Executors And Administrators

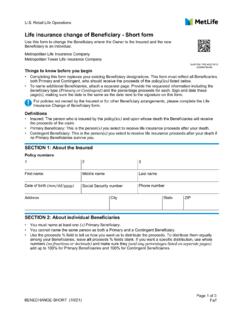

Found 3 free book(s)Life insurance change of Beneficiary - Short form

eforms.metlife.comis living, I designate payment be made to the Executors or Administrators of the Estate of the Insured. SECTION 4: Signature requirements • For an individual acting on behalf of the Owner, their full name and supporting legal documentation such as

Form 1310 Refund Due a Deceased Taxpayer - IRS tax forms

www.irs.govyour return, or get Pub. 559, Survivors, Executors, and Administrators. Specific Instructions Name of Decedent If you are filing a joint return for spouses who are both deceased and you are required to file Form 1310 (see Who Must File, earlier), you must do the following. • Complete a separate Form 1310 for each spouse.

Return Signature - IRS tax forms

apps.irs.govExecutors, and Administrators, for details. Claiming a Refund for a Deceased Person TaxSlayer Navigation: Federal Section>Miscellaneous Forms>Form 1310 Note: If either Option A or B is selected under Part I, the IRS requires the return be paper filed. Only option C is allowed electronically. If Option A or B is selected, you will receive a