Form gstr 1

Found 8 free book(s)Returns in GST

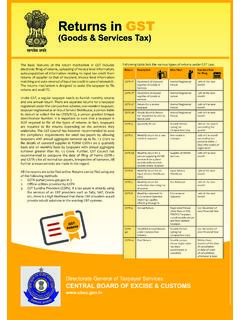

www.cbic.gov.infile details of outward supplies in FORM GSTR-1 on a quarterly basis and on monthly basis by taxpayers with annual aggregate turnover greater than Rs. 1.5 Crore. Further, GST Council has recommended to postpone the date of filing of Forms GSTR-2 and GSTR-3 for all normal tax payers, irrespective of turnover, till

5% Provisional ITC Removed by CBIC, Only ITC Reflecting in ...

icmai.in37, [in FORM GSTR-1 or using the invoice furnishing facility] shall not exceed 5[5 per cent.] of the eligible credit available in respect of invoices or debit notes the details of which have been 6[furnished] by the suppliers under sub-section (1) of section 37 [in FORM GSTR-1 or using the invoice furnishing facility].

43rd Meeting of the GST Council New Delhi, 28th May, 2021 ...

www.cbic.gov.infurnishing FORM GSTR-3B. C. Certain other COVID-19 related relaxations to be provided, such as 1. Extension of due date of filing GSTR-1/ IFF for the month of May 2021 by 15 days. 2. Extension of due date of filing GSTR-4 for FY 2020-21 to 31.07.2021. 3. Extension of due date of filing ITC-04 for QE March 2021 to 30.06.2021. 4.

FORM GSTR-2B - Advisory Q.1 What is GSTR-2B?

tutorial.gst.gov.inFor example, if a supplier furnishes a document INV-1 dt. 15.05.2020 in the FORM GSTR-1 for the month of July, 2020 filed on 11th August 2020, the details of INV-1, dt. 15.05.2020 will get reflected in GSTR-2B of July 2020 (generated on 12th August 2020) and not in the GSTR-2B of

FORM GSTR - 9 [See rule 80]

www.webtel.inIt is mandatory to file all FORM GSTR-1 and FORM GSTR-3B for the financial year for which the return is being filed for before filing this return and for FY 2017-18, the details for the period between July 2017 to March 2018 are to be provided in this return. 2A. [ In the Table, against the serial numbers 4, 5, 6 and 7, the taxpayer shall ...

Improvements in GSTR-1

tutorial.gst.gov.inGSTR-1 can be viewed as usual by navigating from Returns Dashboard > Selection of Period > Details of outward supplies of goods or services GSTR-1 > Prepare Online. The following provides an overview of the updated functionality and their benefits in Phase 1: 1. Reorganized GSTR-1 Dashboard – Taxpayers will now experience an enhanced online user

Form GSTR-1 - Webtel

www.webtel.inForm GSTR-1 [See Rule----] Details of outward supplies of goods or services Year Month 1. GSTIN 2. (a) Legal name of the registered person (b) Trade name, if any 3. (a) Aggregate Turnover in the preceding Financial Year (b) Aggregate Turnover - April to June, 2017 4.

Reportable IN THE SUPREME COURT OF INDIA CIVIL …

main.sci.gov.ina commodity-wise breakup and (iv) c; opies of GSTR-1, GSTR-2 and GSTR-3 returns from July 2017 to July 2018. he appellant T appeared before the third respondent and submitted original tax invoices pertaining to inward outward and supplies for …

![FORM GSTR - 9 [See rule 80]](/cache/preview/5/e/7/3/e/d/1/7/thumb-5e73ed17951b1ef847aa69eed5c0fb84.jpg)