Fiduciary Liability

Found 8 free book(s)Please review the updated information below. - IRS tax …

www.irs.govliability for the decedent’s income, gift, and estate taxes. Nine months, or 6 months in the case of a fiduciary’s request, after the IRS’s receipt of the request for discharge or the earlier payment of any amount determined by the IRS to be owed, the executor or fiduciary will be discharged from personal liability for any

Director’s liability for breach of their duties - CIPC

www.cipc.co.zaDirector liability The Companies Act holds directors & POs liable in numerous circumstances where they fail to comply with their duties . . . Where directors & prescribed officers (‘POs’)fail in their fiduciary duties toward the organisation (or are at fault in the organisation they serve) which causes losses to the

State Liability Laws for Charitable Organizations and ...

www.probonopartner.orgmore liability protection for volunteers than (the VPA) provides. (The VPA) does not apply in a state that has enacted a statute citing the authority of this statute section and declaring the will of the state that this Act won’t apply in the ... the exception for fraud or fiduciary misconduct;

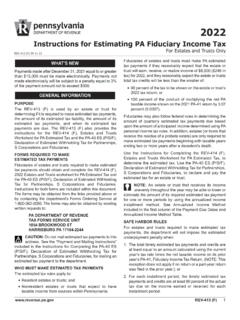

2022 Instructions for Estimating PA Fiduciary Income Tax ...

www.revenue.pa.gov41, Fiduciary Income Tax Return, tax liability as this year’s estimated tax to avoid underpayment penalty unless the tax rate for both tax years is the same and the prior tax 2 REV-413 (F) www.revenue.pa.gov If the estate or trust first meets the requirement to make estimated tax payments: Calendar year filers Fiscal year filers

RECENT CASES INVOLVING LIMITED LIABILITY COMPANIES …

www.baylor.eduor liability absent wrongful conduct committed by partner himself, partner’s direct supervision of someone who engaged in wrongful conduct, or limitation of scope of liability protection by partnership agreement). Vohra v. Cadigan Arbor Park, No. G040387, 2010 WL 1102428 (Cal. App. 4 Dist. March 25, 2010)

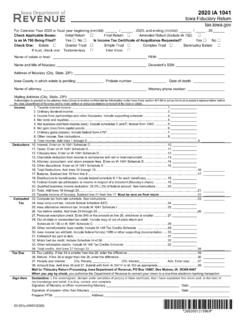

2020 IA 1041 Iowa Fiduciary Return tax.iowa

tax.iowa.gov2020 IA 1041 Fiduciary Schedule A. 63-001b (09/25/2020) Schedule A – Background Information: Answer all applicable questions. 1. Date estate was opened or created: _____

A guide to directors’ responsibilities under the Companies ...

www.accaglobal.comRatification of breaches and relief from liability 100 12. Special cases 102 Appendix 1 107 Appendix 2 130. PAGE 6 ‘CA 2006’ or ‘the Act’ Companies Act 2006 ‘CDDA 86’ Company Directors Disqualification Act 1986 CLR Company Law Review Steering Group

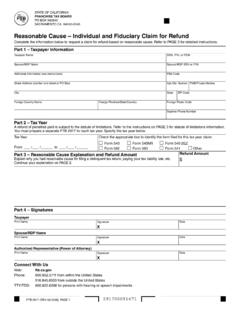

FTB 2917 Reasonable Cause – Individual and Fiduciary …

www.ftb.ca.govFTB 2917 (REV 03-2018) PAGE 1 STATE OF CALIFORNIA FRANCHISE TAX BOARD. PO BOX 942840 SACRAMENTO CA 94240-0040. Reasonable Cause – …