Income Taxes Paid

Found 9 free book(s)Credit for Income Taxes Paid to Other Jurisdictions (Wage ...

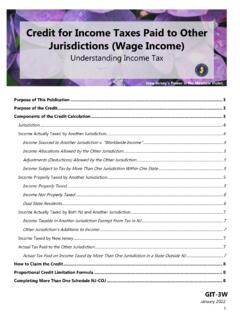

www.state.nj.usCredit for Income Taxes Paid to Other Jurisdictions (Wage Income) Understanding Income Tax Purpose of This Publication Resident taxpayers who paid Income Tax both to New Jersey and to an out -of-state . jurisdiction in the same tax year may be eligible for a credit against the tax they owe to New Jersey. A taxpayer can be an individual, an

FORM VA‑4B TAXES PAID TO ANOTHER STATE - Virginia

www.tax.virginia.govreduce the virginia individual income withholding tax per pay period by the amount on line 3. keep this form with the employee’s form va-4. (rev 5/05) 2601200 virginia employee’s credit for income taxes paid to another state

INFORMATION BULLETIN # 28 - Indiana

www.in.govtaxes paid to Indiana on the rental income. Income Tax Information Bulletin #28 Page 4 . A resident of a reverse credit state with income from Indiana will file a resident return with his state of residence and include the Indiana income. The taxpayer will then file an Indiana Form IT -

CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED …

www.irs.govJan 01, 1996 · 1. The taxes which are the subject of this Convention are: (a) in the case of the United States: (i) the Federal income taxes imposed by the Internal Revenue Code (but excluding social security taxes); and (ii) the excise taxes imposed on insurance premiums paid to foreign insurers and with respect to private foundations

INCOME TAXES - ntrc.gov.ph

ntrc.gov.phinterest income subjected to final tax. (3) Taxes Taxes paid or incurred within the taxable year in connection with the taxpayer’s profession, trade or business, except the income tax imposed under the Code, foreign income tax paid by a taxpayer who did not signify in his/her return his/her desire to have

Business Income & Receipts and Net Profits Taxes General ...

www.phila.govEffective January 1st, 2018 any Business Income and Receipts or Net Profits Tax due April 17, 2018 and later where the tax due on the return is $5,000.00 or greater is …

Income Taxes (Topic 740) - FASB

asc.fasb.orgIncome Taxes—Overall Recognition > Income Tax Accounting Implications of the Tax Cuts and Jobs Act 740-10-S25-2 See paragraph 740-10-S99-2A, SAB Topic 5.EE, for SEC Staff views on income tax accounting implications of the Tax Cuts and Jobs Act. Initial Measurement General > Income Tax Accounting Implications of the Tax Cuts and Jobs Act

Part I - IRS tax forms

www.irs.gov1. Wages fall within the definition of income set forth in section 61(a)(1) of the Internal Revenue Code. Taxpayer A’s wages and other compensation for services are income subject to federal income tax and must be reported on Taxpayer A’s federal income tax return. 2. The payment of wages and other compensation for personal services is

INCOME AND DEDUCTIBLE ITEMS, SUMMARY CHART

www.michigan.govINCOME AND DEDUCTIBLE ITEMS, SUMMARY CHART * All business income and loss must be netted before considering the effect on THR. A resulting loss cannot be used to reduce THR. Exception: Farmland Preservation Tax Credit continues to be based on household income and not THR. Business losses and NOL deductions are allowed in household income.