; case. Any payments due as a result of written or oral contracts for services or sales, regardless of title; If the obligor has more than one assignment for support, add together the amounts of support due for all the assignments.

SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS GENERAL ...

nb.fidelity.comSPECIAL TAX NOTICE. YOUR ROLLOVER OPTIONS. You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan; or if your payment is from a designated Roth account, to a Roth IRA or designated Roth account in an employer plan.