Instructions for completing the quarterly contribution return

Found 3 free book(s)Filing Quarterly [Contribution and Wage] Reports Online

ui.nv.govNote the following regarding Contribution Reports: When filing both a Contribution Report and Wage Report at the same time, the system begins with the Wage Report which automatically calculates the amounts due on the Contribution Report. Instructions: 1. Log into ESS or navigate to the Employer Summary screen.

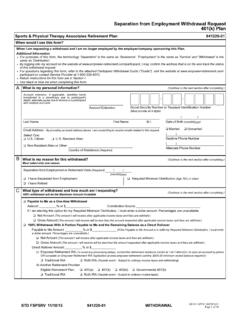

Separation from Employment Withdrawal Request 401(k) Plan

www.atipt.comReturn Instructions for this form are in Section I. Use black or blue ink when completing this form. A What is my personal information? (Continue to the next section after completing.) Account extension, if applicable, identifies funds transferred to a beneficiary due to participant's death, alternate payee due to divorce or a participant

Payroll Setup Checklist 011608 - Intuit

http-download.intuit.comtax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes. to claim on all jobs using worksheets from only Head of household. Generally, you may claim head of household filing status on your tax return only if you are unmarried and pay more than 50% of the costs of keeping up a home

![Filing Quarterly [Contribution and Wage] Reports Online](/cache/preview/0/8/f/1/7/d/b/5/thumb-08f17db58b070fafbb2cf47c7b82cb43.jpg)