Instructions For Form 1099 G

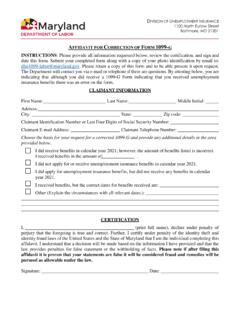

Found 6 free book(s)AFFIDAVIT FOR CORRECTION OF FORM 1099-G

dllr.state.md.usAFFIDAVIT FOR CORRECTION OF FORM 1099-G INSTRUCTIONS: Please provide all information requested below, review the certification, and sign and date this form. Submit your completed form along with a copy of your photo identification by email to: [email protected]. Please retain a copy of this form and to be able present it upon request.

KW-3 Annual Withholding Tax Return and Instructions Rev. 6 …

ksrevenue.govfile Form KW-3 within thirty (30) days after the business was discontinued or payment of wages ceased. LINE A: Enter the total Kansas income tax withheld from all employees/payees as shown on the Form W-2 and/or federal 1099 form(s) that reflect Kansas withholding. LINE D: Add lines B and C and enter the total on line D.

Instructions for Form 1099-G (Rev. January 2022)

www.irs.govInstructions for Form 1099(Rev. January 2022)-G Certain Government Payments Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 1099-G and its instructions, such as legislation enacted after

How to obtain a duplicate 1099-G (IRS Tax Form)

ui.nv.govNote: 1099-G forms are mailed out by January 31st. Please be aware that 1099-G copies may not be available on the website until 1 – 4 weeks after original mailing occurs; an “online-only” method of receipt is not offered. Duplicate 1099-G for tax years 2013 to present:

1099-G Frequently Asked Questions - Kentucky

kcc.ky.govForm 1099-G showing they did not receive the benefits. Taxpayers who are unable to obtain a timely, corrected form from states should still file an accurate tax return, reporting only the income they received. All questions and concerns can be directed to . [email protected]. Be sure to provide: • Name as it appears on the 1099

Form 1099-G (Rev. January 2022) - IRS tax forms

www.irs.govForm . 1099-G (Rev. January 2022) Cat. No. 14438M. Certain Government Payments. Copy A. For Internal Revenue Service Center. Department of the Treasury - Internal Revenue Service