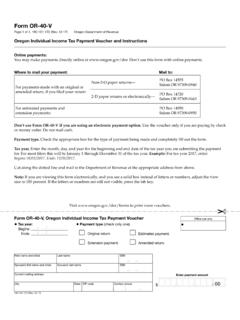

Income tax payment

Found 5 free book(s)Form OR-40-V, Oregon Individual Income Tax Payment …

www.oregon.govEnter payment amount Tax year begins (MM/DD/YYYY) Tax year ends (MM/DD/YYYY) $ Oregon Individual Income Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Payment type (check one) • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

2022 IL-1040-ES Estimated Income Tax Payment for …

www2.illinois.govwithholding, and tax credits for income tax paid to other states, Illinois Property Tax paid, education expenses, the Earned Income Credit, pass-through entity tax credit, and . Schedule 1299-C, Income Tax Subtractions and Credits (for individuals). You will likely need to make estimated . payments if your income is either fully or

2021 IL-1040-V, Payment Voucher for Individual Income Tax

www2.illinois.govYour payment is . due April 18, 2022. If you prefer to pay the amount you owe on your Form IL-1040, Individual Income Tax Return, by . mail, complete the IL-1040-V at the bottom of this page and send it, along with your payment, to . the address on the voucher. Important: Do not redact Social Security Number(s) as this can cause processing delays.

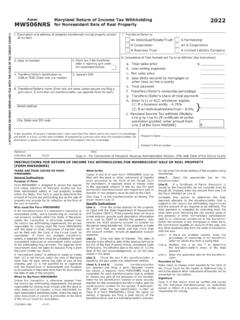

Form Maryland Return of Income Tax Withholding 2022 ...

www.marylandtaxes.govand timely collection of Maryland income tax due from nonresident sellers of real property located within the State. This form is used to determine the amount of income tax withholding due on the sale of property and provide for its collection at the time of the sale or …

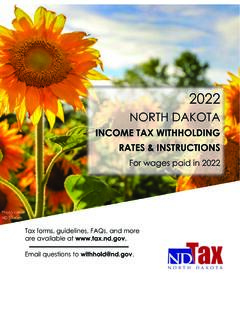

Income Tax Withholding Rates and Instructions Booklet 2022

www.tax.nd.gov(after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $540 $0 Not over $1,079 $0 Over- But not over- Over- But not over-$540 $4,021 1.10% - …