Information About Moving Expenses

Found 9 free book(s)Military Moving Expenses (PDF) - IRS tax forms

apps.irs.govUnreimbursed moving expenses are deducted using Form 3903, Moving Expenses. Armed Forces members receive a variety of moving reimbursements and allowances that must be considered when determining if the expenses are deductible. The travel voucher will contain much of the information needed to compute the deduction.

Your PCS Guide & Moving Checklist - Military.com

www.military.compermanent change of station, you can deduct your unreimbursed moving expenses on Form 3903 . For more guidance and information, see this Military.com article .

2021 Form 3903 - IRS tax forms

www.irs.govfor instructions and the latest information. Attach to Form 1040, 1040-SR, or 1040-NR. OMB No. 1545-0074 . Attachment Sequence No. 170 . Name(s) shown on return . Your social security number . Before you begin: You can deduct moving expenses only if you are a . Member of the Armed Forces . on active duty and, due to a

ELIGIBLE EXPENSES FOR HCSA - Green Shield Canada

assets.greenshield.caMoving expenses – reasonable moving expenses (that have not been claimed as moving expenses on anyone's income tax and benefit return) to move a person who has a severe and prolonged mobility impairment, or who lacks normal physical development, to housing that is more accessible to the

Self-education expenses - Australian Taxation Office

www.ato.gov.auFor more information, speak with your tax agent or visit ato.gov.au/selfeducation NAT 75044-05.2018 C137-49846 Apportioning expenses Some expenses need to be apportioned between private purposes and use for self-education. Travel costs and depreciating assets are good examples of expenses that may need to be apportioned. Use of equipment

Moving to SC

dor.sc.govIf you are considering moving to South Carolina or have been a resident for only a short period of time, you may have questions about South Carolina’s tax structure. This publication contains information for South Carolina’s main state and local taxes. For more details, visit dor.sc.gov or call 1-844-898-8542. INDIVIDUAL INCOME TAX

Page 1 of 11 14:30 - 19-Feb-2019 Expenses

www.irs.govMoving Expenses, earlier, you can deduct expenses for a move to the area of a new main job location within the Uni-ted States or its possessions. Your move may be from one U.S. location to another or from a foreign country to the United States. …

Submitting Settlement Information - CMS

www.cms.govSubmitting Settlement Information . Page 18 of 30 . Slide 14 - of 25 - Uploading Supporting Documentation Guidelines . Slide notes . When the settlement information exceeds the MSPRP threshold restrictions, the MSPRP will prompt you to submit a …

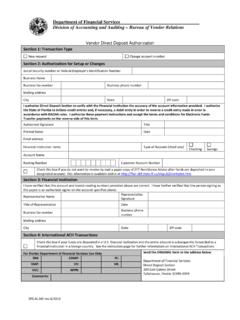

Department of Financial Services Division of Accounting ...

www.myfloridacfo.comAn authorized representativeof the payee must make any changes to the information provided on this form in writing. Changes to account information will cause the original authorization to be immediately inactivated and the new account information will be processed as described above.