Form W 2c

Found 6 free book(s)Correcting 2016 Form W-2 errors - EY

www.ey.comCorrecting 2016 Form W-2 errors 5 6. Incorrect employer name or address The Form W-2 should reflect the employer’s name and address as shown on Forms 941, 941-SS, 943, 944, CT-1 or Schedule H

Correcting 2015 Form W-2 errors - EY - United States

www.ey.com2 Correcting 2015 Form W-2 errors Ten common 2015 Form W-2 errors and how to fix them Despite best efforts to produce accurate Forms W-2, employees and their tax

2019 Form W-2

www.irs.govBox 8. This amount is not included in box 1, 3, 5, or 7.For information on how to report tips on your tax return, see your Form 1040 instructions. You must file Form 4137, Social Security and Medicare Tax on

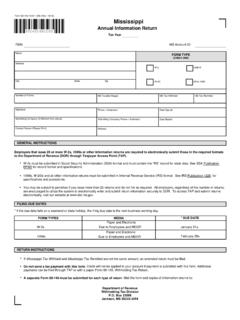

Mississippi

www.dor.ms.govForm 89-140-16-8-1-000 (Rev. 10/16) Name Address City State Zip FEIN MS Account ID FORM TYPE (CHECK ONE) W-2 W-2C 1099-R Other 1099 Number of Forms MS Taxable Wages MS Tax Withheld MS Tax Remitted

Form W-2c (Rev. August 2014)

www.irs.govd Employee’s correct SSN e Corrected SSN and/or name (Check this box and complete boxes f and/or g if incorrect on form previously filed.)

OFFICE OF PAYROLL ADMINISTRATION - City of New York

www.nyc.govoffice of payroll administration 450 west 33rd street, 4th floor, new york, new york 10001 to: all city, cuny community colleges, and housing authority employees from: the city of new york office of payroll administration