Irs Individual Taxpayer Identification Number

Found 5 free book(s)W-9 Request for Taxpayer Identification Number and ...

www.cms.govAn individual or entity (Form W-9 requester) who is required to file an information return with the IRS must obtain your correct taxpayer identification number (TIN) which may be your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number

On-Line Taxpayer Identification Number ... - IRS tax forms

www.irs.gov6. “TIN” – means the taxpayer identification number that a payee is required to furnish to a payor. The TIN may be an Employer Identification Number (EIN), a Social Security Number (SSN), or an Internal Revenue Service Individual Taxpayer Identification Number (ITIN), per IRC section 6109. 7.

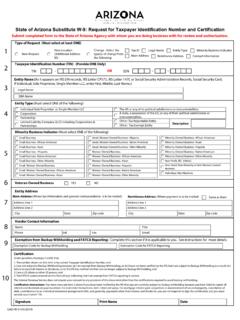

State of Arizona Substitute W-9: Request for Taxpayer ...

gao.az.gov2 Taxpayer Identification Number (TIN) (Provide ONE Only) TIN-OR SSN - - 3 Entity Name (As it appears on IRS EIN records, IRS Letter CP575, IRS Letter 147C or Social Security Administration Records, Social Security Card. If Individual, Sole Proprietor, Single Member LLC, enter First, Middle, Last Name.) Legal Name DBA Name 4

W-9 Request for Taxpayer Identification Number and ...

azcast.arizona.eduNumber To Give the Requester for guidelines on whose number to enter. Social security number –– or Employer identification number – Part II Certification Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and 2.

W-9 Request for Taxpayer Identification Number and ...

ccdhh.comNumber To Give the Requester for guidelines on whose number to enter. Social security number –– or Employer identification number – Part II Certification Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and 2.