Fortnightly Tax Table

Found 10 free book(s)PAYE-GEN-01-G01-A06 - 2023 Other Employment Tax …

www.sars.gov.zaApply Fortnightly Tax Deduction Tables Apply Monthly Tax Deduction Tables Apply Annual Tax Deduction Tables 9 Non-standard employment employee Deduct 25% Deduct 25% Deduct 25% Deduct 25% Deduct 25% Note: The rate of 27% is effective from 1 April 2022 in respect PSPs that have a year-end on or after 31 March 2023. For any PSP that has a year-end ...

COUNCIL TAX 2022/23

www.croydon.gov.ukC A 202223COUNCIL TAX 2021/22 2 children. ... fortnightly bin collections, youth and domestic violence services will all be protected as well as many other council services. ... The table below compares the gross and net cost of providing your services in 2021/22 with 2022/23.

Fortnightly tax table - Australian Taxation Office

www.ato.gov.auFortnightly tax table Incorporating Medicare levy with and without leave loading For PAYments mAde on or AFter 1 JulY 2009. This document is a withholding schedule made by the Commissioner of Taxation in accordance with sections 15-25 and 15-30 of …

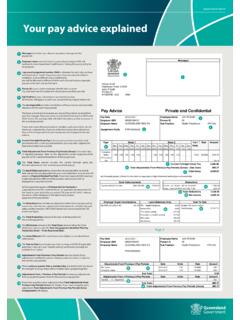

Your pay advice explained - Queensland Health

streamline.health.qld.gov.auThe earnings table provides a breakdown of hours worked and applicable allowance for the current pay period. The hours worked and allowances are sourced from advice received from your line manager, from your roster or submitted forms (such as DSVFs and AVAC forms). The earnings table will reflect this advice and be processed in

07/21 Tax and your CSS pension - Members - CSC

www.csc.gov.auYour fortnightly tax will also change to the marginal tax rate less the 10% offset. • a reversionary pension recipient (regardless of age), and your late spouse was over 60, you are eligible for the 10% tax offset on the pension from an untaxed source. If eligible, these tax offsets will be applied to your pension fortnightly.

Pay Slip Glossary of Terms - Queensland Health

streamline.health.qld.gov.auEarnings table — displays a breakdown of an employee’s hours worked, leave taken, wages and allowances, for example, shift penalties, earned in the two-week paid period Deductions box — details deductions from an employee’s pay, including income tax and

Your payslip explained - Queensland Health

www.health.qld.gov.auMedAVAC form). The earnings table will reflect this advice and be processed in the current pay period – except where annualised arrangements apply. Current Fortnight Gross Pay is the amount (before tax) you have earned for work performed in the current pay period. The Bank Disbursements box shows the Net amount

Nuclear Energy’s Economic Benefits Current and Future

large.stanford.edually. These tax dollars benefit schools, roads and other state and local infra-structure. The average nuclear plant also pays federal taxes of $67 million an-nually. Workforce Income Impacts A recent analysis found that nuclear plants create some of the largest economic benefits compared to other electric generating technologies due to their size

ANZ Home Loan Application Form

www.anz.com.au120274 Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Australian Credit Licence Number 234527 Page 2 of 9 HOME LOAN Please complete this application and return it together with the information requested below to ANZ.

Part 42-04-35A - The Employers' Guide to PAYE ... - Revenue

www.revenue.ieTax and Duty Manual Part 42-04-35A 6 16.4 Employee retiring on a pension paid by the employer and dealt with under a separate registration number or paid by a separate body (trust fund, life